What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: October 4, 2022

It was another tough month-end for anyone who cares about market impact around the London 4pm WM Fix, with potential savings using a longer window reaching $974 per million – the fourth largest saving in the 18 months The Full FX has been publishing this data.

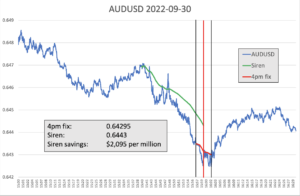

It was particularly tough for anyone involved with the Commonwealth currencies with users of Raidne’s Siren benchmark fix seeing AUD/USD providing potential savings of over $2,000 per million and NZD and CAD above $1,300 and $1,400 per million.

Predictions of dollar selling failed to materialise, although sources in the market say they did see users of the Fix hedging exposures earlier in the week to avoid the month-end itself – something that would appear to raise questions about why these users are using the Fix in the first place.

The good news for users of WM was that the both EUR/USD and USD/JPY, the heaviest traded pairs in the world, saw less market impact, however Cable, subject of extreme volatility over the past weeks provided a potential saving of $601 per million, above its 18-month average of $570. Equally, the two Scandinavian currencies, often providing serious savings, were both relatively quiet compared to their 18-month average of $829 for USD/NOK and $757 for USD/SEK.

To provide more context, the table also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”.

| September 30 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 0.97965 | 0.97942 | $235 | $141 | $94 | $47 |

| USD/JPY | 144.745 | 144.676 | $477 | $286 | $191 | $95 |

| GBP/USD | 1.1163 | 1.11563 | $601 | $360 | $240 | $120 |

| AUD/USD | 0.64295 | 0.6443 | $2,095 | $1,257 | $838 | $419 |

| USD/CAD | 1.37405 | 1.37207 | $1,443 | $866 | $577 | $289 |

| NZD/USD | 0.56565 | 0.56639 | $1,307 | $784 | $523 | $261 |

| USD/CHF | 0.98425 | 0.98238 | $1,904 | $1,142 | $761 | $381 |

| USD/NOK | 10.8973 | 10.89431 | $274 | $165 | $110 | $55 |

| USD/SEK | 11.0975 | 11.10224 | $427 | $256 | $171 | $85 |

| Average | $974 | $584 | $389 | $195 |

*According to Raidne calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

Hedging ahead of the WM five-minute window in AUD/USD appeared to start about 10 minutes before the calculation window opened and accelerated in the three minutes leading into the window. Interestingly, in the window itself, market impact was relatively muted with two bouts of buying in the second half – something that could have been what is anecdotally, the growing number of speculators trading around the Fix off signals, taking profits.

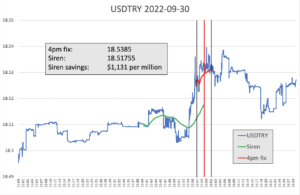

Every month, The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/TRY. Data is again provided by Raidne according to the same guidelines in place for the regularly reported currency pairs.

Price action in the lira looks similar to that in the AUD with the majority of the hedging ahead of the window occurring in the last three minutes before it opened, and then more two-way price action in the window itself. At the $1,131 per million saving, this month’s Fix is right on the 18-month average for the emerging market pair selected, which is $1,009 per million.