What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: March 9, 2024

It was a mixed bag of outcomes at the February month-end FX benchmark fix, with six of the regular currencies tracked by The Full FX providing below-average savings by using the Siren FX 20-minute methodology compared to the WM five-minute window. That said, the portfolio savings were very much in line with the 35-month average at over $600 per million.

It is perhaps testament to how inured we have become to large savings that the very significant execution cost of $314 per million in EUR/USD is shrugged off as a “quiet month”, as compared to the just over $580 per million average saving over the past three years. That said, given the amount of volume executed in EUR/USD at the Fix, a lot of money has clearly been left on the table by users of the five-minute window.

The same can be said, even more so, in the world’s second largest FX pair, USD/JPY, where the potential saving from using the Siren FX fix was $742 per million, above the long-term average of $640 per million.

To provide more context, the table below also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”. The Full FX has verified that the WM rates used here are a reasonable reflection of that fixing.

| February 29 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.08215 | 1.08145 | $314 | $188 | $126 | $63 |

| USD/JPY | 149.67 | 149.559 | $742 | $445 | $297 | $148 |

| GBP/USD | 1.26486 | 1.2653 | $348 | $209 | $139 | $70 |

| AUD/USD | 0.65112 | 0.65145 | $507 | $304 | $203 | $101 |

| USD/CAD | 1.35632 | 1.3558 | $384 | $230 | $153 | $77 |

| NZD/USD | 0.60913 | 0.60929 | $263 | $158 | $105 | $53 |

| USD/CHF | 0.8805 | 0.88025 | $284 | $170 | $114 | $57 |

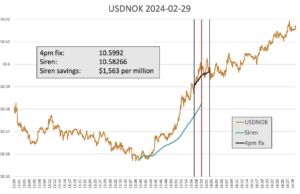

| USD/NOK | 10.5992 | 10.58266 | $1,563 | $938 | $625 | $313 |

| USD/SEK | 10.3475 | 10.33555 | $1,157 | $694 | $462 | $231 |

| Average | $618 | $371 | $247 | $124 |

*According to Siren FX calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

As is often the case, the highest potential savings from the longer calculation window came in the Scandies, with both USD/NOK and USD/SEK above $1,000 per million for the first time since September 2023 (it I the seventh time, however, that both have been above that threshold). Both Scandi pairs were also comfortably above their already high long-term averages.

Source: Siren FX

The chart for USD/NOK, which at $1,536 per million was the highest potential saving this month, but still only the sixth highest in the 35 months’ worth of data, shows a classic (pre)hedging move. The pair was drifting lower into the fixing window, when steady buying started around 15 minutes before the WM window opens – often the time when (pre)hedging starts. The buying was steady, although interestingly there were two reasonably sharp sell offs in the WM window, of 50-70 points, indicating speculators taking profits.

There was undoubtedly demand for USD/NOK around the window, as the pair continued to rise in the minutes after the WM calculation was completed, suggesting the flow was too much for a five-minute execution.

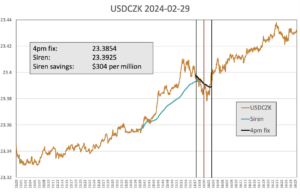

Every month, The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/CZK. Data is again provided by Siren FX according to the same guidelines in place for the regularly reported currency pairs.

Source: Siren FX

After a nine-month run of potential savings over $1,000 per million, for the second consecutive month, the EM pair selected had a quiet month-end – perhaps because it was overbought in the minutes leading up to the window. Two accelerated bursts of dollar buying may have sucked in speculators, but the buying died out some five minutes before the WM window opens, and the pair exited that window pretty much where it entered, albeit after dropping steadily for the first half.

Contributing to a confused picture, the dollar buying that recommenced in the second half of the WM window, continued in the minutes afterward. Overall, the suggestion is that there was minimal flow at the Fix in USD/CZK, and that speculators may have been burned by the price action.