JP Morgan e-FICC Survey Reflects the Return of FX, Interest Rate Volatility

Posted by Colin Lambert. Last updated: February 23, 2022

The findings of the sixth annual JP Morgan e-FICC survey, which polls the opinion of traders in the FICC markets, very much reflect the return of volatility to financial markets, which concerns rising over liquidity and price consistency, and inflation charging to the number one influence on markets in 2022.

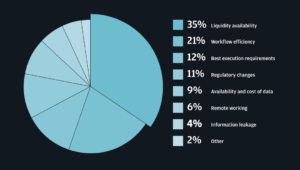

The latest survey contains the responses of 718 traders, up from the 260 that took part in the pandemic-ravaged fifth survey, and for the sixth year in six, liquidity availability is the number one daily challenge for traders, with 35% citing this as their primary concern. Indeed, the results indicate an awareness amongst traders of the potential challenges arising from increasing geopolitical and macroeconomic risks and their impact on market functioning.

While access to liquidity is slightly below the 2019 rating of 40%, it represents a significant rise from 29% in last year’s survey. Equally, whereas most other categories saw a decline in importance – for example workflow efficiency dropped to 21% from 24%, as did the availability and cost of data (from 12% to 9%) – meeting best execution requirements was unchanged at 12%.

Also of note, for the first time, information leakage emerged onto the scene, with 4% of respondents citing that as their top daily trading challenge. This was joined by 11% citing regulatory changes as their top challenge – a subject that didn’t make the list of responses in the 2021 survey.

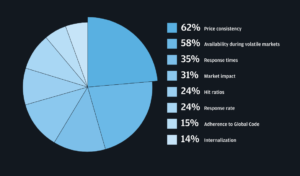

Continuing the theme of execution risk, when asked to rate their top three criteria when selecting a liquidity source, 62% cited price consistency and 58% availability during volatile markets. These are both significantly higher than the 2021 survey where they rated 48% and 40% respectively.

Interestingly, given the ongoing debate around the use of additional hold times in last look, the percentage of respondents citing response times as an important criteria almost doubled to 35% from 18% in the previous survey, however the response rate as a criteria was only slightly higher at 24% versus 23% in 2021.

Again, reflecting possible concerns over changing market conditions (as well as growing awareness of the issue amongst the buy side in particular), those citing market impact as an important criteria more than trebled to 31% from 10% in 2021. This was also reflected in 14% citing internalisation as an important criteria, compared to just 5% in 2021. Hit ratios were also more important, rising to 24% from 10%. Overarching these findings were a growing importance of adherence to the FX Global Code, cited by 15% of respondents in the latest survey, compared to 5% in 2021.

Source JP Morgan

There was an interesting emergence in the top three forms of data seen as the most helpful when supporting execution objectives, with 38% citing pre-trade and real-time data delivered via a UI or API. This likely reflects execution desks not only using algos more, but monitoring performance much more closely, perhaps with the intention of intervening where necessary.

Pre-trade and real-time data tied for second ranking with third party sources of data at 38% (down from 51% in the 2021 survey), behind workflow efficiency and STP at 54% (52%). More emphasis was placed upon execution management systems to provide analysis and evaluation, in the latest survey this was named by 36% of respondents, up from 22% in 2021. Post-trade transactional data’s importance was largely unchanged at 31%, whilst dealer performance metrics and axes history dropped slightly, from 38% to 32%.

Drivers

Reflecting the likely macroeconomic impact in 2022, when asked what will have the biggest impact on markets in 2022, 48% cited inflation – again this was not featured in the previous survey. Market and economic dislocation dropped as the primary impact to 13% from 24% and, naturally, the global pandemic, whilst still attracting 13% of respondents to cite it as the biggest impact, is far off its 42% rating the previous year.

Traders are less concerned about recession risk, it was named by just 5% in the 2022 survey compared to 15% in 2021, and concerns over international trade tensions remain steady at 8%, down from 9% in 2021. Interestingly, for the first time – and this reflects a wider trend in financial markets, ESG and climate risk factors are noted, with 3% naming them as having the biggest impact on markets.

Structural Changes

For the first time, JP Morgan asked traders about their market structure priorities and again there was an emphasis on execution in the responses. 51% named execution management system integration or set up as being among their top priorities, while access to streaming prices and aggregation were cited by 48%. Work automation clearly remains a priority in 2022, with 49% citing this – equally regulatory change figures highly in 43% of respondents.

The Full FX View

Overall, the impression from the 2022 e-FICC survey is that traders are preparing for more volatile conditions. It should not be a surprise, however, when surveying this group that execution themes dominate, but the shift higher again, after the importance of these themes dipped in 2021, certainly betrays a certain unease over conditions.

It is interesting to view the responses through the prism of the 2019, pre-pandemic, results, however, because the percentage expressing concerns over liquidity and price consistency is lower than it was two years before. This suggests that having survived the worst of the pandemic in terms of market conditions, that traders are cautiously optimistic that they will get their trades done – it is natural caution that is driving their responses.

