Theta

Posted by Colin Lambert. Last updated: April 11, 2024

![]() By City Rover

By City Rover

Spare a thought, Dear Reader, for the FX Options Trader.

Does it not strike you as odd, that within our very special FX market, where most of us generally rub along well together, our different backgrounds melting into a cohesive sense of shared belonging, of being part of something bigger than the sum of its parts; that within the shared culture that we have created and passed down from generation to generation, there exists a group that is an island of its own, with a language of its own, a sub-culture of its own?

A world away from the ebullience of the spot desk, the full-send swing of the bat from the STIRT traders, the patrician insouciance of the salesperson, there sits a row of traders that quite demonstrably have the world on their shoulders.

You look above at the sign hanging from the perforated metal ceiling panels: FX Options.

Underneath sit a line of wizened faces, often unloved and unappreciated by those who don’t understand the complexity of their market, a walled garden of Greek terminology, of vanillas and exotics, of Monte-Carlo simulations, stochastic models and volatility surfaces held close to chests for fear of leaking proprietary positioning information, an unrelenting game of 3-D chess played according to the rules of their supreme overlord, the immortal, omniscient and omnipresent, John C. Hull.

The Real Bible

Why so put-upon you may ask? I mean, it is a fair question. These traders are masters of their craft, generally remunerated and promoted accordingly, usually with great longevity due to the specificities and specialisation of their day to day, operating in the last mostly-voice bastion of the FX market, one of the last areas that still has the one thing we all crave: SPREAD. So why, to put it mildly, are they so miserable?

Theta.

I know that we all know this, but for the benefit of a layman (or Equities salesperson) that has stumbled into the City Rover, Theta is simply time-decay. As the Supreme & Glorious Leader John C. Hull would tell us, Theta “measures the value of a derivative in relation to the time left before the expiration date. As an option gets closer to the expiration date, it will lose value priced into the extrinsic value.”

What that means is that the most famous soundbite ever said by Warren Buffet – “If you don’t find a way to make money while you sleep, you will work until you die” – must really, really sting the FX option trader. Whilst Buffet implores us to find ways to make money whilst we sleep, the FX option trader is by design, very unable to do that. Their books, for they are almost always long vol, will deteriorate in value whilst they are tucked up with teddy in Balham, such that every day they turn on their screens and see a negative P&L.

Every single day.

Imagine what that must do to a person. Can it be any wonder that they are gloomy. Does it explain why they are famously the most parsimonious of all traders? If you have to struggle every morning to get your book back to flat for the day, is it any wonder that you would rather drive a Ford Focus than a Ferrari? Has anyone ever met an FX options trader that has a Ferrari? In 25 years I haven’t – well there was one, but there was some noise about mis-marking of books so we’ll leave that alone for now.

If you really want to know how it would feel to be an FX options trader, to experience the psychology of negative Theta, of waking up every single morning and being down money, regular as clockwork, no exceptions other than on a Monday when it is three times as bad, well then I have a perfect solution.

Go outside and look at your electric car.

That’s right, the very same electric car that the UK government first nudged us towards, then incentivised us, then told us we had to have one by 2030, in the process completely discrediting diesel (remember when they told us that’s what we had to have last time around?). Well, that electric car sitting on your driveway is Theta in metal and plastic, the physical embodiment of John C. Hull’s time decay. Like the best FX option trader in the City, you too are waking up every morning with negative P&L.

If the Financial Times says the market’s long it must be

For something truly astonishing is happening in the EV market. Put simply, it is collapsing before our eyes. We should have seen it coming of course – artificially-juiced demand created by ill-thought out regulation dissipates with the realisation that the charging infrastructure is unable to keep up, coupled with a switch from scarcity (“two year wait for your tesla Sir”…“OK, yes please where do I sign?”) to massive oversupply as the legacy car makers’ switch to EV coincides with massive over-supply from China, most of which are sat at the docks.

Manufacturers seek to shift metal at all costs, so offer absolutely thumping discounts, the more expensive the car, the bigger the discount has to be. How big you ask? Well, here are a selection of my favourites.

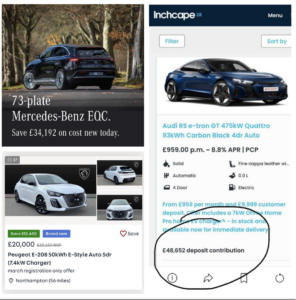

We start with the new Mercedes EQC, where Mercedes will offer you a discount of £34,192 off a new vehicle, with a list price of £64,090, a mere 53%.

