What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: December 6, 2023

Investors whose funds use the five-minute WM window for the month-end FX fix missed out on potential savings of more than $1,000 per million at the end of November as large flows saw sustained (pre)hedging across a number of currency pairs.

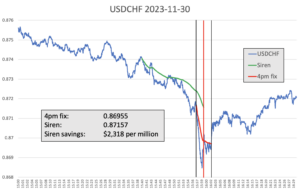

USD/CHF saw the largest potential saving recorded in any currency pair tracked by The Full FX data thus far in 2023 and the second highest since the data was first published 32 months ago. The $2,318 per million saving was one of five pairs to record savings above $1,000, the others being USD/JPY, Cable, NZD, and USD/NOK.

The blow-out comes after a sustained period of relatively quiet month-end fixes (assuming an average market impact of $500 per million is “quiet”), and at $1.029 per million across the portfolio of nine pairs, it is the fourth highest potential saving that could have been to the benefit of end-investors since The Full FX started publishing data.

To provide more context, the table below also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”.

| November 30 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.09106 | 1.09061 | $413 | $248 | $165 | $83 |

| USD/JPY | 147.828 | 147.98 | $1,027 | $616 | $411 | $205 |

| GBP/USD | 1.26595 | 1.26413 | $1,440 | $864 | $576 | $288 |

| AUD/USD | 0.66302 | 0.6624 | $936 | $562 | $374 | $187 |

| USD/CAD | 1.35586 | 1.35625 | $288 | $173 | $115 | $58 |

| NZD/USD | 0.61762 | 0.61686 | $1,232 | $739 | $493 | $246 |

| USD/CHF | 0.86955 | 0.87157 | $2,318 | $1,391 | $927 | $464 |

| USD/NOK | 10.78139 | 10.7657 | $1,457 | $874 | $583 | $291 |

| USD/SEK | 10.47885 | 10.4804 | $148 | $89 | $59 | $30 |

| Average | $1,029 | $617 | $412 | $206 |

*According to Siren FX calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

The two fixes in USD/CHF were almost in different postcodes, with the Siren FX Fix settled on a different big figure and by some 20 pips compared to WM. The price action is heavily suggestive of hedging the flow over a longer window, with the pair dropping over 50 pips from what is often the start of the hedging window some 15 minutes before the opening of the WM five-minute window. Heavy dollar selling was expected at the Fix and it certainly materialised in USD/CHF, the pair dropping quite sharply, by more than 30 pips in the first two minutes of the WM window.

Source: Siren FX

Again there is the suggestion of speculative activity in the pair, not only did USD/CHF exit the WM window some 10 pips below where it entered, but it continued to recover gently in the next 25 minutes.

There was also some interesting price action in Cable, with much more two-way action within the expected broader dollar decline. Cable rose some 40 pips from five minutes before the opening of the WM window to the mid-point of the WM Fix, before settling into whippy price action.

Source: Siren FX

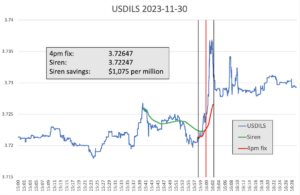

Every month, The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/ILS. Data is again provided by Siren FX according to the same guidelines in place for the regularly reported currency pairs.

Source: Siren FX

Given events in the Middle East, the shekel bucked the trend of dollar selling, however price action suggests most of the USD/ILS buying took place in the WM window itself, although there was, again, a reversal in the last minute of the five-minute window. The saving from the Siren FX Fix was largely in line with the 31-month average at $1,075 per million.