The Conundrum of Regional FX Share

Posted by Colin Lambert. Last updated: October 28, 2022

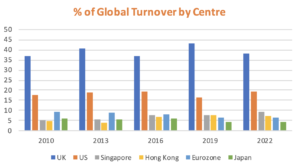

A striking aspect of the latest BIS Triennial Survey of FX Turnover is the quite sharp drop in the share of trading held by the UK. Notional activity in the centre grew significantly from 2019, however its share of the global market dropped from 43.2% to 38.1%.

It could be that 2019 was an outlier in terms of the UK’s share, for just over 38% is more in keeping with the longer-term average in the BIS survey. Equally, there are some, inevitably, who will point to Brexit and banks’ moves to Continental Europe as a factor in the decline. In reality, however, it was not Europe that benefitted from the shift away from the UK, but the US.

This is, in itself, a little surprising, for the semi-annual turnover surveys from the New York Foreign Exchange Committee have for some time drawn a picture of a centre standing still, indeed compared to the FXC survey in April, the BIS, admittedly on a “net-gross” basis rather than the “net-net” used by the FXC, has FX turnover in the US more than double that recorded by the local committee. The FXC survey reported earlier this year, average daily turnover of $957 billion, the BIS records it at $1,912 billion.

There is a significant difference in how the two surveys are collated – the FXC uses the location of the trading desk (or pricing engine), while the BIS collates on the sales desk’s location. This could mean that the major US bank trades are calculated differently, which could indeed have a significant impact given their collective position in the FX market.

There is a stark contrast in the level of activity with customers in the UK and US, with the UK seeing a decline in turnover with both Other (OFI) and Non-Financial (NFI) Institutions and the US an increase with the former. Both centres saw a surge in inter-dealer activity, the UK by 47.7% and the US by 56.5%, however whereas the UK saw OFI activity drop by 17.3% to $1.72 trillion per day, the US saw a 20.2% increase to $689 billion.

In keeping with the decline in corporate activity more generally, both saw a decline from this segment, the UK by a massive 57.6% (to $74.6 billion) and the US by 20% to $69.1 billion.

One thing that may skew the data is the BIS methodology of using the sales desk, for while a great deal of the volume will be with Reporting Dealers still treated as clients by the top tier institutions, the activity between those top tier firms – which has clearly grown significantly – is rarely, if ever, conducted via a sales desk.

Either way, the US is reinforced as the second largest FX centre in the world at 19.4 of activity, again in contrast to data from the semi-annual committees, which have shown Singapore gaining quickly in recent years.

Mixed in Asia as Canada Passes Australia

The BIS survey does back up Singapore’s measure of over $900 billion per day ($929 billion versus the local FX committee’s $909 billion), but when it comes to the global share of market, it lags a long way behind the US at 9.4%. This is comfortably ahead of regional rival Hong Kong ($694 billion and 7.1%) and erstwhile leader in the region, Japan ($433 billlion and 4.4%). Both Hong Kong and Tokyo lost share compared to 2019, while Singapore added 1.7 percentage points.

Elsewhere, Australia saw a decent bump to $150 billion per day, largely in FX swaps, some 1.5% of global activity, but it remained behind China and was leap-frogged by Canada – another centre on the rise. Canada saw daily activity rise to $172 billion from $109 billion in 2019, a 1.7% share from 1.3% in the last survey.

China saw $153 billion per day in the latest survey, an increase from $136 billion in 2019, but still a 1.6% share of global activity. Elsewhere, Korea, which is largely futures based, saw activity rise to $68 billion from $55 billion and retains a 0.7% share of activity.

No Brexit Bounce for Eurozone

Although the spate of relocations amongst banks as a result of Brexit may have been expected to result in a bounce in activity in the Eurozone, this did not materialise. In some ways this could be that sales desks have always been located in these centres, but either way, the Eurozone’s share of FX trading remains at historical lows.

Those countries using the euro saw a combined $632 billion per day in April 2022, for a 6.4% share of global market activity – unchanged from 2019, but down from 8.2% in 2016 (taken prior to the Brexit vote) and 9% in 2013. France continues to hold the most share at 2.2% ($214 billion per day), from Germany’s 1.9% ($184 billion).

Neither nation has made a dent on the largest single centre on the continent, Switzerland, which saw $350 billion per day in 2022 for a 3.6% share, up from $264 billion in 2019 (3.2%). There were mixed fortunes for the three non-euro Scandinavian centres, with Denmark ($83 billion) and Sweden ($42 billion) seeing an increase in activity, while Norway was one of the few centres globally to register a noticeable decline (Belgium and South Africa were the others), dropping to $24 billion from $30 billion in 2019.

CNY on the Rise

The BIS report also breaks down global turnover by currency and the inexorable rise of CNY has continued, with the Chinese currency vaulting into fifth place above the Australian dollar.

The BIS says $526 billion per day was traded in the yuan in 2022, up from $285 billion in 2019. This represents a 7% share of global activity (on a double-counted basis, therefore the whole is 200), up from just 4.3% in 2019. Less than a decade ago in the 2013 survey, CNY had a 2.2% share and was the ninth most-traded currency.

The dollar remains, unsurprisingly, the most traded currency, being involved in 88.5% of volume. This is up from 88.3% in 2019 and is the highest recorded by the BIS since 2001. The euro comfortable holds second place, but actually saw its share of activity drop, to 30.5% from 32.3%, the lowest since the launch of the single currency.

It was a similar story for the yen, in third place with 16.7% of activity, down from 16.8% in 2019 and the lowest since the BIS started recording the data. Sterling remains fourth at 12.9%, this is slightly higher from 2019’s 12.8% and is broadly in line with the longer-term average recorded by the BIS.

In spite of what is seen as a growth in emerging markets trading, generally these currencies were subdued compared to 2019

As is the case with the geographical data, the Canadian dollar has narrowed the gap on its Australian counterpart, however the AUD holds onto sixth place with 6.4% of activity ((down from 6.8%) compared to 6.2% for the CAD (5%). The Canadian dollar is consolidating its place above the Swiss franc, the latter had an increased 5.2% share of activity (from 4.9%), but the multi-year trend towards CAD and away from CHF continues.

The top 10 currencies are rounded out by the Hong Kong dollar at ninth with a 2.6% share (from 3.5%) and the Singapore dollar, which jumps into the top 10 for the first time with a 2.4% share. The SGD has jumped above three other currencies, SEK, KRW and NZD to take a top 10 place.

It is interesting to note, that in spite of what is seen as a growth in emerging markets trading, generally these currencies were subdued compared to 2019. This could be a reflection of the “risk-off” sentiment in markets generally during 2022, but the EM story could very much be one about China and its growth.

In terms of notable EM currencies, only the Taiwan dollar showed a volume and global share increase ($23 billion and 0.2% to $83 billion and 1.1% respectively). The Indian rupee and Korean won also saw notional volume increases but lost global share, while the Mexican peso, Brazilian real, South African rand and Turkish lira all lost out in both volume and global share terms.