How Much Does the Buy Side Know About its FX Costs?

Posted by Colin Lambert. Last updated: September 29, 2021

There is little doubt that in the institutional investor/asset manager space, focus has been increasing on the quality of FX execution, but a new survey finds that progress in assessing the true cost of FX trading is uneven at best, and that widely diverse attitudes exist between asset owners in particular, and fund managers and banks. It also highlights a high degree of antipathy towards FX hedging on the part of many on the buy side.

The survey The Grey Costs of FX was conducted by the ValueExchange and HD Financial Consulting, sponsored by National Australia Bank and Lumint, and supported by NewChange FX and ACI – The Financial Markets Association. It surveyed industry specialists form all sectors, but predominantly investors (45% of respondents), asset owners (25%) and banks/brokers (20%).

Probably the most startling aspect of the survey is how 39% of respondents say they don’t track FX execution quality at all, including 27% of fund managers, 31% of equities managers, and a huge 44% of fixed income managers. Indeed only 25% of respondents (including 50% of bank respondents) track TCA using multiple time stamps, while 26% track TCA with a single, in-house time stamp (10% use a single time stamp that it outsourced). Of the fund managers, 54% have outsourced this function, amongst equities managers it is 55% and fixed income 50%.

While TCA can be seen as the low hanging fruit, less than 30% have a view of their total FX costs, with only 25% of asset owners and 29% of fund managers tracking this metric. This is important, the survey finds, because only 17% of the cost of FX trading is in the spread, although it should be noted that market impact, which is obviously closely related to execution, accounts for 9% of costs – evidence perhaps that the buy side is still not paying serious attention to how it hedges its currency exposures.

Source: ValueExchange HD Financial Consulting

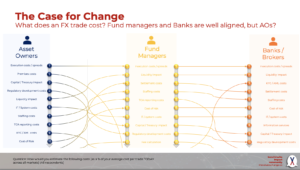

Perhaps even more stark is the difference in where the various stakeholders see their costs. Fund managers and banks are well aligned, with only two serious – and natural – divergences in their scale of importance, fund managers place TCA costs much higher up the ladder than banks (who typically offer TCA as a service rather than use it assiduously for their own transactions) and fund managers don’t face the anti-money laundering and KYC costs that banks do. Otherwise, execution costs/spreads, market impact lead the way, with a variety of other costs (settlement, staffing, IT, regulatory etc) following up in nearly the same order.

For asset owners, however, the picture is very different, aside from execution costs/spread being their number one cost. This group places premises costs at number two – a factor that does not register in the top 10 of either fund managers and banks; capital/treasury impact at three (it sits at eight with fund managers and nine with banks respectively); and regulatory development costs at four (nine and 10).

Market impact only rates fifth in terms of costs as far as asset owners are concerned, TVA reporting costs are eighth (fifth with fund managers). The cost of risk, while sixth with fund managers and banks, is 10th with asset owners.

With only 40% of investors tracking the overall cost of their FX trading, as opposed to execution costs (60% track this) and settlement costs (44%), the survey finds that 60% of investors are missing up to 72% of their FX costs. More pertinently, these hidden costs are also rising, for while investors will be pleased to see respondents forecasting a decline in execution (-1.8% to 16.8%) and settlement costs (-0.6% to 9.2%), of the other 10 costs highlighted, only two – fee calculation at (-0.9% to 5.5% and TCA reporting costs (-0.3% to 7.5%) – are expected to decline. Liquidity impact (+0.4% to 10.1%) and staffing costs (+1.2% to 10%) are expected to rise and remain the third and fourth highest cost by percentage.

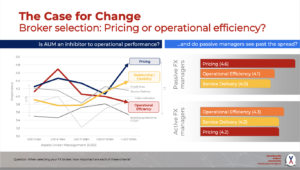

When selecting their brokers (LPs), passive FX managers place a higher importance upon pricing (4.6 rating) than active managers (4.2). Operational efficiency is number one priority for active managers at 4.3 and second with passive managers at 4.1. Service delivery is third most important for passive managers (4.0) and second with active managers (4.2).

