What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: January 9, 2025

2024 closed out with a relatively quiet month-end benchmark fix, with savings from using a longer calculation window largely in line with the year’s average, albeit the highest in the second half of the year.

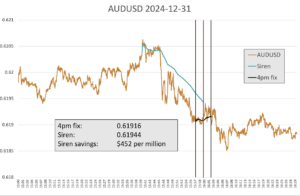

The average saving of $316 per million across the portfolio of nine currency pairs was a fraction under the 2024 average, with only the AUD providing significantly higher savings that the 2024 average, while GBP was significantly below. It was the highest saving from using the 20-minute Siren FX benchmark compared to the five-minute WM, since June, when it was $321 per million.

It is notable, that as has happened regularly since The Full FX started publishing this data, that checks with market sources indicate that the actual WM fixes were largely further away from the New Change FX-sourced Siren Fix as published, meaning the actual savings could have been significantly higher. Notably, GBP was 1.77 pips further away using the WM calculation methodology, while JPY was 1.3 pips away, CAD was 1.1 and EUR was 0.5.

Aside from Cable, in which the difference in points would have almost doubled, most were between 20 and 35% further away.

To provide more context, the table below also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”. The rates used for the WM column are calculated using a higher frequency data set from New Change FX, however The Full FX endeavours to check that they are a reasonable reflection of those published by the LSEG-owned business.

| December 31 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.03556 | 1.03578 | $212 | $127 | $85 | $42 |

| USD/JPY | 157.147 | 157.086 | $388 | $233 | $155 | $78 |

| GBP/USD | 1.2526 | 1.25277 | $136 | $81 | $54 | $27 |

| AUD/USD | 0.61916 | 0.61944 | $452 | $271 | $181 | $90 |

| USD/CAD | 1.43809 | 1.43776 | $230 | $138 | $92 | $46 |

| NZD/USD | 0.56027 | 0.56043 | $285 | $171 | $114 | $57 |

| USD/CHF | 0.90620 | 0.90580 | $442 | $265 | $177 | $88 |

| USD/NOK | 11.35519 | 11.35128 | $344 | $207 | $138 | $69 |

| USD/SEK | 11.04791 | 11.04399 | $355 | $213 | $142 | $71 |

| Average | $316 | $190 | $126 | $63 |

*According to Siren FX calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

Markets were naturally quieter as the year-end approached, however as noted, AUD saw notable potential savings of $452 per-million, more than double the 2024 average of $202 per million, but below the 45-month average of $568 per million.

Source: Siren FX

As is often the case with larger differentials between the two methodologies, the market saw sustained selling in the 15-20 minutes before the WM window opened – a period that is captured by the Siren calculation. In December, dropped by some 15 pips in the lead up to the five-minute window opening, however unlike several other instances, the selling did not continue in the window – indeed AUD/USD actually bounced in the second half of the WM window, before exiting largely where it entered.

Post-WM window, the pair dropped again, before recovering slightly to trade sideways – largely as levels below where it traded in the five minutes.

Every month, The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/CZK. Data is again provided by Siren FX according to the same guidelines in place for the regularly reported currency pairs.

Source: Siren FX

There was more linear price action in the CZK as the dollar buying started early and was sustained throughout. There was a slight dip in the middle of the WM window, perhaps as speculators took profits, but the pair resumed its uptrend, which only ended some five minutes after the WM window closed.

At $652 per million, the potential saving was below the average of pairs selected by The Full FX in 2024, which is $774 per-million, it is also below the 44-month average of $1077 per million. In terms of the 2024.