In Memoriam – Liam Hudson

Posted by Colin Lambert. Last updated: February 23, 2024

I hate having to do this, but sadly I have to pass on news of another tragic passing in our industry – again at way too young an age – as Liam Hudson lost his long battle with illness last week.

Most of you will have come across Liam at some stage in his time at Abelee, most recently, and before that in his senior roles at Fenics, Bank of America, Barclays and Lehmans. Liam was a highly intelligent man with a great sense of humour – over the years I regularly – and shamelessly (I did attribute “a friend”) – use some of his one-liners in my columns. We did not always agree, but when we did disagree it was with humour and respect, although on balance I am proud to say we did see eye-to-eye on so many things.

The FX industry has lost a deep thinker, and as I hope I am about to remind everyone, an innovator, but Liam’s family has lost a loved one and our heartfelt condolences go out to them. Another good one has gone way too soon to the market in the sky, but I, and many of you, did at least have the privilege of knowing Liam Hudson for at least part of his too-short life.

I have been lucky, and grateful, for Liam’s feedback on items I have been writing, or have written, but one item in particular stands out – it remains my favourite piece that I have produced since I started in this business in 2001. I am not sure where I stand on copyright here, but I did write the original for Profit & Loss, so I am hoping all is OK.

Read on friends, for a taste of Liam’s genius, in an abridged version of my original story of Clack, the robotic hand Liam designed and developed with Eric Hirschhorn and Dexter Senft in his time at Lehman.

RIP Liam, you will be missed.

Meet Clack

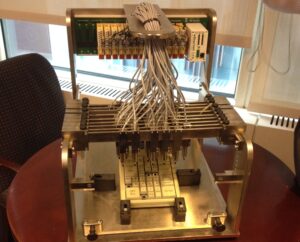

The office, just off a trading floor in midtown Manhattan was much like any other. In the corner, however, sat a device unlike any other.

The resident of the office was Dexter Senft, managing director at Morgan Stanley and the device was Clack, one of four such devices that were created during an 18 month period from early 2003 within the walls of Lehman Brothers. Following an office move at Barclays in New York after it had acquired the US assets of Lehman, Senft received a call asking him what to do with a very strange looking machine, which was duly dispatched to his office.

Senft, along with Eric Hirschhorn, and Liam Hudson, worked together at Lehman Brothers, where Hirschhorn and Hudson designed, created and operated Clack – an innovative solution aimed at creating what amounted to an API accessable, synthetic order book for clients without access to EBS.

“In 2003 EBS was a closed system – a screen and a keyboard was all you got,” explains Hirschhorn. “Our FX business had a client on the buy side who was looking at the problem of gaining access to EBS – he was amazed there was no API. The client needed electronic access and asked what could Lehman do?”

As Hirschhorn recalls, the first thing they had to do was look up the contract between Lehman and EBS to understand what was permissible. “We sat around brainstorming how to give this guy electronic access within the rules,” he says. “We could have unplugged the keyboard, cut the cord, taken the wires and fed them into the computer, but clearly that was outside the terms of the contract. If we were going to make this happen, we had to think differently.”

Hudson adds, “We thought about taking the video signal, cutting the cable and plugging into a computer to get the data from the dealing tiles, but that too was a grey area so we worked on.”

What was happening was certainly unlike any other project likely to have been taking place in a bank then or since. “We were thinking way outside the box in a way not usually seen at a bank…how could use mechanical engineering to innovate around a closed system. It was wild!” observes Hirschhorn.

The thought of even considering this project was due to the culture that pervaded Lehman Brothers in the months and years after 9/11. “Lehman was heavily impacted on that day,” recalls Senft. “Its infrastructure and technology was destroyed and the only way to recover was to think differently. We were encouraged to be innovative.”

Hirschhorn agrees, “The trading ‘robot’ was the tail end of our re-emergence from that day and reflects the level of our research and development budget available at the time. It is an interesting question as to whether we would have been given this leeway if it were ‘normal times’ back then but the fact was it wasn’t, we were rebuilding.”

Design and Development

Having discussed and thrown out several ideas, the team finally came up with what they admit is the crazy sounding idea of a machine that “pecked” down onto a keyboard. That is to say a computer driven robot that actually typed the trades as any human would, only faster. A robot typist was not contemplated by the EBS contract one way of the other and so the team was confident that the potential solution was close at hand and work could proceed.

With the concept agreed, as Hirschhorn notes, what was needed was to either build or better yet, find a company that could build a robot to their specifications without disclosing what they were actually doing. “We searched for companies that developed the robotic mechanisms that tested keyboards and amazingly we found a cell phone testing company in the Midwest that fit the bill,” he says.

The team called the robotics company and, according to Hirschhorn “rather vaguely” told them they were developing a system in financial markets and wanted a keyboard tester. They agreed to build the robot and we sent one of our team members out to supervise. This tester become the core of Clack. Now all that was needed were a few keyboards to test the robot with. The keyboards were a concern because we thought we would likely break a few will getting this entire contraption working.