Pricing has become much more important for larger managers, in terms of the score, pricing becomes hugely more important for managers with AUM over $50 billion, rising to above 4.8 from below 4.3 for managers with $10-50 billion AUM. Equally, larger managers appear to have the operational efficiency more in hand, it declines in importance in brokers the larger the manager.

Impact of Outsourcing

The survey also studies outsourcing by investors and finds that while FX costs centres are regularly outsourced – for example 55% of share class hedging is handed on, along with 64% of back-office tasks – there is, it says, growing outsourcing of alpha or income activities, with 27% either currently, or planning to, outsource this activity. Elsewhere, 36% feel the same about FX execution and emerging markets FX execution.

Source: ValueExchange HD Financial Consulting

Respondents have found good savings in some areas over the past 12 months, APIs have delivered just short of 5.9% savings, along with offshoring, and, paradoxically given the increased interest in outsourcing, insourcing, at 5.7%. Other notable areas of savings involve the inevitable renegotiating of fees and system consolidation, both of which are above 5.5% savings, but more interestingly perhaps, respondents reported savings from counterparty consolidation (around 5.6%) and peer-to-peer execution (just over 5.5%). This reinforces the notion that fund managers are looking more intently at their FX execution strategies.

In terms of where the greatest costs savings are expected over the next 12 months, the survey finds system consolidation and the growth of utilities and collaborative projects as delivering the highest savings, all projected between 5.6% and 5.8%. Robotics will also play a larger role, as ill outsourced processing and new systems.

The role of outsourcing will in all likelihood be driven by technological reviews clearly underway at managers, 67% of investors say they are planning technological change in 2022. By far the biggest push is going to be in adding new technologies and systems to their current infrastructure – something that may not help those managers seeking to unify their technology stack it has to be said – with 67% saying their focus will be on this in the next 12 months (up from 43% over the past year). Good news for those looking at delivering peer-to-peer services, comes with 43% of respondents saying they will look at that aspect next year (30% last 12 months), while 45% are set to outsource execution (was 40% over the previous 12 months) and processing (33%).

The survey also finds that some transformations are maturing, namely counterparty consolidation is expected to be a focus of 35% (37% over the previous 12 months), system consolidation for 33% (38%), insourcing for 30% (37%) and renegotiating fees for 35% (37%). Insourcing at 30% (37%) and collaborative projects at 32% (43%) will both remain in focus, but at a lower level, the survey also finds.

Is Change Coming?

Overall the survey paints a rather bleak picture of how the buy side, especially in the asset manager community, does not engage with the FX market on an efficient basis. To be fair to managers, a lot of the grey costs are fixed and will be with the firm no matter what, although as pointed out, there are opportunities to cut these through outsourcing.

It is on the execution side of things that the findings most stand out, however, for almost one third is an extremely high percentage of firms who appear to care less about how much the FX hedging costs in the market. In part this could reflect an over-reliance upon a benchmark fix such as WM 4pm London – and it was a little ironic to see passive managers, large users of the Fix, place a higher rating upon pricing by their brokers than active manager – but it also highlights an ongoing problem in that too many managers remain content to ignore FX and the role it plays. It remains an administration role, albeit one that can consume significant resources (and have significant impact on returns if hedged inexpertly).

It is, perhaps, no surprise to see fixed income managers lagging their equities brethren in adopting more progressive attitudes to FX – the latter have long been looking at factors such as TCA and liquidity so it is an easy switch to doing the same for FX. Fixed income, heavily established in the passive space, does not have a long pedigree when it comes to executing in highly automated markets.

The good news may be that the survey has been taken at the start of an evolution in which managers will look much more closely at this. Equally, the fact that many are looking at areas of potential collaboration is a positive for those seeking to deliver solutions. Anecdotally, more managers are looking to streamline and enhance their automated processes and the findings from ValueExchange and HD Financial Consulting suggest this, which means they should be more open to conversations that were, perhaps, impossible just two or three years ago.

It is hard though, not to read this report and find oneself thinking – often not for the first time – that the asset management industry is missing an opportunity to tap into the expertise rife in an industry (foreign exchange) that has seen such a tremendous innovation over the past five years in particular. This report should be a call to arms for this sector to finally start focusing on what it does in the FX space – and, more importantly, how it can do it better.