Never Knowingly Undersold

Posted by Colin Lambert. Last updated: November 13, 2023

![]() By City Rover

By City Rover

As the readership of this column surges into double figures (Yours – Ed), I feel sure that there will be those amongst you who will be sufficiently well-read so as to call into mind Leviathan, wherein Thomas Hobbes outlined a world in which the lives of the citizens within could be “solitary, poor, nasty brutish and short”.

It is remarkable that this famous English philosopher, writing some 400 years ago, could so accurately be describing the life of an FX salesperson.

Hobbes believed that in a world of scarce resources, and in the absence of a social contract, it could actually be rational to kill other people before they killed you. Sure, the scarce resources he had in mind were food and water, but that is only because in 1651 the concept of sales credits and a bonus pool had not yet emerged.

Hobbes believed that in a world of scarce resources, and in the absence of a social contract, it could actually be rational to kill other people before they killed you. Sure, the scarce resources he had in mind were food and water, but that is only because in 1651 the concept of sales credits and a bonus pool had not yet emerged.

And before you think I am stretching the metaphor, note that our man identified three principal causes of quarrel: ‘competition, distrust and glory’. A better description of the politics inside an FX sales organisation I have yet to see.

These characteristics can be traced to the simple fact that it is the hardest sales role on the trading floor. Consider by way of comparison, the Credit or equities salesperson who has, more often than not, the ability to leverage scarcity, and in doing so, finds that the customer is beating a path to their door.

Think of the Credit salesperson, sat on the 3rd floor of a Wall Street bank’s headquarters in May 2013. Apple, then, as now, the darling of the analysts, enlists a few chosen banks to market $17 billion in corporate debt, its first issuance in 20-years, and the largest debt deal in history at that time. Oh, and their three-year bond offered a coupon barely more attractive than US Treasuries.

Largest debt deal you say? Coupon a mere sniff above the risk-free rate? The very definition of a really hard sell. Surely those salespeople would have had to work like dogs to shift the supply? Actually, no – the investors bidding on the deal, the usual pension funds/insurance companies, hedge funds, HNWI etc., submitted orders of between $50-60billion…more than three times over-subscribed!

What it must have been to be on the Credit sales desk then; your clients jostling for position in the queue like kids at the Halloween door, waiting for the mini-Mars bars to be shared out. Not a single slammed phone, no shouted expletive, no threats to call the CEO; just a line of Oliver Twists, begging the empowered salesperson: “Please sir, can I have some more”.

Or the equities salesperson – a role that is the very definition of selling fruit and vegetables; commoditised and with ultimate price transparency. Not for them, however, a Hobbesian life. Instead, a regular pipeline of IPOs via the ECM folks keeps them in the Curule chair[1], each one massively over-subscribed. I would have liked to have been an Institutional salesperson covering Blackrock or Fidelity when the Alibaba IPO came along, a mere 22 times over-subscribed! “A business lunch you say, courtesy of the PMs? Scotts on Tuesday for a tasting session on the Sevruga, Oscietra, Baerii & the Beluga…. how very kind[2]”.

All of this, and believe me I could go on, serves only to illustrate exactly how tough FX sales really is. There is never ever ever an opportunity to create scarcity – liquidity is homogenous and has been underpriced for 25 years. Competition is intense, both internally and externally, the ever-present of a random mugging of your livelihood: “Meet Harper, we just hired her from Pierpoint & Co; Harper covers Brevan and made 5x what you do, so we will transfer the account and see how things develop”. You have all been there, right?

Clients, even those who become firm friends after many years, are nonetheless never actually minded to form an orderly queue at your door. I feel for poor Harper – her price in 500 USD/JPY is broadly the same as Yasmin’s, or Amol’s or Robert’s; so is her 1mth EUR vol level, or in fact her 3w USD/CHF points. Frankly, even her USD/BRL 1yr Range Binary is likely to be within a gnat’s chuff of the same one priced by the fella next door – and this is before you consider that the whole shooting match is now almost entirely electronic, where the erosion of any remaining market inefficiencies is measured in the milliseconds. How do you sell into that?

Which of these folks has the best pricing engine?

Source: BBC and HBO

When it comes to cars, as I remind myself that this is a City Rover column and not a therapy session, I have always assumed that the life of the Porsche dealer was similar to that of an equities salesperson: simply proclaim ‘Open Sesame’ on the morning of Alibaba’s IPO and the orders come flooding in.

You see, much like an IPO, the Porsche business model is also driven by scarcity.

The exclusive, limited edition 911 ‘halo’ cars that sit above the proletariat models, the GT2, GT2 RS, GT3, GT3 Touring, Sport Classic, Speedster, the 911R, S/T, Dakar etc., are intentionally very supply constrained to create extreme scarcity. The cynic might observe that since the Porsche IPO (as it happens, the largest IPO by market capitalisation in European history) these special editions have been coming thicker and faster, but they all have one thing in common. Each of these halo models is massively over-subscribed, indeed, being granted the ‘opportunity’ to buy one is the key to monetising a significant premium in the second-hand market, just like an allocation at the IPO price of an in-demand stock.

