FX Volatility Remains High After Event-Driven 2022: BofA

Posted by Colin Lambert. Last updated: January 31, 2023

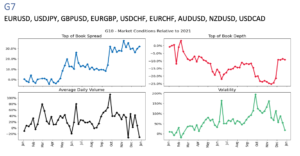

Bank of America’s latest FX market structure analysis finds that conditions in the FX market remained elevated after several events in 2022, with the cost of trading on public platforms significantly higher over the year.

The bank’s latest Global FX Microstructure paper – 2022 in Review – looks at market conditions across the year and finds that while markets reverted after the initial shock of the Russia-Ukraine conflict, the impact of the UK budget chaos and Japanese FX intervention in Q4 were much longer lasting.

Compared to 2021, BofA says that G10 spreads blew out 30% in Q4, and that volatility peaked in October, thanks to the UK and Japanese events. Top of book depth in G10 fell by 25% in Q4, before recovering in December and into early January 2023. Average daily volume was itself volatile, compared to 2021, with obvious spikes in March, June and late September/early October, however there were also volume dips. In May volumes were down almost 20% and in late November and late December they were down some 25% compared to the previous year.

Source: Bank of America

Trading conditions in Scandis offered some contrasts to those in G10. Compared to 2021, top-of-book spread jumped first in late January, before reverting, and then spiking at the start of the Ukraine conflict. There was another reversion (of probably some 75% of the spike), before it started climbing again, hitting new peaks in July and October at 50% higher, before ending the year some 40% up.

While there were a couple of extra spikes in spreads in the Scandis, top-of-book depth seemed untroubled. There was a steady decline into March, when depth was some 15% lower than in 2021, but then after the Ukraine conflict started in earnest, depth leapt to 25% higher than 2021, and pretty much stayed there until December, when it drifted off to around 5% higher. Although “spikier” average daily volume in Scandis largely reflected that in G10, as did the level of volatility.

It was a similar picture in those emerging markets covered in the report, USDTRY, USDZAR, USDMXN, USDILS, USDPLN, USDCZK, USDHUF, USDRON, EURPLN, EURCZK, and EURHUF. Unsurprisingly given the large number of eastern European currencies in the group, spreads and vol spiked in March, although as was the case with the Scandis, top-of-book depth jumped to almost 30% higher following the start of the conflict.

Overall top-of-book spread reverted post-March in EM pairs and remained steady for the rest of the year at around 20-25% higher. Both volumes and volatility had their moments, but ended the year roughly where they started.

Trading Costs Higher

The paper also provides trading cost analysis on the platforms to which the bank is connected. Overall in G10, trading costs on these platforms remained elevated compared to January 2022 with the exception of USD/CAD.

EUR/USD, Cable and EUR/GBP were all some 25-30% higher at the end of the year compared to the start, and USD/JPY some 80% higher. The metric used by the bank was the estimated cost of trading 50 million base currency.

Source: Bank of America

The higher trading costs on external platforms were driven by a decline in average top-of-book size (although interestingly, Cable was largely unchanged and EUR/GBP was higher). EUR/USD top of book size dropped in March around the time of the Russian invasion of Ukraine and struggled to recover, ending the year even lower than that initial March drop.

Again, conditions in Scandinavian currencies contrasted, with the average cost of trading on these venues ending the year lower than January 2022, with EUR/SEK and USD/NOK some 25-30% lower, while USD/SEK and EUR/NOK were broadly unchanged to slightly lower.

Likewise in EM, EUR/CZK cost of trading on venues went down slightly across the year, while EUR/PLN was some 30-40% higher (as were USD/MXN and USD/ZAR), but EUR/HUF remained at elevated levels, ending the year some 90% higher than it entered.

Good Conditions for Algos?

As was the case at the onset of the Pandemic, there appears to be value in adopting algo execution strategies that are able to capture spread. BofA says its algo trading volumes grew steadily in line with heightened volatility, which suggests that clients were indeed using spread capture strategies.

The bank says algo performance against risk transfer was consistently positive on average, although performance against Arrival Mid did deteriorate in Q4 when spread and liquidity costs increased.

Source: Tradefeedr

Algo performance for all eligible flow as illustrated in the TradeFeedr dashboard

Overall, it is interesting to observe that while recent years have seen FX markets react to, and revert from, geo-political events (obviously in 2022 it was the Russian invasion of Ukraine), macro-economic events have a much more lasting impact – something that will no doubt please the economists of the world!

The report also reinforces something that came out of the Bank for International Settlements’ report into its Triennial Survey of FX Turnover, namely the tougher conditions facing public platforms. The BIS analysis, in the December 2022 Quarterly Report, observed that a greater share of trading was executed via bilateral methods, rather than multi-dealer platforms, thanks to higher internalisation levels and the increased use of algos. It is probably fair to infer that in heightened volatility, customers tend to head for the deeper liquidity pools offered by the major dealers and also to their algos, which often tap into those pools.

Looking ahead, BofA says it is likely that the higher volatility will continue as recession risks loom over many countries and the Russia-Ukraine war approaches its first anniversary. Throw in constrained commodity markets and the uncertainty for emerging markets around China’s re-opening and conditions will remain “challenging” the bank says.

“As spreads remain relatively wide, BofA suggests gravitating towards more liquidity seeking or spread capture strategies like Whisper or Decipher as opposed to schedule based strategies,” the paper concludes. “These tools may help reduce overall impact costs of trading.”

To access the full paper please contact the authors: tan.phull@bofa.com, dean.markwick@bofa.com and Pconlon@bofa.com