What Happened at the Month End Fix?

Posted by Colin Lambert. Last updated: March 2, 2022

Against a backdrop of busier financial market conditions, the February month-end Fix behaved largely in line with previous fixings, although it was noticeable that the major currency pairs – the most liquid – saw some of the larger potential savings by using a longer calculation window.

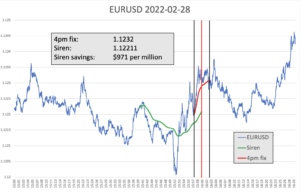

The average saving using the Siren benchmark, which calculates over a longer window and in slightly different fashion, was $698 per million, just below the average saving since The Full FX started publishing comparative data. Although USD/NOK provided the largest saving at $1,491, it is noticeable that EUR/USD and USD/JPY both provided above trend savings at $971 and $781 per million respectively. Equally of note, two perennial “problem” children – Cable and USD/CAD – that often offer the largest savings, were this month the two lowest currency pairs in terms of potential savings at $119 and $32 per million.

The data tables below offer a comparison with data delivered by Raidne, which owns the Siren Fix. The Full FX has independently verified that the WMR data, which is calculated from New Change FX data by Raidne, reasonably reflects the month-end rates delivered by WMR.

To provide more context, the table also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”.

| February 28 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.1232 | 1.12211 | $971 | $583 | $389 | $194 |

| USD/JPY | 115.175 | 115.265 | $781 | $468 | $312 | $156 |

| GBP/USD | 1.34175 | 1.34159 | $119 | $72 | $48 | $24 |

| AUD/USD | 0.72561 | 0.72503 | $800 | $480 | $320 | $160 |

| USD/CAD | 1.26832 | 1.26828 | $32 | $19 | $13 | $6 |

| NZD/USD | 0.67672 | 0.67631 | $606 | $364 | $242 | $121 |

| USD/CHF | 0.91748 | 0.9180 | $566 | $340 | $227 | $113 |

| USD/NOK | 8.79365 | 8.80678 | $1,491 | $895 | $596 | $298 |

| USD/SEK | 9.43820 | 9.44688 | $919 | $551 | $368 | $184 |

| Average | $698 | $419 | $279 | $140 |

*According to Raidne calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

Although EUR/USD potential savings were high, the Siren Fix was undoubtedly helped (assuming you were a buyer of EUR at the Fix) by a 15 pip dip, and rebound, some seven minutes ahead of the WMR window opening. While this could have been some confusion over the direction of (pre)hedging flow, given the current geo-political outlook, it could just as easily have been on an item of news or rumour from Eastern Europe.

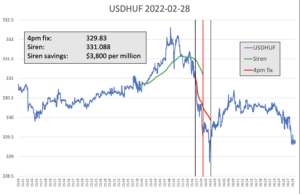

Every month The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/HUF. Data is again provided by Raidne according to the same guidelines in place for the regularly reported currency pairs.

Clearly the Hungarian forint was, and is, likely to be impacted to a degree by events in the Ukraine, but what flow was going through the pair did so largely during the WMR window, creating market impact. The pair did rebound towards the end of the WMR window and immediately afterwards, however it did remain below pre-Fix levels afterwards, suggesting perhaps that liquidity wasn’t quite as expected during the window itself. This led to a large potential saving of $3,800 per million, easily the largest potential saving recorded thus far by The Full FX, surpassing the $2,625 from USD/TRY at the end of November.