What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: January 12, 2022

The last month-end London 4pm Fix of 2021 saw more subdued activity after the blow out in November, with sources reporting hedging trades executed earlier in the month to avoid what was likely to be a challenging liquidity environment at year-end.

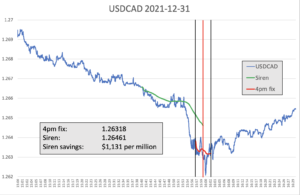

The average portfolio saving at 100% correlation was $558, amidst generally lower market impact, although both AUD/USD and USD/CAD had potential savings above their average since The Full FX starting publishing data.

The data tables below offer a comparison with data delivered by Raidne, which owns the Siren Fix. The Full FX has independently verified that the WMR data, which is calculated from New Change FX data by Raidne, reasonably reflects the month-end rates delivered by WMR.

| December 31 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.1372 | 1.13678 | $369 | $222 | $148 | $74 |

| USD/JPY | 115.155 | 115.074 | $704 | $422 | $282 | $141 |

| GBP/USD | 1.35445 | 1.35391 | $399 | $239 | $160 | $80 |

| AUD/USD | 0.72705 | 0.72643 | $853 | $512 | $341 | $171 |

| USD/CAD | 1.26318 | 1.26461 | $1,131 | $678 | $452 | $226 |

| NZD/USD | 0.68465 | 0.68418 | $687 | $412 | $275 | $137 |

| USD/CHF | 0.91115 | 0.91149 | $373 | $224 | $149 | $75 |

| USD/NOK | 8.8183 | 8.82093 | $298 | $179 | $119 | $60 |

| USD/SEK | 9.05385 | 9.05575 | $210 | $126 | $84 | $42 |

| Average | $558 | $335 | $223 | $112 |

*According to Raidne calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

To provide more context, the table also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”.

Although activity was subdued there were still substantial savings to be had with a longer window, not least $704 per million in USD/JPY, the second heaviest traded pair in FX markets. USD/CAD also saw significant heading ahead of the five-minute WM window around 4pm, resulting in a saving of $1,131 per million.

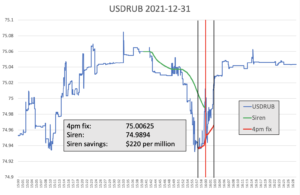

Every month The Full FX is selecting an emerging market currency pair at random to broaden the analysis – this month the selected pair is USD/RUB. Data is again provided by Raidne according to the same guidelines in place for the regularly reported currency pairs.

There was a recovery late in the WM window in USD/RUB meaning reduced savings in the longer window, although interestingly, the WM Fix does seem to have been close to the end of the window, and represents a rate above which the pair traded sparsely during the five minutes. This suggests perhaps that more actual trades were executed towards the end of the window, rather than across the span of the fixing.