Digitec Unveils FX Swaps OMS

Posted by Colin Lambert. Last updated: September 7, 2023

With The Full FX View

Digitec has unveiled D3 OMS, its new order management system targeting the inter-dealer FX swaps market by automating traders’ workflows and enhancing venue connectivity.

The solution combines position management, risk management, OMS and EMS functionality to increase workflow automation and enable traders to connect and efficiently place orders in the interdealer FX swaps market. At launch it is connected to 360T SUN and LSEG FX Forwards Matching, with more venues to be added.

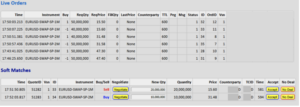

Resting orders on 360T SUN: Source Digitec

“FX swaps trading between banks and buy-side clients is already highly electronic, but the interdealer market has been slower to migrate to these channels, mainly due to the complexity of pricing along the forward curve,” explains Peer Joost, CEO of Digitec. “For over 40 years Digitec has developed pricing tools for FX swaps and we have used this expertise to build D3 OMS for traders to accurately and efficiently place orders in the interdealer market.

“As FX swaps continue to evolve, this is a first but significant step towards automating workflows in this market,” he continues. “We already help FX swaps dealers with price formation and distribution, which is bringing client flow in, this helps with the next link in the workflow chain – managing and executing the resulting risk.”

Stephan von Massenbach, chief revenue officer at Digitec, adds, ““D3 OMS enhances current workflows, and allows traders to manage interdealer FX swaps orders from a single screen. Dealers can manage their curve on D3 and now also place orders into the market from there. We have done a lot of work to enable dealers to have one view of their curve and give them the ability to join the market and place an order where the market is, rather than where their curve is.”

The Full FX View

This could mark a major step forward for the FX swaps market as it continues to wrestle with the challenges (and resistance in some quarters) to further automation.

The challenge for providers thus far in this space has been that the dealers on the desks rarely feel as though a solution provides the flexibility and granularity they require for their everyday task – most pertinently the ability to take risk on through downstream pricing to clients and use an automated process to post interest to offload that risk.

The naysayers continue to argue that by rolling out new technology, spreads will be squeezed in swaps the way they have been in spot – they also argue that dealers want to deal at mid, so will have no interest in trading on MTFs. Both are easily refuted arguments. For a start, FX swaps pricing is largely based off other markets where there is an existing spread – no-one offers choice in interest rate products that’s for sure! Secondly, and more importantly, an OMS allows dealers to post interest discretely, with minimal information leakage. There are funding, commercial and treasury-related ‘axes’ in play that can often result in being able to trade at mid, or very close to it, especially in the short dates.

A third factor ignores the nuances that are enabled by a more sophisticated technology offering. It is fair enough that dealers do not want their customers trading at mid in FX swaps markets, unless the dealer has an ‘axe’. Generally speaking, the major dealers want to enter risk in the D2C market and exit it in the D2D – this requires two distinct technology offerings. The fact that one company is bringing them together should not divert from the fact that each brings a unique workflow to the FX swaps trader.

Currently the major dealers quote customers on their single dealer platforms and some multi-dealer. This will not change, and it allows them to assume risk largely at levels they want to. When exiting, they currently leave static orders with voice brokers or on the MTFs, although the brokers know that there is an interest to “meet in the middle” for wont of a better expression.

It’s hard to see how the workflow being offered via an OMS differs to this, aside from it being more efficient!

It has been shown in other markets that greater automation of workflow often leads to higher volumes and, often, increased revenues. The launch of an OMS should help the FX swaps venues themselves with increased volumes; they help the major dealers manage risk better; and, end-users should see tighter spreads through the improved data that will result.

The ability to nuance order placement in the market is a key element of the new offering. Unlike placing static orders, how things currently work in FX swaps generally, traders are able to dynamically manage their order placement. As the trader’s curve moves so they will need to move their prices, this is done automatically using D3 OMS, rather than having to cancel and repost potentially dozens of orders across multiple tenors. It also means the dealer can stream their interest downstream to clients and also to the MTF venues, while dynamically managing the amounts and prices shown on each channel.

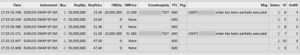

D3 OMS orders and soft matches on LSEG FX Forwards Matching: Source Digitec

“Dealers can also use the D3 OMS as a two-way, automated, market making tool, because it is integrated with the existing workflows on the MTFs,” explains von Massenbach. “And by manages both the prices and the amounts being sent through various channels it ensures the trader is not over-exposed and executes only the amount they want to trade.”

An example of the integration with the MTF workflows can be found in how the dealer’s information is protected. “The dealer can send an Iceberg order and if hit on LSEG FX for example, they are able to negotiate a larger amount – using D3 OMS, if two Iceberg orders match, there may be no need for the negotiation,” von Massenbach continues. “Also, if the dealer sends an order that is inside the current spread shown, all the system will do is let it join top of book and wait for a soft match on its actual interest. Additionally, discretionary IOCs can be used to cross the market as it moves towards the dealer’s price inside the spread.”

D3-OMS orders and partial fills on 360T-SUN: Source Digitec

Digitec is keen to stress that D3 OMS is not a spot solution for the swaps market, observing the required workflows are very different between spot and FX swaps. “There has not been a tech solution available until now that does this, everything until now has been based upon aggregation and message flow,” observes von Massenbach. “Here we are offering an advanced order management capability that engages within the rules of the MTFs, using logic built for the FX swaps market. We have combined our experience across workflow and trading in FX swaps to tackle this problem, and I think it is unique at the moment.

“We are cementing our place in the emerging FX swaps ecosystem,” he continues. “The more automation we can achieve, the more accurate the trader’s view of the market will be. We want to sit in the right place in the client’s tech stack to help them manage their business more efficiently.”

Joost concludes, “There is a lot of interest and we are actively talking to new clients about this product, so now is the time to hit the accelerator. We are building momentum, we have added resources globally, and people are more alert to what’s happening around automation in the FX swaps space compared to even two years ago.”