What Happens When a Primary FX Venue Goes Offline?

Posted by Colin Lambert. Last updated: October 4, 2023

With The Full FX View

The latest FX market microstructure study by Bank of America looks at what happened on 25 July 2023, when one of the primary spot venues, EBS Market, experienced an outage in its New York matching engine for around four-and-a-half hours during the London day. The New York engine is responsible for EBS Markets G10 pairs, while the London engine – which was unaffected – handles NDFs and the vital USD/CNH pair.

The BofA report, authored by Dean Markwick and Paul Conlon of the bank’s e-FX quant team, along with Tan Phull, who runs FX algo trading, observes that Bank of America’s algos, like most, if not all, of its peers, uses the EBS price as a reference for trading decisions, as well as an input into risk and market models. On the day in question, with EBS Market down, the bank’s systems switched to a new reference rate and continued to trade smoothly across principal, algo and voice systems.

A smooth transition to secondary venues appears to have been the order of the day, the study notes that after the day started with a typical market share split, around 11:30am UK time, when EBS Market went down, an abrupt change took part, with secondary venues absorbing all of the volume – one in particular gaining good market share. Once EBS Market came back on line around 4:00pm UK time, the study observes that its volumes remained less than the secondary venues until the New York close.

Source: Bank of America

Venue 1 clearly established itself as the “go-to” platform and interestingly it continued to see more business after EBS Market came back online. This smooth changeover is reflected in BofA analysis which estimates that EUR/USD volumes were 15% higher than the 30-day average on 25 July, while USD/JPY had 4% less volume. Thus, the study notes, there were no major outliers despite the disappearance of the primary market.

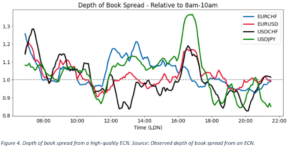

In terms of spread, the study looks at BofA’s observed top-of-book spreads for 1 million on a high-quality ECN for each of the currencies that use EBS, as the primary market. The data is normalised using the average value between 7am and 9am on that day to measure the relative change. A value greater than 1 means wider and less than 1 means a tighter spread.

EURUSD experienced the largest change in spread and was 50% wider through the outage period and tightened once EBS came online at 16:00. USD/CHF also widened immediately, but USD/JPY took much longer than the other pairs. Perhaps unsurprisingly given the relative lack of volatility in the pair, EURCHF remained consistent throughout the period.

“The reactions across the currency pairs suggest differing dependency on the primary market,” the authors write. “The immediate widening of EUR/USD suggests more immediate uncertainty around EUR/USD fair value compared to USD/JPY that took an additional hour to widen.

Source: Bank of America

“It is unclear as to why this difference would exist beyond difference in risk appetite around the currencies on this specific day and general macroeconomic conditions,” they add.

The study also observes that depth-of-book wasn’t impacted as dramatically by the outage, the spread for 10 million widening but not as much. USD/JPY topped out at 30% wider than earlier spreads, while EUR/USD remained constant – even widening out when EBS Market came back online.

“This lack of widening at size and dramatic widening at top-of-book suggests that liquidity providers were mainly concerned with uncertainty around where the true price was rather than the actual cost of trading, as they were willing to take on larger trades over smaller ones,” the study observes.

BofA looks at the cost of trading through the prism of its aggressive and pegged order activities during the period is question. It finds that costs reduced rapidly at the start of the outage – the authors suggest one potential explanation is that everyone wanted to rapidly reduce their risk so skewed aggressively on the available venues, allowing for better prices – and there was significant skew towards mid. “Generally, if there was opposing interest, the costs were lower,” the report states. “This reverted after 12:00 and costs returned to levels similar to the 30-day average.”

Source: Bank of America

“Interestingly, our pegged orders across multiple venues saw a large improvement in their fill rate during the outage period compared to the 30-day average,” it continues. “Again, as more volume migrated away from the primary markets to the secondaries where we had passive interest, we saw the fill rate improve.”

The study observes that overall, the extended EBS outage highlighted the resiliency of the FX market. Despite a primary FX liquidity source being unavailable, trading remained orderly. “We saw one venue take in most of the volume, but not dominate the overall trading flow,” the authors write. “Whilst spreads appeared to be wider, this was limited to just the top-of-book and the larger sizes were not as affected. When it came to execution costs, aggressive orders filled cheaply at the start of the outage before resuming to similar average costs. Pegged orders experienced a higher-than-average fill rate, as more volume was directed to the secondary venues.

“This all suggests that the FX market can quickly adapt to venue disruptions and there doesn’t appear to be a major dependence on the current primary venue for a well-functioning market,” they continue. “However, it did lead to a more fragmented landscape with each secondary venue seeing an increase in market share rather than one venue replacing EBS in the period it was down.

“Given the recent trends in the growth of secondary venues (and reduced volumes on the primary venues), we can conclude that it is more likely that the future FX landscape is of continued fragmentation rather than one where a secondary venue becomes the ‘new primary’ market,” the study concludes. “Furthermore, this event highlights the importance of connectivity to different pools of liquidity.”

The Full FX View

Perhaps the biggest story from this study is that there isn’t a story. As the authors note, the FX market was well-prepared for such an eventuality and the upside of fragmentation is that choice was available in terms of venues. Trading continued smoothly and the probability is that clients who did not have access to the primary venues didn’t notice there was an outage at all.

While the report, naturally, has to retain levels of anonymity, it would be fascinating to know whether those alternate pools of liquidity that the market turned to were firm venues, rather than ones operating with last look? This is also a question when looking at market data – did the alternate sources of market data also come from firm venues, and was it adequate to sustain the business? The data presented in this fascinating study suggests that it was, which is not necessarily good news for EBS and its parent CME Group as it seeks to sustain its OTC FX market data business.

And this is, really, a market data story. While volumes on the primary venues have been in long-term decline – EBS overall average daily volume was $65.7 billion per day (across all spot venues), compared to $112.1 billion in 2012, while LSEG/Reuters reported $99.2 billion (also across all spot venues) from $128.2 billion in 2012, the year before it incorporated FXall volumes into its data – their place as important data sources has remained unchallenged.

There have been rumblings in the industry over the cost of market data given the lower volumes on the primary venues, but this study raises the question of whether, with a reasonable floor, the quality of data is really affected by how much is going through? What matters more – accessing data on a smaller number of valuable trades, or a larger number of smaller trades?

Another sense that I get from this study is that the banks, with their bigger inventories and higher internalisation rates, handled the outage better than perhaps some, but not all, non-banks. The challenge, such as it was, appears to have been at top-of-book, where so many smaller non-bank firms operate, looking for smaller margins. The fact that depth of book wasn’t affected reflects the slightly wider spreads offered in size, which do not need to be so intensely granular to be competitive. This reinforces the point made in last week’s The Last Look, about how the participant demographic on EBS Market has changed over the years.

15 years or more ago, I recall walking into a bank trading room and hearing a blast from the past – voice brokers! The reason the squawkboxes had been turned up was an outage on one of the primary venues – it was also notable that what could be termed the “senior” members of the FX desk were handling the issue much better than their younger colleagues who had a much higher reliance on screen-based data.