Impact of Regulation Seen in BIS Interest Rate Data

Posted by Colin Lambert. Last updated: October 31, 2022

While the FX market has, largely, been minimally affected by the changing regulatory landscape over the past five years, the interest rate world has been at the forefront, and the impact of those changes can be seen in the BIS Triennial Survey of Interest Rate Turnover, which reveals a collapse in FRA trading and a geographical shift in where trading is done.

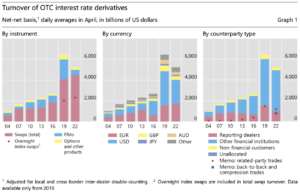

Overall turnover in OTC interest rate derivatives (IRD) actually declined from the 2019 survey, by some 18.8% to $5.226 trillion. The decline was mainly thanks to a collapse in FRA activity, products that reference Libor, activity in which fell by almost four times from over $1.9 trillion in 2019, to under $500 billion in 2022. Interest rate swap (IRS) activity rose, by 10% to just short of $4.5 trillion per day, while there was also a decline in interest rate options turnover, by almost 48% to $238 billion.

In contrast to the FX report, turnover between Reporting Dealers declined, continuing a pattern seen over the previous four surveys, indeed much of the decline seen in the IRD report is from dealers. Overall this segment traded $1 trillion per day, down from over $1.5 trillion in 2019, FRA volumes dropped from $365 billion to $87 billion, while in options its dropped from $282 billion to just $55 billion. Even in IRS, activity between Reporting Dealers declined, albeit slightly, from $884 billion to $861 billion.

The growth segment for IRD markets is Other Financial Institutions (OFI), including non-reporting banks, which, although overall activity declined, saw an increase in turnover in IRS and options. FRA trading was the culprit for the overall decline, dropping from over $1.3 trillion to just over $300 billion, while IRS volumes were just under $3.5 trillion, up from $3 trillion in 2019. Options activity rose slightly, from $163 billion to $174 billion in the latest report.

Source: Bank for International Settlements

Non-Financial customers also saw a decline, with overall activity dropping from $416 billion to $276 billion, FRAs halved to $108 billion, IRS dropped by 16.4% to $163 billion and options were unchanged at $5 billion per day.

With Europe still to invoke risk-free rates (RFR), euro-denominated contracts can reference Euribor, which is yet to be phased out, therefore trading in EUR rose significantly as a share of global turnover, to 33.5% from 24.7%. By contrast, USD’s share, which has been impacted by the phasing out of USD Libor, fell back from 50.7% to 43.5%. GBP, AUD and JPY – the next three heavily traded currencies in IRDs, also saw a decline in their share of the overall pie.

The BIS says that as market participants shift from using Libor as a reference rate to RFRs, their need to hedge interest rate risk is changing. Before this transition, swaps typically referenced Libor with maturities longer than one day (usually three-month or six-month Libor), and had floating leg payments fixed for a longer term than similar overnight index swaps (OIS) that reference overnight RFRs. As a result, the floating rate risk in a Libor swap (the fixing risk) is larger than in an OIS. To hedge that risk, market participants often used instruments such as FRAs. Thus, the transition from Libor to RFRs effectively reduced the hedging needs associated with Libor swaps.

It adds, however, that in spite of the lower floating rate risk in OIS compared with other swaps, the drop in FRA turnover in the 2022 survey was not matched by an equivalent increase in turnover in other OTC instruments.

Brexit Impact

While it is hard to see much of an impact from Brexit and banks’ need to move operations to the European Union, in FX markets, in IRD markets the picture is becoming clearer. As a centre, the UK remains the largest in the world, but its share of the market has declined sharply, but whereas in the FX survey it was to the US and a lesser degree Singapore, in interest rate markets it is to continental Europe.

Just over $2.6 trillion was traded in the UK every day in April 2022, for a 45.5% share of global activity, a meaningful drop from the 50.6% share in 2019. Unlike the FX survey, however, turnover in the US also dropped, from just over $2.5 trillion to just under $1.7 trillion – a 29.3% share from 32.5%.

In contrast, activity in the Eurozone soared, thanks mainly to France and Germany, activity more than doubling from $250 billion per day in 2019, to $572 billion in the latest survey. France saw activity rise from $120 billion to $204 billion, while business boomed in Germany, rising almost five times from $56 billion to $273 billion. This represents a proportion of global trading of 9.9%, up from just 3.4% in the previous survey.

While the Libor transition is clearly a major factor in the shift, the data is also likely to have been impacted by the number of banks shifting operations to the EU and, perhaps more significantly, the uncertainty over the future for UK clearing houses when it comes to EU or euro-denominated business.

This is highlighted by the BIS, which says Libor reform does not fully explain the changes in these relative shares. It notes that daily turnover in the United Kingdom in products other than FRAs also declined. USD-denominated contracts (excluding FRAs) reported by the UK declined by 18% from 2019, to $581 billion per day in April 2022, but this was more than offset by the larger turnover of these instruments in the US, which grew by 21% to $1.6 trillion per day. “As a result, the United Kingdom’s share in the global “net-gross” total for these instruments dropped to 24% in 2022 from 33% in 2019,” the BIS states. “Still, this share remained higher than that in the previous surveys (which range between 9% to 19%).”