BestX to Add Crypto TCA to Service

Posted by Colin Lambert. Last updated: January 28, 2022

In what could be a small, but significant, development for institutions seeking to invest in cryptocurrencies, State Street’s BestX – which provides TCA and execution analytics across FX, fixed income, commodities, futures and equities – is adding crypto to its product suite.

While the noise around institutional adoption of crypto assets remains significant, hard evidence of a meaningful take up remains elusive, something that could be changed thanks to developments such as the availability of TCA and benchmark data from an independent source. It is widely recognised that in order for institutions to adopt crypto, they need the comfort of the institutional infrastructure that exists in all their other asset classes before they are really prepared to deploy capital.

This is a point made by Ollie Jerome, co-founder and director of BestX, who observes, “Unless institutions feel there is an infrastructure that they trust and are familiar with, adoption will remain sluggish.”

We think our clients are going to embrace crypto, therefore we want to be ready with a service that provides them with the confidence that they can operate in the market with the same checks and balances as they do elsewhere.

One element of that infrastructure is TCA, and as Jerome points out, not just in the sense of post-trade reporting. “In a world where prices vary across exchanges, there is also the need for exception reporting, regulatory reporting, as well as the ability to be able to collate the material for internal compliance and external oversight, including asset owners.”

Work has been underway for some time at BestX to develop a crypto offering and key to the release, which is due in March 2022, has been the addition of reliable data for crypto assets. “We needed our crypto offering to reflect the BestX approach in the other asset classes,” explains Jerome. “We are huge consumers of data in other asset classes because we want to ensure that we are the most detailed, granular and reliable source of analysis on the street. To try to match that in crypto has been a challenge because it remains a nascent market and finding the right market data provider wasn’t easy.”

The data hurdle was overcome with the recent signing of an agreement with crypto data provider Lukka, a firm that State Street has a minority stake in, which provides data for the top 100 cryptocurrencies by market cap, on a 24/7 basis. Initially the firm has supplied one year’s worth of back data, which has been subject to robust testing to ensure the validity of the model by BestX.

The User Interface of the BestX crypto service will be familiar to users of the platform, albeit thanks to the early stage of development, it is not as well populated as, for example, FX. That said, users can access analyses including cost to Mid, performance versus benchmark, total spread and market impact. “This is very much the first stage of the product,” says Jerome. “We need to start somewhere – in fact the UI looks very much like the FX version in 2016 after we launched. As clients start to use the crypto service we will be able to add windows and analytics over time to build the same comprehensive service we offer in other asset classes.”

Creating a Benchmark

Key to the new service is, as is often the case in other markets, identifying a robust mid-price for the asset. The methodology used for the BestX Mid stems from a client paper published by the firm late last year. As Yangling Li, head of the quant team at BestX explains, there was need for a different methodology to those currently available. “The decentralised nature of the market means that outliers can impact less robust methodologies,” he says. “For example, in November 2020 there was a dislocation in the price of stablecoin DAI where two separate exchanges saw the 1:1 dollar peg broken. This led to a cascade of liquidations because the core data was not accurate enough.

At the end of 2021 there was in excess of $193 billion locked up in smart contracts linked to the price of crypto assets, so the need for an independent, well-constructed benchmark is obvious.

“Our methodology is more robust and as such can offer tremendous value to the DeFi industry,” he adds. “At the end of 2021 there was in excess of $193 billion locked up in smart contracts linked to the price of crypto assets, so the need for an independent, well-constructed benchmark is obvious.”

Prior to the BestX benchmark methodology, the crypto industry largely had two ways to benchmark cryptocurrency prices, a simple hourly TWAP (occasionally VWAP), and a median on aggregate trades pulled from exchanges. Both, Li argues, are open to being influenced by outliers. “Both TWAP and median benchmarks are sensitive to outliers because they can be influenced by, in the case of the TWAP, outlier trades that are included in the average calculation, and in the case of the median, by the risk of lots of outlier trades or data being sent to one exchange in particular,” he explains. “We have created a double median methodology that protects against such events.”

