What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: December 3, 2021

After what was a very quiet September in terms of price action around the month-end London 4pm Fix, October saw something of a return to trend, with significant savings again available through the use of a longer fixing window.

Potential savings in October were, in many pairs, close to the average since The Full FX started publishing data, the outliers were AUD/USD, which saw little price action ahead of the window, and USD/CHF.

The data tables below offer a comparison with data delivered by Raidne, which owns the Siren Fix. The Full FX has independently verified that the WMR data, which is calculated from New Change FX data by Raidne, reasonably reflects the month-end rates delivered by WMR.

| October 29 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.15720 | 1.15794 | $639 | $383 | $256 | $128 |

| USD/JPY | 114.021 | 113.962 | $518 | $311 | $207 | $104 |

| GBP/USD | 1.37066 | 1.37159 | $678 | $407 | $271 | $136 |

| AUD/USD | 0.75106 | 0.75111 | $67 | $40 | $27 | $13 |

| USD/CAD | 1.23950 | 1.23892 | $468 | $281 | $187 | $94 |

| NZD/USD | 0.71562 | 0.71528 | $475 | $285 | $190 | $95 |

| USD/CHF | 0.91381 | 0.91364 | $186 | $112 | $74 | $37 |

| USD/NOK | 8.45892 | 8.45033 | $1017 | $610 | $407 | $203 |

| USD/SEK | 8.58794 | 8.57832 | $1121 | $673 | $449 | $224 |

| Average | $574 | $345 | $230 | $115 |

*According to Raidne calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

To provide more context, the table also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”.

Of note this month is a reasonably regular feature of this analysis over the first seven months – four digit potential savings in the Scandies, it is also notable that the three heaviest-traded FX pairs combined for a cumulative $1,835 potential saving using the longer window, with EUR/USD – the busiest pair – reporting a saving of $639.

Cable elicited savings very much in line with the average over the last six months, but while there was a small uptick once the shorter window had closed, it resumed a downtrend after that, suggesting sterling selling requirements were heavy at month-end. Again though the (pre)hedging window saw a larger move than in the fixing window itself.

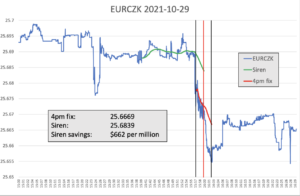

Every month The Full FX is selecting an emerging market currency pair at random to broaden the analysis – this month the selected pair is EUR/CZK. Data is again provided by Raidne according to the same guidelines in place for the regularly reported currency pairs. The actual EUR/CZK WMR Fix was 6.2705 according to market sources, therefore the saving would be slightly lower than stated below.

EUR/CZK saw a sharp spike lower some 30 minutes before the opening of the WMR Window, however this was recouped quickly, a second bout of selling in the WMR Window saw the pair drop again, before recovering after the Fix calculation. The 20-minute window, conversely, largely reflected price action for the hour before.