What Happened at the Month-End Fix?

Posted by Colin Lambert. Last updated: August 2, 2022

The latest month-end FX benchmark fix to be analysed by The Full FX was, frankly, a bit of a bloodbath as far as those executing in the five-minute WMR window are concerned, with all but one of the nine currency pairs tracked projecting a potential saving on execution costs of over $1,000 per million – the first time this has happened. Previously, a maximum of five pairs has breached this threshold.

All of this means that while it has been a quiet couple of months in terms of potential savings from a longer window, that all ended in July with the second highest potential execution cost savings across a portfolio of currencies since The Full FX first started publishing data. This includes the largest ever potential saving was recorded in a single currency pair this month also, with USD/NOK offering $3,315 per million saving from using Raidne’s Siren compared to the WMR Fix.

To provide more context, the table also presents projected dollars per million savings across a portfolio of different pairs using a correlation with the Fix calculation, depending upon how much flow was in the direction of the market, or “with the wind”.

| July 29 |

| CCY Pair | WMR 4pm Fix* | Siren Fix | 100%** | 80% | 70% | 60% |

| EUR/USD | 1.01965 | 1.0185 | $1,129 | $677 | $452 | $226 |

| USD/JPY | 133.65 | 133.789 | $1,039 | $623 | $416 | $208 |

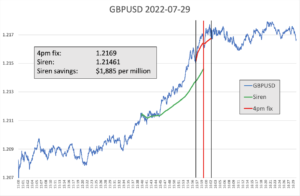

| GBP/USD | 1.2169 | 1.21461 | $1,885 | $1,131 | $754 | $377 |

| AUD/USD | 0.6978 | 0.69657 | $1,766 | $1,059 | $706 | $353 |

| USD/CAD | 1.2813 | 1.28154 | $187 | $112 | $75 | $37 |

| NZD/USD | 0.6271 | 0.62616 | $1,501 | $901 | $600 | $300 |

| USD/CHF | 0.9524 | 0.95362 | $1,279 | $768 | $512 | $256 |

| USD/NOK | 9.6675 | 9.69965 | $3,315 | $1,989 | $1,326 | $663 |

| USD/SEK | 10.1952 | 10.21371 | $1,812 | $1,087 | $725 | $362 |

| Average | $1,546 | $928 | $618 | $309 |

*According to Raidne calculation using NewChange FX data

** Savings are in dollars per million by percentage of correlation to the Fix flow. Blue cells signify a projected saving using Siren, Red cells a saving using WMR

Notably, EUR/USD offered potential savings of $1,130 per million – the second month in a row it has been this high, while USD/JPY offered $1,039 per million. Reinforcing the fact that the savings were not only available in less liquid currencies, Cable offered savings of $1,885 per million, USD/CHF $1,279, and AUD $1,766 per million. NZD/USD and USD/SEK also saw their highest savings yet.

The chart below highlights how Cable buying was steady into the fixing window, however it is also notable that the pair was largely sold off during that day’s session up to 2pm London when, perhaps, fixing orders started arriving from customers. Either way, clearly the flows at month-end were large and directional.

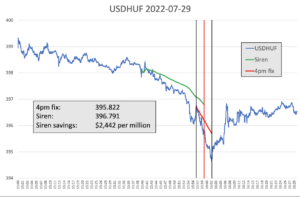

Every month, The Full FX is selecting an emerging market currency pair at random, and before the data is available, to broaden the analysis – this month the selected pair is USD/HUF. Data is again provided by Raidne according to the same guidelines in place for the regularly reported currency pairs.

Again, there seems to have been hedging ahead of the WMR window, followed by a steep sell-off during the ensuing five minutes and, more worryingly perhaps, a pull back to levels seen just before the WMR window opened. At a potential market impact cost of $2,442 per million, this is the third highest monthly saving since the analysis series began.