Value of Algo Limits Strategy Dependent – BestX

Posted by Colin Lambert. Last updated: April 13, 2023

The use of market or price limits when using an execution algorithm became more popular in recent years thanks to several instances – both public and private – where “runaway algos” caused market disruption in various asset classes. The ability to effectively limit the damage caused by a sudden change in market conditions that would not be recognised by the algo is widely seen as a sensible risk management strategy, but the question has always been, does it come at the cost of inferior performance?

Two obvious examples would appear to be the EUR/CHF flash even and sterling markets on the evening of the Brexit vote. In the first, where markets collapsed to nonsensical levels and quickly rebounded, the use of a limit would probably have saved the executing party some serious money (depending upon levels and re-papering policies of course); while in the latter, the fundamental – and significant – move lower by sterling was not retraced, meaning, for example, any execution with a price limit of 1.45 when selling from 1.50, would have been 20 big figures worse when it did eventually restart the trade.

Flash events and major moves happen rarely, of course, but the question of performance over risk management still persists with day-to-day trades, leading BestX to analyse the issue in its latest white paper, Do Limits Improve Algo Performance? The paper acknowledges the “relatively controversial topic”, and seeks to discover whether limit placement can be optimised.

The study looks at G10 currency pairs and executions under 24 hours duration only, and largely focuses on orders with one limit only to simplify the problem for analysis. It uses the BestX Expected Risk Transfer Cost as its main benchmark, thus taking into account market conditions at time of execution. As a robustness check it also uses the performance of a TWAP algo without limit during the execution period as a secondary benchmark, although these results are not part of the study (but are available on request).

The five styles studied as part of the analysis are Get Done, Opportunistic, Pegged, Interval and VWAP. BestX notes in the paper that an important consideration when having a limit is the trade-off between better performance, but the order not being completed. It observes that a TWAP with a limit will mechanically outperform one without, but the full amount may not be executed, thus the overall performance may be diminished.

Source: BestX

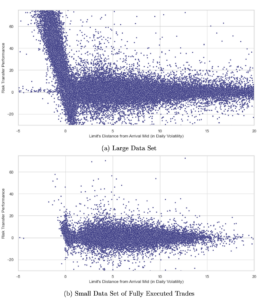

The firm says not all clients provide intended trade amount when submitting data and accounts for this by creating a smaller data set from trades where intended trade amount was included – the results from this set are compared to the broader analysis to ensure the results from the latter are robust.

This is highlighted in data presented in the paper where the large data set, which includes trades where the intended amount was not disclosed, significantly outperforms the smaller data set the more negative limit distance is. This indicates, the study says, “a very strong trade-off between performance and completion for trades starting with an engaged limit.”

The paper also breaks down the raw performance for the trades with one limit further, by putting them into different cases of limit engagement. The negative limit distance cases are combined under Limit Started Engaged, while the positive limit distance cannot engage during the algo execution period (Limit Not Engaged) or engage after the start (Limit Engaged). “A considerable portion of the overperformance of the limit comes from trades with an engaged limit at start,” the paper states. “Trades with limit engaged later mostly underperform trades where limit never engages and also the trades without a limit. This is probably due to limit engagement correlating with unfavourable market conditions: When the market is moving against the trade, there is a larger chance of underperformance as well as limit engagement. Similarly, when the limit is not engaged, chances are the market direction was favouring the trade.”

The study also looks at the data around order completion, still an important factor of course. It finds that the degree of completion is better in Get Done and Opportunistic algos, where over 90% of trades are fully completed for any limit distance bucket, with the former having a slightly high completion percentage. The performance of Pegged and VWAP algos rarely falls below 80% completion rate, the paper says, however by contrast, Interval algos have a completion rate of around 60% when the limit is near arrival price, but this does improve to over 80% when the limit is set at least 20% of daily volatility away from the mid-price.

Source: BestX

Overall then, the headline finding is that setting limits improves performance of Interval and VWAP strategies, especially when they are set further away from market. The evidence is more mixed for Get Done strategies but tighter limits are preferred, while the paper observes “It is hard to improve Opportunistic algos with limits, which lie on the smarter end of the spectrum we investigate.”

The study highlights the benefits, or otherwise, of setting price or market limits on an algo execution (BestX also observes that future studies should probably add algo duration as a dimension to improve optimisation), however it is hard to escape the notion that market conditions, which are notoriously changeable, remain the biggest factor in algo performance. Very few executions will be influenced by an SNB or a Brexit-type event, but understanding how limits influence day-to-day performance of the different strategies should be an important learning point for anyone using algos.