Year-End Basis Pressure Double 2021: NCFX

Posted by Colin Lambert. Last updated: October 15, 2022

Year-end funding pressures have long been a part of the FX industry with liquidity historically challenged, however the underlying issues have been exacerbated in recent times by the impact of regulation, namely G-SIB requirements and, more recently SA-CCR.

FX markets have also seen so-called “basis blow-outs” in recent years, when demand for dollar funding in particular outstripping supply, prompting huge surges in funding costs around quarter ends. One voice broking source told the author during one of these events a few years ago that while prices in, for example, GBP/JPY were freely available, Cable and USD/JPY pricing was “practically non-existent”.

The phenomenon has also been noted by central banks, with the Bank for International Settlements publishing a study in 2019 that found US banks in particular were “window dressing” their balance sheets at year-end to avoid going into the next G-SIB bucket. This, the study found, prompted wider spreads around quarter – and year – ends, with second tier banks making up much more of the available liquidity in markets.

Now, new analysis by New Change FX seems to indicate that the issue is continuing to worsen, something that may serve as a warning to participants, some of whom, have already been subject to “margin shock” as volatility hits interest rate markets and central bank policy divergence becomes, once again, the norm.

Source: New Change FX

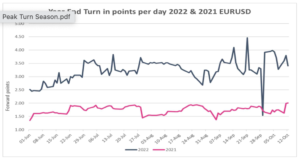

The study uses a forward curve interpolation method that allows NCFX to calculate the basis around turn periods such as year-end and finds that the demand for dollars has pushed the basis significantly more than around the end of 2021, with EUR/USD. GBP/USD and USD/CHF all indicating that funding pressures have doubled.

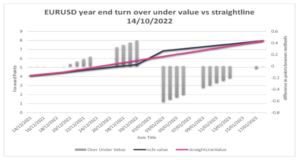

NCFX plots the forward points from the 14 October trade date for EURUSD to value dates between 14 December and 17 January (see graph below). The blue line shows the forward points adjusted for funding pressures over the year end, while the straight-line value is what is typically supplied by data vendors and ignores the year-end turn. “It can be seen that the failure to properly account for the turn can render the straight-line data unfit for purpose,” NCFX says.

Source: New Change FX

The model calculates the broken data value, which is compared to market value as supplied by a survey of dealers. NCFX users are able to access a benchmark providing what the firm terms the “true rate”, thereby limiting potential margin and capital charges resulting from positions being marked to what is, it points out, an erroneous rate, thus creating a false exposure.