What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: April 7, 2024

For the third consecutive month, the potential savings from using a longer window for the month-end FX Fix were below the long-term average; they remain significant, however, at $271 per million.

The potential savings, from using the 20-minute Siren FX Fix as compared to the five-minute WM Fix, are the third lowest in the 36 months that The Full FX has been publishing the data, and the lowest since June 2022, when the savings were $217 per million. In March, one pair, USD/SEK, provided the lowest saving yet, at $7 per million. With the exception of one instance, in 2022, the 60% correlation saving of $1 per million is the closest any comparison has come to favouring the shorter window.

Market sources suggest that a proportion of fixing flows were executed in the days leading up to the month-end as end-users feared a drop off in liquidity ahead of the extended holiday weekend in many parts of the world.

To provide more context, the table below also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”. The Full FX has verified that the WM rates used here are a reasonable reflection of that fixing.

| March 28 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.0800 | 1.08102 | $111 | $67 | $44 | $22 |

| USD/JPY | 151.34 | 151.288 | $344 | $206 | $137 | $69 |

| GBP/USD | 1.2633 | 1.26305 | $198 | $119 | $79 | $40 |

| AUD/USD | 0.6524 | 0.65225 | $230 | $138 | $92 | $46 |

| USD/CAD | 1.3532 | 1.35364 | $325 | $195 | $130 | $65 |

| NZD/USD | 0.5982 | 0.59803 | $284 | $171 | $114 | $57 |

| USD/CHF | 0.9007 | 0.90112 | $466 | $280 | $186 | $93 |

| USD/NOK | 10.8486 | 10.84351 | $469 | $282 | $188 | $94 |

| USD/SEK | 10.6926 | 10.69252 | $7 | $4 | $3 | $1 |

| Average | $271 | $162 | $108 | $54 |

*According to Siren FX calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

Source: Siren FX

USD/CHF provided the second largest savings via the longer calculation methodology at $466 per million – second only to a perennial “offender” in USD/NOK. While below the 36-month average of just over $635 per million, this is the highest saving in 2024 for USD/CHF.

As is often the case, the pair entered the WM window at the low for the hour having been sold down initially some five minutes before. A short bounce was reversed and the pair traded sideways for much of that calculation period, before – again as often happens – it rebounded at the end, and immediately after, the closing of the WM window.

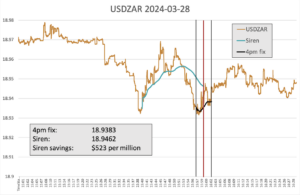

Every month, The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/ZAR. Data is again provided by Siren FX according to the same guidelines in place for the regularly reported currency pairs.

Source: Siren FX

As was the case in the major markets, USD/ZAR was also sold off into the WM window – flow captured by the Siren FX calculation window. The pair actually hit the low 20-minutes before the WM window opened, but a subsequent bounce meant the pair entered the latter at the hour’s lows. Again, trading was mixed in the WM window, and, again, it bounced immediately the window closed.

The $523 per million saving, while significant, is also below the longer-term average of the emerging markets’ pick by The Full FX, which stands at just over $1,123 per million for the 35 months.