Inflation Hedging

Posted by Colin Lambert. Last updated: April 24, 2023

By City Rover![]()

….George Clooney, Vin Diesel, Paul Walker, Jordana Brewster, Michelle Rodriguez and Initial D occupy the mind of The Full FX’s motoring correspondent this month – your editor has heard of two of them…

Much has been written about inflation.

You will be no stranger to this, and not only because of your position as a Senior Guy in the financial markets. “‘Ow much?” you say to your colleague as you are relived of the thick end of twenty quid for two pints in the Jam Pot [Ed’s note: A popular City of London hostelry that should be a must-visit for travellers to that fine city], whilst the accompanying pack of 20 Rothmans Blue is wheezing at the door of £15. And should these drinks be the amuse bouche before you settle into a steak at Gaucho then you had better be flexing the corporate Amex, because a 400g Churrasco de Lomo has broken the £60 barrier.

Leaving aside, for now, the fact you can buy an entire cow for £2,500, which will yield around 190kg of meat, conversations around the price of everything dominate our current daily discourse. Specifically, given our day jobs, those conversations gravitate towards how best to hedge yourself against inflation, and prevent the insidious creep of diminished purchasing power.

Over that ruinous Gaucho steak, we could discuss in an informed manner the well-trodden inflation mitigation clichés, the four horsemen of property, art, wine and classic cars. You might enlighten your audience with a fifth horse, that of Japanese whisky, which has steadily exploded in value, but this is a car column so we leave that for another day.

For sure, there are inherent disadvantages in whisky or wine as your chosen hedge, not least because you can enjoy using a car and still be able to sell it, which is rather less true of your preferred tipple. As for property and art, well it depends on how much of your gain you are keen to hand over to the nice lady from HMRC. Works of art held for one year or less in the UK are subject to personal marginal income tax rates of up to 39.6%; hold it for more than one year and you will be taxed at a maximum rate of 28%. Second homes attract Capital Gains Tax (CGT) on a sale, 28% again if you are a higher rate taxpayer, [1] and that’s before all the other costs of carry of a bolthole in Dorset.

But, did you know Dear Reader, there is no CGT to pay on the sale of classic cars. Rub your eyes, find your reading glasses, and check that again. You see, HMRC classifies them as a ‘wasting asset’ (actually very true if they happen to be old Land Rovers), and as long as you are deemed to be buying the car for your own enjoyment, i.e. not trading them, there is no tax to pay[2]. The actual language is as follows: “Any motor vehicle which was constructed or has been adapted to carry passengers is not a chargeable asset unless it is of a type which is not normally used as a private vehicle and is unsuited for such use. Disposals of normal motor cars are therefore exempt under TCGA92/S263. This includes vintage cars of this type.”

Given City Rover’s mission is to entertain and educate, make yourselves comfortable as we spend a bit more time on the latter half of that mission this month and give you two very different alternatives to the traditional bond markets (now you have bailed out at the lows):

Investment Grade

I will assume a budget of £1 million, and begin with the best home for that money. Firstly, the bad news – a million quid is not what it used to be. It rules you out of the Ferrari F40/F50/Enzo club, but that could be a bullet dodged as some of these ‘icons’ have a whiff of Gordon Ramsey these days, and whisper it, are not that cool.

That doesn’t apply to all Ferrari’s of course… it goes without saying that, if you could find one, a 1985 288 GTO is still a very special thing. If you own an F40 or Enzo, you’re just like every other collector and/or investor – but if you own a 288 GTO, then you’re one cool cat.

Name me another 80’s car that used Kevlar and composite panels over a tubular chassis to get the weight under the Group B limit of 1,100kg? I’ll wait. But the entry fee is at least £4million, assuming you could even find one.

But as we ‘only’ have a million to invest, after a rather enjoyable session of exhaustive research, I offer you a true Investment Grade automobile: the Mercedes-Benz Classic 300SL Roadster.