That e-ratios are going to rise in other products is a given, but it is notable that FX e-ratios are likely to increase further. This suggests not only a greater confidence in the e-channel, but also in the algos’ ability to handle different market conditions – indeed the survey predicts a 19% increase in algo usage over the next two years.

What would be helpful in these surveys is an indication of how much volume is being executed by algos currently. Increased algo trading has been a feature of these surveys for some time now and while algo usage no doubt increased in 2020, evidence remains anecdotal, with some reporting a drop in usage as markets calmed down.

Likewise with mobile trading – the fact that traders expect it to be less important in three years compared to today, doesn’t mean mobile will go away. With flexible or ‘agile’ working likely to remain a feature for some time to come, mobile devices will most likely become a part of the trader’s suite of hardware, rather than decrease in value.

Finally, it is good to see the survey adding a third ‘C’ in crypto, clearly it remains early days, but given the job specs and firms involved in the JP Morgan survey, going forward future surveys are likely to provide a true insight into the pace, or otherwise, of institutional adoption of cryptocurrencies.

Again ESG makes it mark in the survey, being named by 23% as among their top priorities.

The survey finds an increasing role for ECNs or third-party platforms, for while banks remain the top liquidity source that traders connect to for the third year, 76% named this channel compared to 88% in 2021 – the latter likely reflecting the impact of the pandemic peak. Equally, while 32% named non-banks as their top liquidity source, this has also fallen to 25% from 32%. While listed exchanges are steady at 29%, ECNs and third-party platforms are cited by 43% of respondents, compared to just 20% in 2021.

Source: JP Morgan

Continuing a theme, and for the second survey in a row, mobile trading is expected to be the most influential technology to shape the future of trading, with 29% citing it as being so over the next 12 months. In the 2021 survey, 33% believed mobile trading would be the biggest influence in the next 12 months, followed by machine learning (19%), blockchain (7%) and natural language processing (3%). In the latest survey, looking at the next year, blockchain is cited by 25% of respondents, AI and machine learning by 25%, and NLP at, again 3%. Slotting in as a response in the 2022 survey is API integration, cited by 19% as the most important over the next 12 months.

Over a three year span, again largely reflecting last year’s survey, AI and machine learning takes centre stage with 45% citing it as the most influential, while mobile drops to 10%. Blockchain is clearly expected to have an increased influence with 24% citing it – and API integration is at 14% and NLP gets a small boost with 7% expecting it be critical technology in three years’ time.

Platform usage is also expected to grow, and, unsurprisingly perhaps give the evolutionary path they are on, credit and Rates are expected to expand quickest, although only just. Respondents saw their e-volumes in these two products rising 17% from November 2021 to 2023, although FX (and futures) are expected to grow 16%. Commodities and options on futures, both at 15%, indicate that the automation of markets is gathering pace across the board.

In November 2021, 69% of FX volume was electronic, this was expected to rise to 77% in 2022 and again to 85% in 2023 – remaining easily the heaviest e-traded product. Futures e-trading volumes are expected to grow from 56% in the survey month, to 64% and 72% over the next two years, however the gap to Rates is expected to narrow, with 59% of flow expected to be electronic in 2022 (up from 52% in the survey, before leaping to 69% in 2023.

Commodities, currently the third heaviest traded e-product at 54% will see its e-ratio rise to 62% in 2022 and again in 2023 to 69%, where it will be joined by Rates in third spot. Credit will continue a decent pace of increase, as noted, at 48% in the survey, electronic volumes are expected to increase to 57% in 2022 and 65% in 2023. Interestingly, this places the evolution of e-trading in credit on a quicker path than Rates.

Trader are clearly going to be more flexible going forward, with 78% saying they will increase electronic trading, 63% that they will use more algorithmic trading and, conversely, 38% expecting to voice trade more. In the 2021 survey, 54% thought they would increase e-trading, 23% that they would do more algo trading and just 8% that they would voice trade more. This could reflect an increase in the number of respondents trading credit and Rates products, which are still developing as electronically traded assets, but also is likely to be a reflection of trader uncertainty over market conditions.

Talking Crypto

For the first time, JP Morgan also asked traders about their crypto assets activities, and, unsurprisingly perhaps given the schism in the financial industry over these assets’ worth, there was a healthy divide between those currently trading crypto assets (27% of respondents) and those who have “no plans to trade crypto assets” at 26%. There remains upside potential for crypto, however, with 13% saying they do not currently trade the asset but plan to within one year, and 6% planning on taking it up within five years.

There is without doubt interest in the development of the crypto market structure, with 16% saying they are interested in the pricing and workflow efficiencies available from blockchain technology more broadly and 6% saying they are currently trying to leverage blockchain efficiencies. In contrast, 4% say they don’t use blockchain and 2% say they do not believe it will affect their business “in the near future”.