Lower FX Volatility Brings Improved Market Conditions in Q2: BofA

Posted by Colin Lambert. Last updated: July 24, 2023

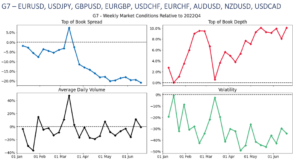

The latest Global FX Microstructure in Review published by Bank of America suggests that FX markets calmed down in Q2, bringing improved market conditions, but slightly lower volumes in G10 markets.

The report, which is authored by Dean Markwick and Paul Conlon from the bank’s e-FX quant team, along with Tan Phull who runs FX algo trading, studies market conditions using a mix of internal BofA data as well as data sourced from third parties. It excludes major holidays and the early hours in Asia when spreads are typically much wider and liquidity much lower.

The latest report finds that while central bank policy divergence has emerged in Q2, macroeconomic conditions generally have increased spot liquidity. This is also associated with lower volatility, which often encourages more passive engagement with the market on the part of buy side clients, perhaps through algo strategies that capture spread. The report notes that conditions are such where algos benefit from strong franchise liquidity and the ability to source additional liquidity not available elsewhere.

Source: Bank of America

Spreads tightened in G10 during Q2, drifting lower throughout the three-month period and continuing a decline that started in late Q1 2023 as the banking crisis abated. Reflecting greater engagement with the market, top-of-book depth also increased steadily throughout the quarter ending at its highest level thus far in 2023. The volatility profile was steadier throughout the quarter and ended close to where it began.

As noted, this translated into lower G10 volumes, BofA says that only two weeks in the quarter were higher than the previous average, something that reflects the improved trading conditions.

For the start of the second quarter conditions were similar in Scandi currencies, however BofA says that volatility trended higher over the last two months, with the associated decline in top-of-book depth and slight tick higher in spreads. Volume was more variable, the report observes, and was largely comparable to the previous quarter.

EM Following Suit

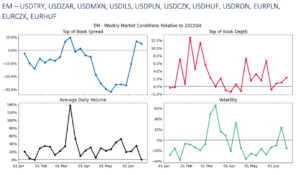

Emerging markets meanwhile, also followed the G10 path, until the last few weeks of the quarter, when spreads widened, to end the period slightly wider than they were at the end of 2022. This coincided with an increase in volatility at the start and end of the quarter, although across the three-month horizon, it was barely changed.

Source: Bank of America

Top-of-book depth in EM increased slightly, BofA says, but was still below levels seen at the start of the year. Unlike in G10 and Scandies, EM volumes were consistently higher than in Q4 2022.

In Asia currencies, spreads were consistent throughout Q2, having fallen at the end of Q1, top-of-book also slightly reduced, BofA says, with volatility steady and volumes lower.