“Because what we were doing was so secretive, we didn’t feel as though we could approach EBS for keyboards,” Hirschhorn explains. “So we approached another tech company that developed keyboards and told them we wanted something that kind of looked like an EBS keyboard, but wasn’t.

“We didn’t want to get caught up in copyrights but the firm in question told us the EBS keyboard wasn’t copyrighted and duly sent us some look-alikes. It turns out the knock-off keyboards cost a lot less than the real thing.”

The Robot and the keyboards were now in hand, so it was time to test our innovation. “Eric was upstairs, I was downstairs and Eric would test the trading program and the machine would hit the keyboard,’ says Hudson. “Simulated orders would come in, there would be a burst of noise for a few seconds, not unlike a machine gun, and then silence. So it made a loud “clack” noise when it traded and was christened Clack, subsequent versions were called Clack 2, Clack Jr etc.”

Operation

With the keyboard tested and the robot manufactured, the team started to write the software and around this time the buy side firm that started the whole process off got more involved. “The firm wanted electronic access to FX markets, EBS in particular as it was the primary market,” explains Hudson. “They wanted to model the market and place bids and offers and asked if we could, effectively, offer them rudimentary access to the market via a FIX API.

“We looked at it and decided we could offer them market data and trading over FIX while we could automate the hedging on our side” adds Hirschhorn. “With the robot this meant we were able to effectively provide the seemless to the market that the client wanted. When they traded with us, we traded out, most often – but not exclusively – on EBS.”

The testing work continued, “We cranked it up and down to test the limits of the keyboard,” says Hirschhorn. “EBS keyboards were tough – they were built to withstand angry traders – but we had to test them properly because what we were doing was very different. A broken key at the wrong time could be very costly.

“We created a synthetic order book – an ecosystem that was the genesis of the central limit order book – and did this at least a year before the API was opened up,” he adds.

“It was a sophisticated program,” agrees Hudson. “We built a central limit order book and modelled the market and allowed a client to place orders in the book and execute. The client got proper e-commerce execution and market data – it was well ahead of its time.

“We even had execution discussions with clients presenting what was effectively transaction cost analysis,” he adds.

Secrecy

As well as being ahead of its time, Clack, or Project Merlin as the broader concept was designated, was also shrouded in secrecy. As Hirschhorn puts it, “This was tech innovation at its best – and it worked amazingly well. We didn’t know how far it would go.”

The secrecy was mainly the result of the desire to keep the project nimble, there was a real fear if too many people were to become involved, speed of delivery would slow.

The level of security around the project would not be out of place in a spy movie. All but a handful of people at the bank knew of the project, which operated in a couple of rooms “off a back corridor” with card swipe access. “We had a switchbox so that if anyone came in unexpectedly we could switch to manual access to the keyboard and discuss the general testing work we were doing for various platforms,” explains Hirschhorn.

Hudson recalls the Clacks were stored in Plexiglass covers, in a room lined with egg crate foam to provide sound proofing. “Noise reduction was a big part of this project because the noise it made was pretty loud,” he says. The specially built trading room also had TV screens showing news channels to make it look like another dealing room.

In keeping with the secrecy theme, Hirschhorn points out that the various suppliers who built the individual pieces of technology had no idea what the team was doing. “They just sent stuff we ordered,” he says. “They never even came to the office to see how it was working out. We got the material and built the technology – the physical engineering was the most fun part, but there were business benefits as well.”

Legacy

As the veil of secrecy around the project inevitably slipped, so misconceptions were bred around what it was doing. “It was never about developing something to get fees,” explains Hudson. “It was a scientific project that effectively kicked off the arms race that continues to this day.

“What we created looked remarkably similar to how the modern FX market looks today,” adds Hirschhorn. “While Merlin created expertise, many of the skills we developed also developed independently 2 years later as the hedge funds started to sink their teeth into the then new released EBS API”

Although it is easy to see such an invention as a step on the road to high frequency trading this would be wrong. “Clack’s DNA was not high frequency trading, it was high frequency typing,” observes Senft.

“It was never an arb engine,” agrees Hudson. “It was a market and data access mechanism more than anything else. It allowed electronic firms to participate passively in FX markets like never before.”

In late 2004 the project was shut down, but it remains an important period in the career of the men at its helm. “It inspired my career,” acknowledges Hudson. “The next stage was the creation of FX Live at Lehman, which really raised the bar in terms of that bank’s service to its clients.”

Hirschhorn agrees, “We learned so much from the project. It informed so much of what we all went on to do elsewhere. It was one of the wildest thing we worked on in 25 years in the markets and I like to think we’ve been involved in some pretty cool stuff along the way.”

From here, the fate of Clack remains undecided. It sits in Senft’s office but will be preserved as testimony to the innovation and creativity of the FX industry. “There are one or two places it can go now and we are deciding which it will be,” concludes Senft.