Rather amusingly photographed in the advert[3] next to the (Swiss, natch) owner’s private jet, hopefully not indicative of running costs, you have here a cast-iron copper-bottomed gilt-edged classic. Resplendent with the glorious race-spec ‘M186’ 3.0L inline six generating 240hp, film star good looks, and no risk of seeing another one in the Waitrose car park; only 1,858 of these glorious machines were built between 1957 and 1963, the roadster following the rather more well-known (and considerably more expensive) hard roofed ‘gullwing’ version.

Better than money in the bank, take yours down to Lake Como, channel your inner Clooney, safe in the knowledge that your car is as fabulous and good looking as he is.

Samurai

You will all be very expert on the BOJ’s yield curve control, although somehow it hasn’t stopped the vast majority of my readership remaining convinced that USDJPY is going lower. As your colleagues scrambled to cover stops up through 134.00, your mind wandered as how best to get any return on your JPY.

The answer, Dear Reader, is an odd combination of Vin Diesel, Paul Walker, Jordana Brewster, Michelle Rodriguez. And something called Initial D, which I should clarify is not a vitamin.

Let me explain.

As a kid, when the poster shop Athena was in its heyday, I had three large prints on my wall: a red Ferrari Testarossa, a white Lamborghini Countach and a tennis player scratching her bottom. These were the icons I grew up with. But we are getting on a bit now, and one of the keys to value is surely to spot the icons of the next generation: those millennials that were brought up on a diet of Fast & Furious, Grand Theft Auto, and aJapanese street racing manga series written and beautifully illustrated by Shuichi Shigeno, called Initial D.

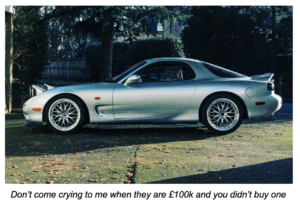

The motoring icons of those that seek to replace us in the dealing rooms are no longer Italian; they are Japanese. The Nissan Skyline R34 GT-R (aka Godzilla), the Honda NSX that Ayrton helped to develop, the Toyota Supra, and most niche of all, the FD3 version of the Mazda RX-7. For it was Keisuke Takahashi’s RX-7, in rare luxury ‘Efini’ spec, that is the undisputed star of Initial D. It is driven by Takahashi during his time as part of the Akagi RedSuns, and later during his time in Project D.

The sub-culture of Fast & Furious, GTA and Initial D has sent the values of 1990’s Japanese cars into the stratosphere. Rare ‘millennium jade’ (green) versions of the Skyline are already through half a million pounds and going higher; the Honda NSX that Mr Wolf famously (albeit fictionally) drove across Los Angeles in 9 minutes and 37 seconds on his way to ‘clean up’ for Marsellus Wallace in 1994 would now stand you at a solid 6 figures.

The RX-7 is, however, still just within reach. Detractors would say ‘cheap for a reason’: the Wankel (no sniggering at the back) rotary engine has a voracious appetite for oil and rotor tips. From personal experience they can pull hard to the left on acceleration, and even harder to the right under braking. Most have been ragged to within an inch of their lives as drift racers at Ebisu by folks like our hero Keisuke Takahashi, although these days that is called ‘provenance’.

But, find a good one, get it sorted mechanically and cosmetically, drink in the curves and the pop-up headlights and enjoy the howl as you take the motor up to its rev limiter at 10,000rpm.

There are only 207 left in the UK, of which maybe a dozen are the coveted Efini version, and every single one of those 207 is going to be more sought after as the youngsters chase their dreams and spend their bonuses.

[1] Not tax advice, repeat not tax advice, take tax advice from a tax advisor, not a motoring columnist.

[2] See footnote #1, but I am right on this one: https://www.gov.uk/hmrc-internal-manuals/capital-gains-manual/cg76906

[3] https://www.autoscout24.ch/de/d/mercedes-benz-300-cabriolet-occasion?vehid=9935254&accountid=60812&backurl=%2Fautos%2Fmercedes-benz%3Fyearto%3D2000%26make%3D51%26sort%3Dprice_desc%26vehtyp%3D10&yearto=2000&make=51&vehtyp=10&eventLabel=vehiclePosition%3A1%20%7C%20sortingOption%3Aprice_desc&packageName=member%3Aas24_basic&sortingPosition=1