Inter-Dealer Brokers Spinning Off Their Data Business: Aiming for the Head?

Posted by Colin Lambert. Last updated: June 26, 2023

By Keiren Harris

This article first appeared on marketdata.guru

William Shatner’s quote must have had the Inter-Dealer Brokers (IDBs) in mind when he talked about aiming high for the head, not for the feet, because spinning off their data businesses will have the same effect, with potentially catastrophic consequences. It is also not hard to work out why.

Why is this a big deal?

Of the four leading IDBs, it is only TP Icap’s Parameta data & analytics business that has been in the public frame as spinning off from the parent company, however, BGC’s Fenics looks set up for a similar deal and it would be in keeping with their track record. Tradition’s business is not large enough, and Marex’s data business is an afterthought.

So why the fuss?

Basically, the IDBs market valuation is in the doghouse especially when compared to exchanges and their fully electronic venue competitors like MarketAxess and Tradeweb. With price/sales ratios of 1:1, despite increasing revenues, shareholders have turned to activism, especially US based hedge fund Phase 2, with the inevitable call to monetise assets, i.e. spin off the Crown Jewels, and top of the list is Parameta.

Back to Basics

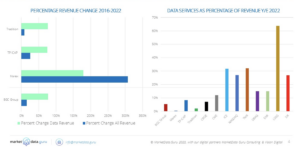

Although all the IDB’s market data businesses underperform their exchange peers in terms of percentage of revenue generated from information and analytics (See chart below) these have, with the exception of Marex, comfortably outperformed their underlying venue business since 2016 both in terms of revenue growth and profit margin.

These are good indicators of the folly of spinning the data businesses off now, because not only are they some way from reaching their potential, but it would be akin to separating a head from its body.

It is all about the foundational role brokers play in financial markets. They create liquidity through bringing counterparties together across multiple markets, asset classes and instruments by enabling price discovery and setting market levels facilitating trading.

How is this done? Through providing prices over the phone or via their data businesses.

Broking and data are so intrinsically linked that separating the two damages both. No broking = no data, no data = no liquidity, no liquidity = no broking.

How does the Brokerage affect the Data Business?

The interactions between brokerages and their data businesses is not as strong as it should be beyond the supply of the data. The data business is responsible for the commercialisation, distribution, management and development of its own business. Yet there are significant impacts:

- The broking relationships with their clients drives the data relationships, this is an important link

- If a new desk or new traded instrument comes online it needs connectivity

- In more liquid markets as voice broking becomes displaced by electronic trading then the price flow dries up

- This has a double impact because the less the price flow the decrease in broking activity leading to even lower price flow

- If a desk pulls a traded instrument then there are no more prices, and notice is not necessarily given

How does the Data Business affect the Brokerage?

In important, and understated, ways. The data business distributes the prices the front desks need to get in front of their clients, it supplies the publishing tools to capture data and supplies the connectivity to the market. Therefore any interruption to the dataflow, incorrect pricing distributed has a direct impact on the broking activities and has higher operating margins.

Negative Impacts

There is an immediate divergence of interests, mostly working against the newly-independent data business which would need to have some pretty stringent safeguards in place to avoid the fate of Air Canada’s Aeroplan Frequent Flyer Programme.

It would need continued access to data from the desks. What happens when the broker opens or closes a desk? The data consumers are going to be far less understanding when the prices are cut off from a third party than directly.

Equally, what happens when there are problems with prices off the desks? Who is responsible and at what point? Who invests in the trading technology and price extraction applications required to access price data?

Most of all, though, the Spin Off entity is most at risk because it has a single source of revenue, and that revenue is driven by a single source of data. This is where the Air Canada/Aeroplan experience comes into play. In 2005 Aeroplan, whose sole client base was Air Canada’s passengers, was spun off valued at CAD 1.9 billion. In 2017, Air Canada announced plans launching a new loyalty programme to replace Aeroplan prompting its value to crash allowing Air Canada and partners to buy back Aeroplan from Aimia for CAD 450 million in cash

This means the Spin Off will have to diversify away from a single source to avoid an Aeroplan ‘crash & burn’ and means less emphasis on the core business, which weakens the relationship between broker and data company. This will inevitably lead to the brokers realising that spinning off the data business in the first place was a bad idea because it removes a vital direct relationship between the data consumers (i.e. the brokers clients) and the brokers.

Winners and Losers

Parameta has been optimistically valued at GBP 1.6 billion, roughly the same as TP Icap’s entire market capitalisation, so on paper it looks like a strong win, despite all the downsides we have discussed, which are just as valid for spinning off data and analytics businesses at other companies.

So yes, there will be winners, i.e. TP Icap shareholders which abandon ship the moment they get their payday. The effects on the losers will inflict far more pain, notably on the brokerage in the short term because it will impact the broker’s ability to facilitate trading, i.e. a loss of commissions, as well as the loss of revenues from the data business which will only put more pressure on their share price.

In the medium term the data business will struggle to diversify and pay for being forced to branch out, and then the inevitable divorce from the brokerage leading to being bought back cheaply. There are some good people in the IDB data businesses, these could be lost too.

The inbound investors will also feel pain unless the Spin Off entity gets lucky.

Other venues like ICE, LSEG, Nasdaq see data and analytics in strategic terms as part of the overall trading workflow. IDBs need to get onboard with how data drives trading back into the business.

Unlocking the potential of the IDB’s data businesses will be far more beneficial to shareholders and the IDBs themselves by maintaining the symbiotic relationship between broking desks and the data business by leveraging the intrinsic value each brings to the other.

In other words, if a broker spins off a data business it is a bad idea.