Don’t like an SUV? Well how about the new Audi saloon, the concisely named Audi RS e-tron GT 475kW Quattro 93kWh carbon Black 4 door Auto (car naming convention is clearly the subject for another column, I mean, it has become ridiculous, you need to put P.T.O. on the boot of this one) where the Stealer will give you £48,652 off the list price of £118,000. Yes, only 41%, but I would wager you could squeeze him a little more as there are 250 still unsold.

Or perhaps something more in the real world, a Peugeot E-208 50kWh E-Style Auto 5 door (again, stupidly long name Mr. Peugeot, for what looks like a white-good kitchen appliance), where you can get 12 large off the list price, £32,650 down to £20,000. Yessss, that’s only 32% on paper, but City Rover called this one to test the water and so far I have him down to £18,000, (although frankly I would rather walk). He keeps calling back.

Two for a pound

Hold on you say, surely this is good news…discounts are always good news, right? Not so much if you have already bought one of these with your own money. If you paid £64,000 for that new Mercedes two years ago, thinking it will be worth low 40’s now, you will find that the phone doesn’t ring once as your advert is placed alongside offers for a brand new one for £10,000 less than yours. And let’s be honest, the new one comes without the dog hair in the boot and the remnants of your child’s egg sandwich in the seat pocket.

Even if your electric car is nearly new, and reading this you think ‘I will bail out now’, forget it. Look at this Fisker, two months old and 70% off (Fisker are actually a very good US rival to Tesla, and it is a handsome thing at that).

Even if your electric car is nearly new, and reading this you think ‘I will bail out now’, forget it. Look at this Fisker, two months old and 70% off (Fisker are actually a very good US rival to Tesla, and it is a handsome thing at that).

We have the makings of a good old fashioned buyers’ strike. Not only have government incentives evaporated, for both the new vehicle and the home charger, but Rishi has flip-flopped on the deadline for all new cars to be EV from 2030 out to 2035.

That is too far out for it to be anyone’s ‘next car’, so predictably the great British public wants to stay with internal combustion. Same is true of most markets globally actually, other than those where substantial pressure and/or incentives remain, like China.

This puts the car makers in a bind. They have EV percentage of sale quotas to comply with the regulations that become ever harsher as the decade rolls on, but no buyers. Aside from the discounts, there is another very amusing trend coming round the corner. Slowly, and understandably rather quietly, they are putting thermal engines into their EVs…

Let’s start with Fiat. I recommended the glorious 500e a few columns back, well it is quite clear that nobody listens to the Rover, as Fiat aren’t selling many of these cars at all.

Fiat have had to reduce shifts at the Mirafiroi plant in Turin and are now working on retro-fitting a petrol engine as nobody is buying the EV. A crying shame in my view, but Adam Smith’s invisible hand has dealt Fiat a lousy set of cards.

And perhaps the final insult, the real canary down the mine, is likely a car you won’t ever have heard of.

The Microlino. The very definition of a modern-day clean, green, urban transport, a modern day BMW Isetta bubble car, launched in 2021 in Geneva to huge acclaim as the future of everything. The electric car the Polar Bear had been waiting for, the daily run-around even Greta would drive to the mall for her daily quinoa and horse-hair smoothie.

Only guess what? Nobody bought one. The electric drivetrain was just too compromised – too heavy, too expensive, they just about sold 3,000 examples globally. So, amid much fanfare, last week they announced they will put a petrol engine in there, probably the same one as in your leaf blower. Small, light, efficient, cheap, and somehow described (without a hint of irony) as a radical step by Microlino themselves (on Insta, where else?).

A radical step backwards in some eyes I dare say, but not mine. The interference in people’s lives symbolises a mania for control that has infected our political class, all under the pretence of climate change. We have been here with diesel and we know how that ended. There is no accountability for the rare-earths that go into EVs, their inability to be recycled, their predilection to spontaneously combust, the lack of sensible usable range, the overall expense and the simple fact that they are unlikely, in their current guise, to be the final answer.

That will be hydrogen.

So yes, go channel your inner FX option trader today after you read this. Log on to your preferred WeBuyAnyCar-type website, stick in your registration number, and see what your Theta bill has been. My Fiat 500e, the apple of my eye, has decayed at £64.79 per day.

Now I am just as grumpy as they are.