What kind of a significant premium you ask? Well, in 2016 the order form for a 911R would have a balance owed of £136,901. Only 911 of these special editions were made (German ‘humour’ I suppose), and if you weren’t lucky enough to have been able to buy one new (who was?), prices for any that subsequently became available after launch were up to £800,000. Don’t adjust your set, you read that correctly, eight hundred thousand pounds[3]. I think we can all agree that is a significant premium for a glorified VW Beetle.

This, or a nice cottage in the Cotwolds?

So how do you get on the list to buy one? Well, this is where the more insidious side of the Porsche business model becomes more apparent. It is in the discretion of the dealer, or more specifically the salesperson/sales manager at the dealership, and you can see where I’m going with the parallels here. Heaven knows what must go on behind the scenes to get onto the list. What is clear, is that it would have been very helpful if you had bought, each and every single year, a number of the cooking models to ingratiate yourselves with the Dealer/Stealer. You want to be part of that Alibaba IPO? Well start sucking up.

And Porsche managed to shift an awful lot of metal. You want to get on the list for a GT3RS? Well, would Madam like this Taycan in cerise pink that we can’t sell? Or how about a Boxster or three?

Lo! Porsche sales rocketed and the IPO was a roaring success. Whilst the demand was perhaps artificially inflated, the pandemic induced a vicious supply crunch that created long waiting lists, more scarcity, such that even somebody wanting a ‘regular’ 911 would be waiting two years – indeed, even longer if you wanted to add PTS, ‘Paint to Sample’, such that your motorcar was the same colour as your favourite Tellytubby.

Porsche did the rational thing, and with an eye on firming up their newly-floated stock price, began to ramp the list prices. In 1995, a 911 turbo (the 993 series if you care, probably the best ever 911) cost £41,900. A trip through the Old Lady’s inflation calculator puts that figure at £82,315 in today’s money, even accounting for some proper inflation of late.

How much will Porsche charge you for a 911 Turbo today? Sit down and wait for it… £230,000.

To recap then: Porsche made second-class citizens of the belly of their client base by possibly granting favours to preferred clients, whilst simultaneously ramping the prices of the ‘regular’ models threefold. And having then turned the supply taps to full, how are things looking?

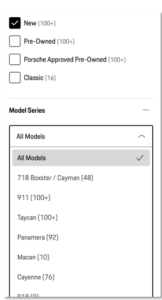

Horrific, actually. As I type this, there are 83 brand spanking new 911 Turbomodels for sale on the Porsche website. That alone is more than £19 million of unsold stock.

More astonishingly, there are exactly TWO HUNDRED brand-new 911 of all variants for sale on the Porsche UK website.

You think that is shocking, try this. Would Sir like a Taycan, the electric wundercar? Well, Sir has 650 to decide between on the website. If that sounds like an awfully large number, City Rover’s market sources says that in fact the true number is 1,700 unsold new Taycans in dealer stock! And lest we forget, their website also offers a choice of 92 Panameras, 76 Cayennes, 48 Caymans.

I could go on.

To repeat, these are brand new unregistered vehicles. Millions and millions of euros worth of unsold stock, waiting to find buyers. All this from a manufacturer that has been the absolute master at balancing supply and demand. Go have a look yourselves![4]

What, you may ask, does this do for the residual values of these vehicles?

Beyond horrific, actually. If brand spanking new cars are being advertised by the Stealers on Auto Trader with discounts of £17k (what would you get if you actually called up to negotiate?!) you can only imagine what the second-hand values are doing: collapsing.

So, let me conclude with a traditional bit of City Rover advice. Two takeaways:

Firstly, I would not be a buyer of Porsche stock (does not represent investment advice – ed), the supply overhang can only be cleared through discounting, and that destroys margins and reputation in the short term.

Secondly, I like a Porsche Turbo, believe me I do, but look at the photo below, and tell me you can really see why the one on the left costs THREE times the one on the right (£230k v £80k!!) Could you really tell the difference whilst pottering around Sevenoaks?

Exactly. If you want a Porsche Turbo S, get a used one and negotiate hard – that salesperson hasn’t had to work very hard in recent years, time make them sweat like it’s FX sales.

As homogenous as USD/JPY vol

[1] In ancient Rome, these chairs were used by the highest government dignitaries, senior magistrates, officials and emperors and served as a place of judgement.

[2] Clearly this is not a suggestion that any actual coercion went on, pure fiction of course. But goes without saying that I would have gone for the Sevruga.

[3] https://www.autocar.co.uk/car-news/new-cars/porsche-911-r-prices-rise-almost-%C2%A31-million

[4] https://finder.porsche.com/gb/en-GB/search?condition=new