What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: January 8, 2023

It was another month of potentially costly FX hedging for those firms using the shorter calculation window for their month-end trades, with the longer Siren window delivering savings of up to $853 per million compared to the five-minute WM Fix.

While the two Scandinavian currencies delivered the highest potential costs savings of $1,141 in USD/NOK and a massive $2,512 per million in USD/SEK – the second highest saving since The Full FX started publishing this data in April 2021 – of perhaps more concern, given the amounts involved, are the savings available in the major pairs.

EUR/USD delivered potential savings of $922 per million, Cable $889 per million and USD/JPY $602 per million. While USD/JPY is slightly below the 20-month average saving of $648.85 per million, the savings for the other two are significantly higher than the $716.95 and $706.35 longer-term average.

To provide context, the table below also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”.

| November 30 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.02965 | 0.66918 | $922 | $553 | $369 | $184 |

| USD/JPY | 139.54 | 139.624 | $602 | $361 | $241 | $120 |

| GBP/USD | 1.1909 | 1.1916 | $889 | $534 | $536 | $178 |

| AUD/USD | 0.6697 | 0.63913 | $777 | $466 | $311 | $155 |

| USD/CAD | 1.3557 | 1.35577 | $52 | $31 | $21 | $10 |

| NZD/USD | 0.6211 | 0.62077 | $532 | $319 | $213 | $106 |

| USD/CHF | 0.95275 | 0.95299 | $252 | $151 | $101 | $50 |

| USD/NOK | 9.97115 | 9.95979 | $1,141 | $684 | $456 | $228 |

| USD/SEK | 10.6638 | 10.63708 | $2,512 | $1,507 | $1,005 | $502 |

| Average | $853 | $512 | $341 | $171 |

*According to Raidne calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

With the exception of a five-minute spell close to when the pre-hedging window would normally start, EUR/USD was in a steady downtrend throughout the hour leading up to the WM Fix, in the 15 minutes prior to the opening of that window the pair dropped some 40 pips (having fallen another 40 in the previous 40 minutes). Again, there was a small bounce towards the end of the five-minute window, suggesting speculators had once again been involved, and the pair traded steadily to slightly higher in the next 30 minutes.

Source: Raidne

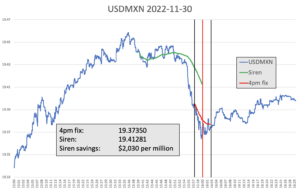

Every month The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/MXN. Data is again provided by Raidne according to the same guidelines in place for the regularly reported currency pairs.

It was a tough month-end for any seller of USD/MXN (and presumably, given the price action, that’s what most people were), with the price dropping sharply in the five minutes leading up to the WM window opening, continuing to fall until about half way through window, and then steadily reversing back some 50% of the original fall.

Source: Raidne

The savings from the longer Siren window are $2,030 per million, the fourth highest saving since The Full FXstarted published EM data in May 2021, and significantly above the 19-month average saving of $1,077.47.