What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: August 8, 2023

Longer windows to calculate month-end fixes continue to offer substantial potential savings thus far in 2023, however they remain below the longer-term average in terms of dollars per million – the July fixing offering the second lowest saving after June.

Fixes executed using the 20-minute Siren FX calculation methodology would have saved $408 per million across the usual basket of nine currency pairs, compared to those using the five-minute WM methodology. It is the fifth lowest saving since The Full FX started publishing data in April 2021.

There was “good” news for those using the EUR/USD WM Fix in that while there was still a notable and meaningful saving in the longer window, it was only $118 per million – the fourth lowest in the last 28 months and below the longer-term average of $632.96 per million. Coincidentally, EUR/USD has once before delivered a saving of $118 per month – in July 2021, perhaps it’s a July thing!

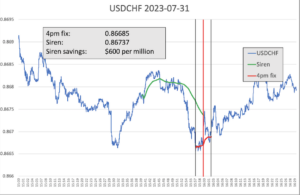

Across the nine pairs, only USD/CHF offered savings above its 28-month average (see below), while USD/SEK, at $832 per million, was bang on its average. In contrast to last month, which was the quietest in terms of savings since April 2021, where they offered the highest savings, in July, EUR/USD and USD/JPY offered the lowest.

| July 31 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.10255 | 1.10268 | $118 | $71 | $47 | $24 |

| USD/JPY | 142.08 | 142.114 | $239 | $144 | $96 | $48 |

| GBP/USD | 1.28665 | 1.28618 | $365 | $219 | $146 | $73 |

| AUD/USD | 0.67385 | 0.67355 | $445 | $267 | $178 | $89 |

| USD/CAD | 1.31625 | 1.31663 | $289 | $173 | $115 | $58 |

| NZD/USD | 0.62235 | 0.62209 | $418 | $251 | $167 | $84 |

| USD/CHF | 0.86685 | 0.86737 | $600 | $360 | $240 | $120 |

| USD/NOK | 10.1165 | 10.12016 | $362 | $217 | $145 | $72 |

| USD/SEK | 10.5075 | 10.49876 | $832 | $499 | $333 | $166 |

| Average | $408 | $245 | $163 | $82 |

*According to Siren FX calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

Price action in USD/CHF, which offered a $600 per million saving using the longer calculation window, is a classic example of the challenge of using shorter calculation windows. The likelihood is that a substantial amount of dollars had to be sold, meaning the executing party needed to hedge ahead of the WM window.

Whether the calculation over how much to (pre)hedge went awry or whether the hedge had unexpected market impact, USD/CHF was sold off in the 10 minutes leading into the WM window, actually entered that window pretty much at the low, before spending the first half in a tight range. The latter half of the WM window saw a small bounce, possibly profit taking by the speculators keying on the algo activity ahead of the WM Fix, before a retracement.

USD/CHF closed out the WM window slightly above where it entered, however, and proceeded to rise steadily in the 20 minutes after it closed, ending pretty much unchanged from the levels at which the hedging presumably started.

It is noticeable in the chart below, that only briefly, did USD/CHF trade above the Siren FX fix, calculated over 20 minutes.

Source: Siren FX

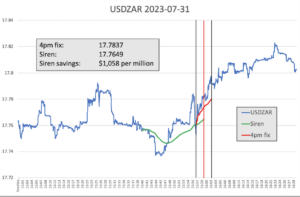

Every month The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/ZAR. Data is again provided by Siren FX according to the same guidelines in place for the regularly reported currency pairs.

USD/ZAR offers a different picture entirely to USD/CHF, with the price action suggesting steady buying of dollars ahead of, and during, the WM Fix. With the exception of a sharp drop leading into the five-minute window, the market saw buying from 10-12 minutes ahead, which continued through that five minutes, before steadying post-Fix.

Source: Siren FX

The $1,058 per million saving available from the 20-minute Siren FX window is shy of the $1,155 per million 27-month average since The Full FX started publishing emerging markets data, and is the second lowest in 2023.