Hedge Fund Confidence Bounces: AIMA

Posted by Colin Lambert. Last updated: October 5, 2023

The Q3 2023 AIMA Hedge Fund Confidence Index (HFCI), which is produced alongside Simmons + Simmons and Seward & Kissel, finds that confidence amongst hedge funds has bounced close to historic highs.

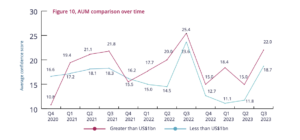

The latest survey, based upon responses from 300 hedge funds accounting for approximately $2.2 trillion in assets, registers a score of +21.6, up seven points on the Q2 reading, and above the long-term average score of +17.9. AIMA warns, however, that the reading is likely influenced by an over-weighting of larger hedge fund managers (above $1 billion AUM), who historically record higher scores. It adds that equity-focused strategies, which are enjoying a resurgence, are also over-represented in the latest survey, contributing to the rise. Another factor could be the record number of respondents in the last survey in Q2, when 408 funds took part.

Respondents are asked to provide a confidence score between -50 and +50, based upon their firm’s ability to raise capital, generate revenue and manage costs, as well as the overall performance of their fund(s). AIMA says 97.3% of respondents provided a positive score, with all regions and strategies back above their respective rolling averages. The survey also provides, for the first time, a detailed breakdown of responses by region and the three aforementioned factors.

With the survey in its third year, AIMA says Q3 is emerging as the most confident quarter – the three highest scores have been returned in Q3 of 2021, 2023 and 2022 – the last of which offered the highest confidence score at +25.4.

“With signs that the higher inflationary environment in the US, UK and EU has begun to ease, confidence levels among some hedge funds in these regions has roared back from the near historic lows reported in the previous quarter,” says Tom Kehoe, global head of research and communications at AIMA. “It remains to be seen whether the feelgood factor is a temporary respite amid ongoing macro, geopolitical and industry regulatory concerns or if the industry feels the worst is over.”

While the US and UK have generally been the two most confident regions, AIMA says in the latest survey both have been eclipsed by the Middle East, which recorded its highest number of respondents to date. All these respondents not only recorded a positive confidence score, the association observes, but also gave a minimum score of +14, with over a dozen reporting their confidence as north of +30. AIMA suggests that part of Middle Eastern respondents supreme confidence can be attributed to their average AUM size ($9.6 billion), which dwarfs the overall average of $7.3 billion.

Breaking down the three factors hedge fund managers consider when evaluating their economic prospects for the next 12 months, almost all (98%) Middle Eastern respondents cited capital raising as increasing their confidence, the highest proportion of any region.

By contrast, the same respondents cited factor two as negatively impacting their confidence. The third factor for consideration was not seen as much of a concern as factor two, with 64% saying it decreased their confidence, implying that the managing costs aspect of the prior factor is the primary issue.

“It is pleasing to see increased confidence in the Middle East market which reflects our own workflows from European, US and Asian managers,” says Muneer Khan, partner at Simmons & Simmons. “The ecosystem in the region has matured significantly over the last two years and has created various opportunities, in particular for capital raising and the acquisition/retention of portfolio management talent, which have been key drivers behind the latest inflow of hedge fund managers. As service levels and infrastructure further develop both in the UAE and the wider Middle East, we expect to see more managers, both hedge and other alternatives, looking at building their presence in the region.”

The clearest divergence between funds in the US and UK is in their attitudes towards capital raising and managing costs, with79% of UK managers saying capital raising increases their confidence compared to 65% in North America. Of those in North America that said capital raising was a cause for concern, there was not an over-representation by any one investment strategy or AUM bracket, AIMA points out, which runs counter to the common narrative that the oft-cited bifurcation of the industry means smaller managers are disproportioned challenged by securing allocations.

Source: AIMA

UK respondents are more concerned by challenges in generating revenue and managing costs, with 64% of respondents saying this factor reduces their confidence, compared to 49% in North America. APAC has seen a massive jump in confidence (+9.4 in Q2 to +19.3 this quarter). APAC is now once again closer in confidence with North America, although the below-average sample size for APAC does mean selection bias may be more present than usual in the respondent pool, AIMA observes.

Within APAC, Hong Kong scored +19.8 – although this includes a wide variety of scores – while Singapore scored +22.9 with a closer cluster of scores. For Hong Kong, AIMA says the disparate scoring reflects the ongoing uncertainty for the future of the financial hub “which is seeing challenges to its status as the gateway to mainland China and APAC more broadly”.

The data suggests that while larger managers remain more confident, the broader trend is more based upon geography. The UK (average AUM $ 6 billion) reported a higher confidence score than North America (average AUM $9.2 billion), but APAC scored roughly the same as North America with an average AUM of only $3 billion.

When analysing the three factors underpinning the confidence scores of larger and smaller fund managers, there is a 10-percentage point difference between their bullishness of capital raising, favouring larger fund managers. This margin is reversed when considering overall performance of the funds. The third factor produces the clearest difference. Less than half (36%) of larger managers consider their ability to generate revenue and manage costs a positive factor, compared to 67% for smaller managers.

“With respect to the lower average confidence levels in North America regarding fundraising, this may be attributable to the fact that allocations coming from US taxpayers are becoming more challenging to secure as many are taking a more cautious approach when it comes to investment allocations, in part due to increasing interest rates, uncertainty about the upcoming presidential election next year and other macro factors,” says Steve Nadel, Partner at Seward & Kissel.