Effectively, the BestX methodology involves polling trades by exchange (it is typically looking for data from the top 10 exchanges), but allocating each exchange the same weighting. The median price across the exchanges can then be the benchmark mid-rate for the crypto asset. Given that inadvertent errors often involve one trading venue, the methodology protects against that eventuality, and if there was a deliberate attempt to manipulate a fix, the perpetrator would need to hit at least six of the largest exchanges to succeed, which would, potentially, involve significant capital outlay and high risk.

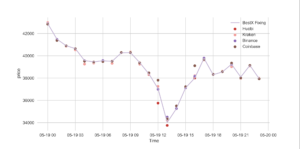

As part of the backtesting of the calculation methodology, BestX calculated the Bitcoin/USDT fixing using the double median method on May 19 2021 (see graph), a day of high volatility in crypto markets as Bitcoin tumbled from USDT 42,000 to 34,000 and then bounced back to 38,000. “Our fixing remained robust during this period and the outliers could not bias the fixing.” explains Li. “For instance, at 4 PM, Coinbase printed the price at 39K USDT while other big exchanges remained at 38K USDT. BestX fixing results stood with the majority and yielded a result at 38K USDT.”

Use Cases

With the Mid created, it is then fed into the BestX analytics engine, which will generate the reports. Initially, the crypto TCA service will be offered on a post-trade basis only, given the nascent nature of the product. As Jerome points out, there is a process to be followed as the product suite matures. “When we get meaningful data on post-trade we will be able to build out pre-trade and peer analysis,” he says. “That’s the way BestX has evolved in other asset classes and I don’t see it being any different here.”

In terms of use cases for the Mid and TCA service, Li points to the growing crypto ETF world, observing that these products need a robust data source for both valuations and best execution on adjustments to the ETF. Additionally, the aforementioned growing number of smart contracts linked to the price of crypto assets will benefit from an independently-created mid-rate against which to value.

There will also be uses familiar to FX market participants, the need to provide proof of best execution, both from an agency point of view if a broker is executing the trade, or institutionally, to internal oversight. “I think institutions are going to use the metrics that they are comfortable using, to try to better understand and optimise execution in what is, to many, a brand new asset class.,” says Jerome. “Being able to attest to the execution quality will help drive adoption of crypto because not only the traders, but the compliance function, will be comfortable – thanks to their ability to both understand, and explain, why and where they traded in the fashion they did.”

A fourth use for an independent mid-rate will be to help accelerate the demand for crypto NDF products. With banks increasingly looking to offer, perhaps even trade, these products, a clear methodology and independent source for a fixing is required to build confidence further.

Development

As use of the crypto TCA service builds, and as part of any pre-trade analysis, BestX will be able to follow what it did in FX, by offering venue analysis. Market impact is already an issue in crypto markets even though the vast majority of trading is retail based, and as institutions become more involved, they are going to have to be careful over where they trade. “We certainly foresee demand emerging from institutions for venue analysis,” confirms Jerome. “These players will need to get size done, so that venue information becomes critically important to them.”

Currently the firm says that hedge funds and wealth managers are showing the early interest, but asset managers and pension funds are likely to follow, albeit it at a distance as they are keener to see the infrastructure built out before they enter the market in any serious manner.

Either way, the development could be a key one for the crypto industry because another brick has been placed in the wall of confidence that institutional investors in particular require before they enter a new asset class. The move could also help the crypto world overcome any regulatory hurdles that it may face in its quest for institutionalisation. Several asset managers spoken to by The Full FX have observed how their regulator will not allow them to hold crypto assets due to the lack of infrastructure providing transparency to the end investor. “At the moment, we can’t offer these products, but we are getting an increasing number of questions from investors about crypto,” says one asset manager based in the UK. “If the infrastructure exists so that it really becomes just another asset class, then while I don’t see the floodgates opening, there will certainly be increased demand – it would be foolish to ignore a new asset class with all the infrastructure required for industries like ours.”

For BestX, Jerome believes the addition of crypto TCA highlights the firm’s ongoing commitment to become the industry standard. “Take up will probably be slow to start with, we don’t expect all of our 140-plus clients to sign up straightaway,” he says. “We do think there will be demand, however, and as such for us, it is as much about being at the forefront of market structure evolution as it is anything else. We think our clients are going to embrace crypto, therefore we want to be ready with a service that provides them with the confidence that they can operate in the market with the same checks and balances as they do elsewhere.”