CME Updates FX Market Profile Tool

Posted by Colin Lambert. Last updated: July 23, 2021

CME Group has rolled out a new version of its FX Market Profile (FXMP) tool, the latest iteration includes data from FX Link, seven additional currency pairs and actual volume data from FX futures (in notional and contract terms). Users are also now able to conduct historical liquidity analysis.

Source: CME Group

The FXMP offers insights into top of book spreads, liquidity profiles at top of book, down the stack and at different times of day, and how the profile has changed over set time periods up to six months. It now supports 18 currency pairs across CME FX futures and the EBS platforms, as well as eight FX Link contracts and the OTC spot equivalents.

Users are able to compare liquidity conditions in the futures and OTC markets down to 10 levels. FXMP has also been reconfigured to offer three main tabs – Cash Futures Analysis; FX Link – Futures; and Historical Analysis, and data can be downloaded with up to five-minute granularity.

The newly-revamped FXMP is launched into a more competitive market place than previously, thanks to the rolling out by Euronext FX of its FX Dashboard, which uses data from CLS Group. That said, by combining the trading data across its futures and OTC platforms, CME Group is offering insight into average daily volumes in the $140-150 billion range according to data from the first six months of 2021.

Analysis released by CME with the announcement of the updated platform uses EUR/USD as an example. While there is no revelation in the Cash-Futures analysis that liquidity is highest during the London trading day and especially so during the overlap with the US, interestingly, the data does suggest a skew in activity on the disclosed-based EBS Direct during Asia hours.

Source: CME Group

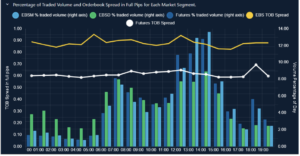

Futures top-of-book spreads are typically inside EBS spreads, however in liquidity terms, the latter typically has greater depth at that level, although down the stack, that reverses back in favour of futures – typically around 33% more volume is available via EBS until late in the trading day.

The FX Link – Futures analysis allows users to study the relationship between OTC spot FX, CME futures and the spot/futures basis as presented by FX Link. The data released by CME indicates, perhaps unsurprisingly given FX Link is still finding its feet as a product, that activity is centred on London/US hours.

It also indicates top-of-book EUR/USD spreads at 0.1 pip throughout the bulk of London/US hours (the tightest spread available on the FX Link contracts) and top-of-book volumes of around $90 million – the latter compares to $3.5 million value on the futures contract, reflecting the lower volatility profile of the forward FX markets to spot.

Source: CME Group

The historical analysis released indicates a growth in EUR/USD futures top-of-book order volume from January to June from $1.8 million to $3 million, while the same measure on EBS Market has risen from $3.8 million to $4.5 million. Top-of-book spread on EBS Market has also shifted from one pip in January to 0.85 in June, the analysis indicates.

When presenting EUR/USD data, CME says that, “Combined with the data on orderbook size this indicates substantial improvements to liquidity on the central limit orderbook venues in the first half of 2021.” This is interesting because at first glance FX volumes on EBS dropped 16% from January to June, from $72.8 billion to $61.1 billion, which suggests that maybe activity dropped off sharply away from EUR/USD, or a lot of the liquidity was not being executed upon. A similar comparison with futures data offers little because the data will be skewed by June being a roll month, whereas January was not. CME FX futures and options had notional ADV of $73.6 billion in January and $92.6 billion in June.

“The FX Market Profile Tool is a hugely powerful resource, available free of charge, that provides very granular data to enable FX traders to make more informed decisions,” says Paul Houston, global head of FX at CME Group. “The enhancements to the tool include historic data analysis, actual traded volumes in Listed FX, and also the inclusion of FX Link data. Traders will now have more information and analytics at their fingertips to evaluate the complementary nature of liquidity available in listed FX and cash markets on the EBS venues.”

Jeff Ward, global head of EBS, adds, “FX Market Profile uses data across our leading EBS Market and EBS Direct platforms and therefore accurately reflects anonymous and bilateral spot market activity. As a result, FX Market Profile brings our broad spot market coverage together with the listed market to provide a fuller picture of market conditions on one screen, providing greater efficiency for decision making and transparency into current and previous market position.”