Volatility at Top of Traders’ Minds: JP Morgan E-Trading Edit

Posted by Colin Lambert. Last updated: February 1, 2023

The seventh edition of the JP Morgan e-Trading Edit, which surveys traders for their key issues in markets, finds that recession risk and volatile markets are top of traders’ minds for 2023, the latter supplanting liquidity availability for the first time.

The 2023 edition contains the views of 835 institutional traders from 60 global locations. When asked “Which potential developments will have the greatest impact on the markets in 2023?” recession risk loomed large with 30% citing it as their number one. Inflation risk, which was the number one impact forecast by traders last year at 48%, is still a significant threat in 2023, however, with 26% citing it as the likely number one impact.

Unsurprisingly given world events, geopolitical conflict ranks three at 19%, with economy and market dislocation ranking fourth at 14%. It is notable that while ESG factors were cited by 3% of the 700-odd traders to respond in the 2022 survey, in the latest edition, ESG and climate risk factors drifted to 1%.

Finally, while the medical profession may disagree, no respondents cited a global pandemic as a risk for 2023.

On inflation, there is a balance towards a more optimistic view, with 44% believing it will decrease in their region, while 37% believe it will level off. Just 19% believe it will increase in their region.

Across the regions, 58% of US respondents believe inflation will level off, while just 10% believe it will increase. In the UK it is a less clear picture with 41% believing it will decrease, while 32% believe it will level off and 27% it will increase. For the rest of Europe, 56% believe it will decrease, 31% it will level off and 13% it will increase. Finally, in Asia-Pacific, 40% believe inflation will level off, 35% it will decrease and 25% it will increase.

Market Structure

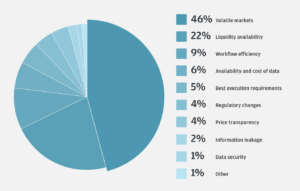

For the first time, liquidity availability is not the top concern for traders when asked about their greatest daily trading challenge. It does come it at 22% in second place, down from 35% in 2022. Volatile markets ranks as the number one challenge at 46%.

Workflow efficiency has dropped as a challenge, from over 50% the last two years, it drops to 9% in the latest edition, suggesting that the hard work of the technology teams at buy side firms is starting to pay off. Elsewhere, the availability and cost of data, best execution requirements, regulatory change and price transparency all achieve ratings of 6%, 5% and 4% for the latter two. All were lower than the equivalent rankings last year.

What will be your greatest daily trading challenge in 2023?

Source JP Morgan 2023 E-Trading Edit

Another challenge to drop, slightly, was information leakage, which came in at 2%, from 4% last year when it first registered on the Edit – this suggests that traders have become more accustomed to the advantages of algo strategies and also of where they trade to keep information leakage to a minimum.

Perhaps reflecting the changing circumstances and return to the office, mobile trading, last year’s number one technology influence, has declined in the 2023 version. Equally unsurprising, is that it has been replaced by AI and machine learning as the biggest likely technological influence with 53% citing it so.

API integration is next most influential at 14%, followed by blockchain/DLT at 12%. Mobile trading has fallen to 7% (it was 23% in 2022), and is matched by natural language processing and quantum computing.

In terms of market structure concerns, access to liquidity remains number one, cited by 33% as the biggest concern and 19% as their second biggest concern, followed by 14% for regulatory change (17% ranked this second) and market fragmentation at 12% (18%). In 2022, access to liquidity had the highest first ranking at 25%, while technological developments were ranked number one by 16% and market data access and costs were number one for 12% of respondents.

E-Trading on the Rise

Although the recent Bank for International Settlements’ Quarterly Review suggested a flattening out of e-trading activity in 2022, the JP Morgan Edit finds there is still room for growth and the appetite is as strong as ever, although in keeping with the BIS observation, much of it is outside FX.

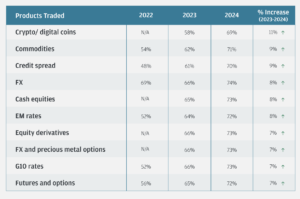

Remarkably, all 835 respondents expect to increase their e-trading volumes in 2023, although there are nuances within this data point. In product terms, the largest growth is expected to come outside FX, indeed the expected e-FX volume actually drops. In 2022 respondents e-traded 69% of their FX volumes, in 2023 that is expected to be 66% – although a return to growth is expected in 2024, at 74%.

What percent of your trading volume is/will be through e-Trading channels?

Source: JP Morgan 2023 E-Trading Edit

G10 Rates had a e-traded ratio of 52% in 2022, this is expected to soar to 66% in 2023, and again to 73% in 2024. Likewise, credit spread trading was 48% electronic in 2022 but is expected to hit 61% in 2023 and 70% in 2024. There are also healthy expected gains for commodities (54% to 62% to 71% in 2024); EM Rates (52%, to 66% and 73%); and futures and options (56%, 65% and 72%).

FX and precious metals options, which were not electronically traded in 2022, are expected to see 66% e-ratio in 2023 and 73% in 2024.

Reflecting this, when asked, which products are likely to have the most developments in electronic trading over the next 12 months, commodities was ranked first by 16% of respondents (28% ranked in second and 27% third); followed by corporate bonds at 15% (32% and 19%); and FX options at 14% (13%, 12%).

Although respondents said that they expected their e-ratio to be 58% in 2023 and 69% in 2024, 72% that took the Edit also said they have no plan to trade crypto or digital coins within five years – 14% said they would be within that timeframe. Just 8% were currently trading crypto or digital coins, with 6% said they were not but plan to in the next year.

“We continue to see strong momentum towards electronic trading, as seen by 100% of survey respondents predicting an increase in electronic trading over the coming years,” says Scott Wacker, global head of FICC e-sales at JP Morgan. “We’re seeing a lot of new entrants in the fixed income market, which is really pushing the electronic agenda for the whole industry. It’s an exciting time for the electronic and automation space right now, as we look to offer clients choice of execution options.”

Kate Finlayson, global head of FICC market structure, adds, “As FICC markets continue to evolve, our global market structure team provides key insights into regulatory initiatives, execution trends and macro developments, enabling our clients to better prepare for currency and future drivers of change.”