What Happened at the Month End Fix?

Posted by Colin Lambert. Last updated: June 7, 2023

Quieter FX markets translated into a relatively low market impact from hedging of flows before the London 4pm Fix with the majority of currency pairs monitored by The Full FX, providing smaller savings in the longer calculation window than the long-term average.

Just three pairs – USD/CHF, USD/CAD and USD/SEK had larger market impacts, above the 26-month average, with the former seeing a $942 per million saving comparing the 20-minute Siren FX calculation with the five-minute WMR calculation. USD/CAD provided a $867 per million saving, while USD/SEK was $936 per million. Over the 26 month’s since The Full FX started tracking the data, the average saving for USD/CHF is 607.27, for USD/CAD it is 55.77, and for USD/SEK 861.88.

AUD/USD saw the smallest execution cost at just $77 per million, still a meaningful potential saving, the third lowest recorded by the pair in the 26 months. It was also quiet for USD/JPY at $107 per million, this too is the third lowest potential saving.

To provide context, the table below also presents projected dollars per million savings across the portfolio of currency pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”.

Please note, Raidne, the publisher of the Siren Fix and provider of this data, has re-branded to Siren FX.

| May 31 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.0661 | 1.06656 | $431 | $259 | $173 | $86 |

| USD/JPY | 139.715 | 139.73 | $107 | $64 | $43 | $21 |

| GBP/USD | 1.2394 | 1.2390 | $323 | $194 | $129 | $65 |

| AUD/USD | 0.64715 | 0.6471 | $77 | $46 | $31 | $15 |

| USD/CAD | 1.3593 | 1.36048 | $867 | $520 | $347 | $173 |

| NZD/USD | 0.59935 | 0.59946 | $183 | $110 | $73 | $37 |

| USD/CHF | 0.91415 | 0.91329 | $942 | $565 | $377 | $188 |

| USD/NOK | 11.14295 | 11.14732 | $392 | $235 | $157 | $78 |

| USD/SEK | 10.8836 | 10.8938 | $936 | $562 | $375 | $187 |

| Average | $473 | $284 | $189 | $95 |

*According to Siren FX calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

The longer window offered smaller-than-average savings at $431 per million, the long-term average is $662.65, with steady EUR selling seeing the pair drop almost 30 points from the peak early in the (pre) hedging window. The pair continued under pressure after the 4pm window closed, suggesting the market absorbed the flow reasonably well.

Source: Siren FX

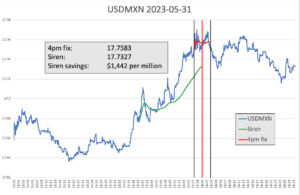

Every month The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/MXN. Data is again provided by Siren FX according to the same guidelines in place for the regularly reported currency pairs.

Source: Siren FX

There was steady dollar buying into the 4pm window as flows were (pre) hedged, seeing the pair rise some eight big figures before the WM calculation window opened. Good two-way interest in the five-minute window followed, this period also saw a small sell-off, most likely as speculators who had anticipated the Fixing flow, took profit.

Also suggesting the existence of trading ahead of the WM window, USD/MXN drifted lower post-calculation, albeit relatively quietly.