What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: February 17, 2025

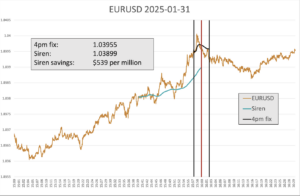

Although the January month-end Fix showed similar market impact to recent months, there might be some concerns that the world’s largest currency pair, EUR/USD, offered the largest potential savings via the longer 20-minute Siren FX window, compared to the five-minute WM methodology.

The overall saving across the portfolio of nine currency pairs was $305 per million, just below the 2024 average of $319.50 per million, with EUR/USD, Cable, NZD/USD and USD/SEK above their 2024 average in January, while all but EUR/USD were below their 46-month average since The Full FX started tracking data. It should be noted that random checks with market sources indicates that again there was some divergence between the actual WM rates and those calculated by New Change FX, the latter uses much higher frequency data, specifically, Cable was over one pip out, and USD/JPY was exactly one pip out. In both cases, this would have increased the execution cost for the end investor, as it would have slightly in AUD and CHF. CAD, very slightly, as well as NOK and SEK provided lower execution cost than presented in the table.

To provide more context, the table below also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”. As noted, the rates used for the WM column are calculated using a higher frequency data set from New Change FX, however The Full FX endeavours to check that they are a reasonable reflection of those published by the LSEG-owned business.

| January 31 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.03955 | 1.03899 | $539 | $323 | $216 | $108 |

| USD/JPY | 154.84 | 154.803 | $239 | $143 | $96 | $48 |

| GBP/USD | 1.24243 | 1.24199 | $354 | $213 | $142 | $71 |

| AUD/USD | 0.6237 | 0.62362 | $128 | $77 | $55 | $26 |

| USD/CAD | 1.44827 | 1.4479 | $256 | $153 | $102 | $51 |

| NZD/USD | 0.56535 | 0.56555 | $354 | $212 | $141 | $71 |

| USD/CHF | 0.90818 | 0.9083 | $132 | $79 | $53 | $26 |

| USD/NOK | 11.30247 | 11.30649 | $356 | $213 | $142 | $71 |

| USD/SEK | 11.05656 | 11.06085 | $388 | $233 | $155 | $78 |

| Average | $305 | $183 | $122 | $61 |

*According to Siren FX calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

Given the size of the market and likely flows, there would be some concern that EUR/USD offered the highest execution costs using the shorter window – indeed at $539 per million, this is the highest recorded for the pair since December 2023 and is three-times the 2024 average. Investors (presumably not the trustees who don’t appear to track this data particularly keenly) will be hoping this does not continue into the rest of the year.

Source: Siren FX

EUR/USD was already in an uptrend as the 4pm window approached and this continued into the first half of the WM window, with a significant rise of some 20 points in the five minutes leading up to the shorter window opening. This suggests that hedging ahead of the WM Fix became more aggressive as the open neared, however, in less than two minutes there was a reversal of some 12 pips into the close.

Post-Fix, the pair traded steadily, suggesting that the sheer amount to be traded at the 4pm Fix had contributed to the jump higher.

Every month, The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/HUF. Data is again provided by Siren FX according to the same guidelines in place for the regularly reported currency pairs.

There was a more confused pattern of trading ahead of the WM Fix in HUF, although there was a notable jump some 10 minutes out, which is often the time fixing flows start to be hedged by dealers. This ran into some selling, which may have been a continuation of the short-term trend – the dollar had been drifting against the HUF for much of the afternoon.

Source: Siren FX

There was a small tick lower at the start of the WM window, before buying resumed in earnest and the pair exited the WM window at the five-minute high.

At $262 per million, while notable, the savings from using the longer Siren window in the EM pair were the lowest since June 2022. They were equally significantly below the 45-month average of $1,059.58 per million in various pairs selected by The Full FX.