What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: February 6, 2023

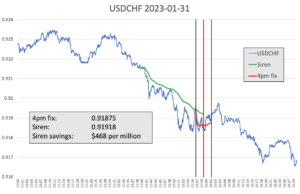

It was a quieter than usual month-end London 4pm Fix in January, although in the bigger picture there were some significant moves in the 30 minutes prior to the fix window opening, especially involving CHF, CAD and the HUF.

Interestingly, the longer 20-minute calculation used by Raidne for Siren was not dramatically different from the WM five-minute window, as is often the case in these circumstances, which suggests that the pre-hedging activity started earlier than usual. Certainly USD/CHF fell around 60 pips in the 30 minutes leading up to 4pm London, while USD/CAD fell around 40 pips, but in spite of that the potential savings from the 20-minute window were large, but not significantly so.

USD/CHF sellers at the fix would have saved a still-significant $468 per million using the longer Siren Fix, while in USD/CAD it was even lower, at $165 per million. Still notable savings, but both below the long-term averages of $626 and $563 per million from the previous 21 months’ calculations.

At the other end of the spectrum, NZD/USD, at “just” $77 per million, saw the lowest potential savings from a longer window sine The Full FX started publishing data in March 2021

The average from the portfolio of nine currencies was $440 per million, again not insignificant, but below the 22-month average of $730 per million. There were large potential savings in USD/NOK at $1,356 per million, and USD/SEK at $951 per million, the next highest potential saving was in USD/CHF.

To provide context, the table below also presents projected dollars per million savings across the portfolio of currency pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”.

| January 31 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.08605 | 1.08581 | $221 | $133 | $88 | $44 |

| USD/JPY | 130.045 | 130.07 | $192 | $115 | $77 | $38 |

| GBP/USD | 1.2311 | 1.23071 | $317 | $190 | $127 | $63 |

| AUD/USD | 0.70465 | 0.7045 | $213 | $128 | $85 | $43 |

| USD/CAD | 1.22435 | 1.33457 | $165 | $99 | $66 | $33 |

| NZD/USD | 0.64625 | 0.6462 | $77 | $46 | $31 | $15 |

| USD/CHF | 0.91875 | 0.91918 | $468 | $281 | $187 | $94 |

| USD/NOK | 9.9882 | 10.00176 | $1,356 | $813 | $542 | $271 |

| USD/SEK | 10.4698 | 10.47977 | $951 | $571 | $381 | $190 |

| Average | $440 | $264 | $176 | $88 |

*According to Raidne calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

As noted, USD/CHF was subject to a major sell-off, indeed there were three bouts of dollar selling in the pair during the day, a smaller 20-30 points move in the UK morning around 11am, and then a more sustained move from 1pm which culminated in USD/CHF coming out of the five-minute window some 100 points lower than at 1pm.

Source: Raidne

The second bout of selling, from 3.30pm, was the most sustained, however a fair piece of the action had occurred before the Siren calculation began. Sources spoken to in the market say larger than usual flows were seen, but they were, as one observed, “nothing we haven’t seen before”. Another source speculates that USD/CHF pre-hedging started earlier than usual, either as an experiment or because the executing party thought it would take longer than usual to execute the order.

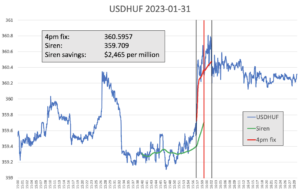

Every month The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/HUF. Data is again provided by Raidne according to the same guidelines in place for the regularly reported currency pairs.

It was, frankly, something of a horror show for anyone executing in the shorter window, with potential savings from using the 20-minute execution window a massive $2,465 per million – the third largest saving seen since The Full FX started publishing EM data for the Fix.

Source: Raidne

Trying to push through the flow in the five-minute window saw USD/HUF spike higher from 359.70 to a peak of 360.80, before exiting the window and spending much of the next 30 minutes between 360.10-40. The suggestion is the move was a “genuine” reflection of what had to be executed, with little or no pre-hedging or speculative activity involved, thus again raising the question, does the calculation and execution window need to be longer?

Multiple execution parties may have been involved, which would have been a surprise and caused the sharp jump – it would also have meant that few had an order big enough to warrant pre-hedging (or, as has been the case previously in some pairs, the customer refused to let the executing party pre-hedge). Either way, there was significant market impact and end-investors missed out on a more efficient and less-costly FX hedge at the month-end.