What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: March 6, 2023

An occasional question over the data published by The Full FX for every month-end Fix is that the overall savings are often boosted by activity in relatively minor currencies – this is refuted by the latest monthly data where not only were there decent savings across the board, but with the exception of the NZD, the major currencies all offered savings above the median.

In broader terms, however, it was a quieter than usual month-end for the FX markets in terms of the market impact of pre-hedging flows. The potential saving from using a 20-minute window was $429 per million against using a calculation based upon the WM five-minute window, this is considerably lower than the 23-month average of $717.43 per million since The Full FX started publishing this data.

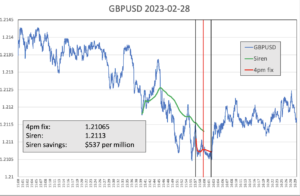

As noted, however, the three major currency pairs, EUR/USD, USD/JPY and Cable, all had savings in excess of the average, EUR/USD being $509 per million, USD/JPY $440 per million, and Cable $537 per million.

The highest potential saving came in NZD/USD at $856 per million, meaning this is the sixth time in the 23 months that there has not been a currency pair offering a saving above $1000 per million. At $429 per million, the overall saving is the joint fourth lowest in that period.

To provide context, the table below also presents projected dollars per million savings across the portfolio of currency pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”.

| February 28 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.0605 | 1.06104 | $509 | $305 | $204 | $102 |

| USD/JPY | 136.215 | 136.275 | $440 | $264 | $176 | $88 |

| GBP/USD | 1.21065 | 1.2113 | $537 | $322 | $215 | $107 |

| AUD/USD | 0.67435 | 0.67410 | $371 | $223 | $148 | $74 |

| USD/CAD | 1.36145 | 1.36113 | $235 | $141 | $94 | $47 |

| NZD/USD | 0.61955 | 0.61902 | $856 | $514 | $342 | $171 |

| USD/CHF | 0.93725 | 0.93708 | $181 | $109 | $73 | $36 |

| USD/NOK | 10.3465 | 10.34853 | $196 | $118 | $78 | $39 |

| USD/SEK | 10.4286 | 10.43414 | $531 | $319 | $212 | $106 |

| Average | $429 | $257 | $171 | $86 |

*According to Raidne calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

In some ways Cable displayed the classic hallmarks of speculative action over the February month-end Fix, although the entry to the five-minute window was anything but straight down. Nonetheless, speculative interests, who collectively target this time of the day and month, seemed to have picked up on sterling selling interest from around 15.45pm UK time to send the pair 25 pips lower. There was a brief bounce but the selling resumed into and through the five-minute window, before there was a decent pullback as the market exited the fixing window, followed by a more sustained, albeit shallow, recovery.

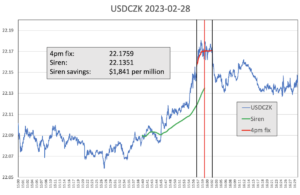

Every month The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/CZK. Data is again provided by Raidne according to the same guidelines in place for the regularly reported currency pairs.

It was, as is often the case with the EM picks, a nasty month-end for dollar buyers using the WM Fix, with a potential saving of $1,841 per million being available from the longer Siren 20-minute window. This is significantly higher than the 22-month average of $1,158 per million and is the seventh highest potential saving during this time.

There was sustained dollar buying into the five-minute calculation window, with the pair rising some eight big figures into the open. USD/CZK largely traded sideways during the calculation period, before drifting lower again as the window closed. Again, this suggests that either a large part of the hedging was executed ahead of the window, or speculators were able to jump on the move in the pre-hedging period.