How do the Platforms Compare to the Latest FX Data?

Posted by Colin Lambert. Last updated: February 20, 2023

The latest FX data from the world’s FX committee’s offers mixed news for those platforms to publish trading volumes, with few matching the global growth in spot turnover, but all performing better in swaps and, largely, NDFs.

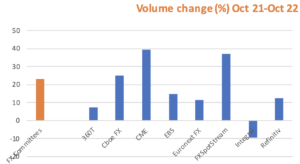

The seven centres to report data semi-annually represent in excess of 80% of global FX turnover according to the most recent Bank for International Settlements turnover report, and as such offer a reasonable representation of all activity. The combined spot turnover in those centres was 23.1% higher in October 2022 compared to the same month in 2021, largely thanks to the continuing fallout from the UK’s political chaos and the Japanese government’s attempts to stem yen weakness through intervention, but it is noticeable that while all spot venues had higher year-on-year turnover in October, only two, FXSpotStream and Cboe FX, managed to outstrip the FX committee gains.

FXSpotStream reports data across all FX products, but it is understood that the majority of activity remains in spot, therefore its 36.8% growth is impressive alongside the overall trend higher. Cboe FX also managed to outstrip the broader pace of growth at +24.9% year-on-year, Cboe’s firm liquidity also rose 32.3% year-on-year.

An interesting datapoint is that CME’s FX futures and options, which are broadly comparable to spot markets, actually put in the best performance over the 12 months, rising 39.3%. This is probably a reflection of the increased volatility, which would have made FX more attractive to the many active trading firms that use futures, but could also be a sign that firms using the Merc’s contracts as an outright were also hedging more given the uncertain outlook.

Away from those three venues it was good news for the spot venues, but not as good as it might have been. CME’s EBS saw activity rise 14.5% year-on-year and LSEG’s Refinitiv saw activity rise 12.4%, both firms report data across at least two platforms. Elsewhere, Euronext FX activity was up 11.4% and 360T by 7.2%.

The only venue to see a decline was Integral, which incidentally seems to have stopped reporting month volume metrics, activity there – which is measured across all products – dropped by 9.5%.

Finally on spot, the broader FX committee data is not reflected in the CLS data, the latter saw spot volumes rise 9.7%.

Note: CME data is futures and options volume, FXSpotStream and Integral volumes across all FX products

Away from spot, comparisons are trickier due to the vagaries of the various FX committee reports and how some platforms bunch everything into “non-spot”. The UK and US are the only committees to break out NDF data, in those two centres activity rose by 13.5%. Against that, 360T saw NDF volumes almost double to $1.23 billion in October 2022, while 24 Exchange activity rose a similarly impressive 85% to $953 million. The third platform to report data did not see growth, Cboe FX NDF volumes were actually fractionally lower, by 1.4%, thanks mainly to what seems to have been a very strong October 2021 performance.

On FX swaps, activity across the seven centres was down 5.1% year-on-year in the latest surveys, but the fortunes of the venues to publish data in this field were quite different.

Refinitiv’s non-spot volumes in October 2022 were 3% lower than October 2021 (it remains by far the biggest venue by volume, however, at $350 billion-plus), so still outperformed the global picture. Elsewhere, 360T, which had a strong year in non-spot products, saw activity rise by 31% (it reports data in euros, but at a steady exchange rate it was +37.1%), and CME Group’s FX Link, which remains in growth mode, saw volumes nearly treble, albeit from $1.2 billion to $3.1 billion per day in October 2022. CLS swap volumes were down just 0.6% on the year, again outperforming the broader FX committee data.

There is no doubt that FX markets were busier last year thanks to multiple events and the return of interest rate divergence, but the platform data from a high level appears to confirm what the BIS found in a recent paper published in the December 2022 Quarterly Report, that a lot of the increased activity did not go to the public venues as it used to.

The good news for those platforms that failed to keep pace with the global growth is that they did, in the main, grow, and that is important for any business. It is also notable that the BIS (and indeed these latest surveys) find evidence that a large part of the growth was in the inter-dealer space. Anecdotally, The Full FX has heard mixed reports on internalisation rates rates for spot FX on the street, with some banks talking steady to higher rates in 2022, but others slightly lower – thanks to the volatility and, naturally, the trend that emerged.

The likelihood is that the various volatility events of the past four years have highlighted the benefit of a relationship with a strong LP – customers are also using LP algos which often seek to internalise – and that has seen the direct channels pick up more business.

If that is indeed the case, then the latest report could be seen as positive for the platforms, for in an environment in which their model was challenged, they still saw good growth.