Modelling Hedging Ahead of the Fix: Does it Work?

Posted by Colin Lambert. Last updated: August 13, 2025

“Pre-hedging”, or “hedging ahead of the Fix” as it is referred to around the major FX benchmark fixes, remains a controversial subject, but how effective is it, and does it actually benefit the client?

The latest in a series of academic papers looking at pre-hedging and activity around the Fix, argues that dealer hedging ahead of the Fix, particularly at month-end, can benefit both client and dealer, and reduce the opportunities for opportunistic traders. The structure of the latest paper is a client fixing order, handled by a dealer, with the information becoming aware to external opportunistic traders at different stages, and the various impacts this information leakage has.

Information Leakage and Opportunistic Trading Around the FX Fix has been published by Johannes Muhle-Karbe, Roel Oomen and Mateo Rodríguez Polo, wherein they have constructed a model that showcases different scenarios using a baseline $200 million order and historic representations of volatility and market impact.

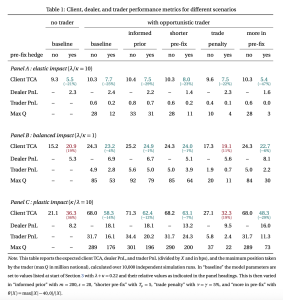

The results find that in the absence of opportunistic traders, the client can reap significant benefits from pre-hedging the Fix, thanks largely to reduced market impact. It offers three broad market impact regimes, an “elastic impact”, which is what would normally be found, as well as a “balanced impact” and a “plastic impact”, which the authors explain over-state the impact but operate as a robustness check to ensure the analysis covers much of the relevant parameter space.

In an elastic impact environment, with a baseline model clients can expect a 9.3bp transaction cost from hedging in the window only, dropping to 5.5bp when pre-hedging occurs (nominally at just under 50% of the order). Interestingly, the research also finds notable benefits even with the absence of opportunistic traders, with the expected cost to the client rising to 10.3bp with no pre-hedging and 7.7bp with – the 25% decrease in the second scenario, outstripping the 21% increase from the first.

In the balanced market impact scenario the situation is reversed. Without the trader, the cost is 15.2bp with no pre-hedging and 20.9bp with it, and with an opportunistic trader the costs are 24.3bp and 23.2bp respectively.

The most dramatic results come with the plastic market impact model, without the trader and pre-hedging the cost is 21.1bp, with it soars to 68bp. With pre-hedging the Fix, the costs are 36.3bp and 58.3bp respectively.

Source: Information Leakage and Opportunistic Trading Around the FX Fix

Johannes Muhle-Karbe, Roel Oomen, Mateo Rodríguez Polo

This data highlights how the situation changes with the opportunistic trader and the market regime. While pre-hedging the Fix can benefit the client in “elastic” conditions, it does not necessarily do so in “balanced” or “plastic”. To complicate the matter further, the presence of the opportunistic trader reverses that, wherein the pre-hedging is a batter path for the client. Either way, as the paper states, “With an opportunistic trader, the situation changes profoundly.”

The paper concludes that information leakage is costly to the client, but that it can be partially mitigated when the dealer hedges a portion of their exposure ahead of the fixing window. It acknowledges that pre-fix hedging is a contentious topic in the industry with some viewing it as front-running client orders rather than sensible risk management, however argues, “We show that across a wide range of scenarios both the client and dealer can benefit and that their interests align in reducing information leakage to impair opportunistic trading.”

The authors also note that certain orders, such as dividend payments, M&A activity and fund repatriation, increase the predictability of the fixing orders, these are not modelled in the analysis. This means, they note, “…Our model is conservative in that the opportunistic trader will likely have a broader set of relevant information sources available in practice. This further increases the risk of information leakage and underlines the importance of managing it.”

The full paper can be accessed here.

The Full FX View

It may surprise some long-standing readers that I agree wholeheartedly with the argument that pre-hedging Fix orders can benefit the client, however they may not have been paying full attention over the years!

To me, this paper reinforces a fundamental need in FX markets – a longer calculation for such a crucial benchmark. What this analysis tells me is that the optimal way to execute larger Fix transactions (and $200 million is in no way a large Fix trade) is over a longer period of time – in which case, why are the clients not calling for a calculation method more reflective of how their risk is hedged, and if the pre-hedging does benefit the client, as this research demonstrates, then surely we need to start thinking about how, or if, the client should see more of that benefit?

I accept the dealers’ argument that they are taking on risk and therefore should benefit, but I would argue that risk is minimal and over a period of time would barely register on the negative side of the P&L ledger. To support this I would point to the regular monthly analysis published by The Full FX comparing execution costs across a 20-minute window (Siren FX) and a five-minute window (WMR).

On only two occasions in 51 months, across nine currency pairs per month, has the shorter window provided less market impact. Even at 60% correlation to the direction of the Fix – and the majority of flow has a higher correlation than that, the potential savings from a longer window (and I accept that there are differences in the methodologies) – the savings are significant at an average of $114.12 per million across more than four years.

Over the past year, when market impact at the Fix has generally been more muted, the savings at 60% correlation were $69.17 per million. Even if this figure is over-stated to take into account the different methodologies, at even half that number there is a significant amount of money being spent on hedging that need not be.

This is not to say the dealers should not benefit beyond the fees or spread charged, after all, skilful execution can, as the paper demonstrates, benefit the client greatly, more that it would be beneficial to end investors if this benefit was shared. Naturally this is not going to happen while trustees and asset owners continue to bury their head in the sand in a fashion that some might term criminal, thanks to the apparent lack of care regarding saving end-investors money.

There are a couple of other areas in the paper I want to highlight, one that I wholeheartedly agree with and one that suspect I disagree. The latter is something of a triviality and an aspect that academic research will not pick up – ignorance! The paper observes that “the dealer’s objective function is to balance PnL and client interests” and “exposes the dealer to market risk”. I would argue that the data suggests this risk is infinitesimal and more than compensated for by huge number of days the pre-hedging makes money. The paper also notes that without taking into account the client experience the dealer “would not win much business”, which is where the ignorance comes in, on the part of the asset owners or trustees.

Put simply, too many in the asset management community tick the box that says “we got the Fix” and have no interest, or understanding I suspect, of how that rate is arrived at. With multiple dealers executing at the Fix (and it would be interesting to see the research extended to a scenario whereby there are multiple, near-identical signals from a number of dealers), it would hard to tell if one of them did a bad job compared to another – they all present the same rate at the end of the day. I accept that the paper’s general premise is correct when it comes to handling customer business generally, but the Fix flows are a little different, and I am not sure the view is relevant there.

Where I wholeheartedly agree with the paper – and this is not part of the analysis, is where it states, “…Dealers have a regulatory obligation to avoid excessive market impact and disorderly trading conditions”.

To me, this is yet another brick in the (large!) wall of evidence that the calculation window needs to be longer. This paper presents more proof that fixing flows are better executed over a longer time horizon, yet we continue to persist in putting people in harm’s way by ignoring that the WMR Fix is being used as a traded rate, rather than the reference rate it actually is, and by continuing with a structure that means they have to execute in a fashion that risks stepping outside legal boundaries.

This paper, and some of its predecessors, in particular where the authors highlighted the benefit of a longer window for larger trades, should serve as a warning to people that something isn’t quite right. It lays out an excellent argument for a practice that remains uncertain in legal terms, but all the time is (by inference I accept) presenting an equally excellent solution.

It is hard to read this, and the rest of the series, and not ask oneself the question, “why are we still at five-minutes?”