The Rise and Rise of the FX Liquidity Manager

Posted by Colin Lambert. Last updated: May 22, 2021

Geoff Jones, founder of GJJC Ltd an e-FX Consultancy, looks at the changing world of the FX liquidity manager, and offers insights into what the next generation should be looking out for.

FX used to be simple, there were sales, there were traders and there were clients. If you were a trader then there were also brokers who either developed into friends or became the person you spoke most to every day, but wanted to see the least.

Then 20 years ago digitisation happened. Now you had relationship managers, platform specialists and out of nowhere, the liquidity manager was born.

Initially known as “the handbag Chihuahua”, the liquidity manager was introduced to traders like the must-have accessory of the era. Unlike Tinkerbell Hilton though, the liquidity manager’s bond with their sales colleagues is stronger than ever with no Instagram likes required.

Far from an accessory these days, the liquidity manager/sales pairing has created some legendary industry double acts (I’m thinking Steve and T-Bone, Barry and Howard amongst others), but as the first generation of the liquidity manager world pass the baton the next it’s worth thinking about how the job and FX market has evolved.

Evaluating Complex Markets

When there was one market per currency, deals were easy to evaluate – either the trader was a legend, or the client let you down, it was black and white. Introduce five new markets and 10 liquidity providers and suddenly the picture becomes less obvious. Who dropped you? Why? Was the liquidity there to be aggregated or were you supposed to be dealing a full amount? Speaking of full amount, did the client trade the whole clip with you in the first place? Or, heaven forbid, perhaps your trader isn’t a legend after all?

In my experience the best liquidity managers, like the best traders, do this with a spider-sense that cannot be explained, but achieve on average, pretty good results. Unfortunately for the next generation of managers the spider sense can’t be easily taught, you have to develop that for yourself, but a good system can really help.

A quick look at how the FX market has evolved gives you an idea why the complexity exists.

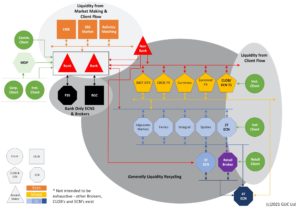

You have bank and non-bank market-makers executing in shrinking markets of firm orders in three main venues, then a swathe of top tier ECN’s co-mingling firm and contingent liquidity. Into these markets some institutional names trade as clients and many more would like to have access to the liquidity. Beyond that, tier 2 brokers look and feel like ECNs without the firm liquidity but with plenty of unique and original client business. Completing the picture, retail platforms run agency and market making businesses, consume liquidity from banks, non-banks, tier 1 ECNs and tier 2 brokers and then tiers of smaller institutions, all-consuming and redistributing pockets of liquidity, driven by relationships.

Step 1 – Technology to Capture and Manage Data

What was once a problem that could be solved for an ECN or a broker with an excel spreadsheet and a pivot table or two, is now a problem that needs an industrialised engineering team to manage it. Generating an understanding of a trade’s impact on the market requires the consumption of all relevant market data, all of the hundreds of updates per second (and then naturally, the alignment of that market data to deal with time synchronisation issues), getting the orders, and the trades and figuring out just what happened.

Sometimes the orders miss the liquidity entirely and there is latency to think about, and whether that was caused by your system, your LP’s or your client’s. Sometimes the order finds the intended liquidity but with so much of the liquidity in the FX market being distributed and redistributed on a last-look basis there are the issues of contingent liquidity and last-look fairness to examine. Before you know it, your hit-rate (or reject rate if you’re the glass-half-empty guy) no longer represents the yard-stick on which to judge an LP or ECN.

Since I found myself outside a bank for the first time in 20 years, at the beginning of a global pandemic, I have been lucky enough to work with a number of different organisations as a liquidity management consultant. What has been a common theme within these firms is that very capable individuals with plenty of industry experience were struggling to get a grip on the data and the complexity.

In an age where everyone’s a liquidity provider, even when some liquidity providers are just agency brokers in everything but name, how can you tell the difference? Who is providing good market data, and who is just replicating someone else a few milliseconds later? How do you aggregate rates to form better prices and protect skews?

First and foremost you need to capture, normalise and store your data, then you need to be able to retrieve it and look at it. In my experience most liquidity management tasks require you to move between a tick chart examining the way the market evolved over the course of 100ms into a view of a year’s worth of trades in a couple clicks.

As a capable hacker I’m able to configure a system that brings these views together very quickly (my ex-colleagues will recall the ‘wizzbanger’ 100 times over), but as my developer friends will tell you I’m not a capable developer, no matter how much I pretend to be. I ended up partnering with an analytics firm to make this work on an industrial scale, and have seen first-hand how well a well-designed system copes with this type of problem. I am now a client and an advisor to this vendor, and am delighted to have freed myself up from the day-to-day management of capturing storing and managing data.

Step 2 – Understanding the Data and Implementing Change

Liquidity management isn’t just about tooling though, it is a process, and for it to be successful in the long term you want to make sure it’s repeatable. Pulling every lever you have is often the first mistake a liquidity manager makes – at some point you’ve no idea who is seeing what, or why, and you’ve no way of improving things for a client or an LP without going back to the start and repeating the same mistakes.

As with everything, integrity, trust and relationships form a part too – particularly if your counterpart at the ECN or bank has a system, or a spider sense, that is better than yours.

Since leaving banking I have worked with organisations that needed help with liquidity management and those wanting a better understanding of the value of their client business and how to evolve it. During this time, where data is everything and the liquidity manager stands proudly beside the relationship manager at the bar, the next generation of liquidity managers should remember that not all flow is good flow, not all data is good data, and despite what some people might say, it is impossible to predict the future through analysis.