How did the FX Platforms Perform Compared to the FX Surveys?

Posted by Colin Lambert. Last updated: August 12, 2022

Ahead of the release of the eagerly-awaited Bank for International Settlements’ Triennial Survey of FX Turnover, The Full FX is taking a look at different aspects of the regional surveys, taken in the same month – in this article, we look at how those platforms to report data performed

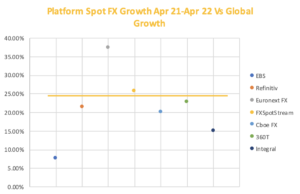

On a year-on-year basis, the major FX platforms to report spot FX volume data can be pretty content with how they performed compared to the broader market, indeed they generally outperformed the data from the UK and US. There is, naturally, the odd outlier, and the data does suggest that trading platform who have yet to co-locate in Singapore might wish to consider doing so, given that centre’s significant increase in activity.

Across the six centres to report April turnover data, total spot FX volume increased by 22.6% to just over $1.737 trillion. Of the five FX venues to break out spot data, three, Refinitiv (+21.6%), 360T (+22.9%) and Cboe FX (+20.1%) were very close to this benchmark, while the other two – EBS and Euronext FX – had varying fortunes. Euronext FX saw average daily volume (ADV) rise by 37.4% from April 2021 to April 2022, while EBS saw growth of 7.6% across the two months.

FXSpotStream and Integral report data across all FX products and no breakdown is available, however The Full FX understands that the majority of volume in both cases is in spot, so while the data is not directly comparable, it is worth noting that FXSpotStream saw volume rise by 25.8% and Integral by 15%.

There is one other data point for consideration in the global picture and that is CLS, which saw activity rise by 15% from April 2021 to the same month in 2022. This suggests that volume may have been high in non-CLS currencies during April – all will be revealed in the BIS report in September.

Looking more generally at volumes, total non-spot volumes across the six centres were $4.175 trillion – largely FX swaps of course – which is a 6.5% increase from April 2021. This also signifies potentially differing fortunes for the two platforms to break out non-spot data, Refinitiv and 360T, for while the latter saw its non-spot activity grow considerably over the year (it did launch its Mid-Match FX swaps platform in this time), by 40.9%, at Refinitiv, activity was largely static, rising just 1.4% year-on-year.

This data includes NDFs, outrights and FX options, however the bulk of activity would be in swaps. NDF data is only available from the UK and US, it is a pity Singapore as such a major centre doesn’t break it out, but across these two centres activity rose by 7%. In contrast, the three platforms to report NDF data – all of whom are very much in growth phase – saw hefty increases, 360T by more than three times, Cboe FX by 49.8% and 24 Exchange by 35%.

While the data largely incorporates OTC trading, it is worth observing that CME Group’s FX futures and options product suite saw an increase of 21.6% – very much in line with the spot market’s rise, but above that in non-spot products.

E-Channels

Although the two centres report data differently, the UK and US do break out execution data to some detail and they indicate that spot activity via trading platforms increased 11.3% year-on-year. Although there were gains in every centre, the difference between this pace of increase and the global picture can largely be put down to Singapore’s 81.3% or $103 billion per day increase in spot turnover; Singapore does not break out execution data.

In the UK $330.6 billion per day is executed via ECNs, which is an interesting number in that while it has consistently been about this level it is hard to pin down exactly what platforms are involved. Even with April being a busy month in spot markets, it is unlikely that EBS Market and Refinitiv Matching executed much more than $80 billion between them in spot. Throw in another $60 billion from Cboe FX and Euronext FX, plus another $20 billion on various smaller ECNs and you are at $160 billion – still not even halfway to the total of the UK alone.

Either way, the ECN segment handled 32.2% of spot flow in the UK in April 2022, down from 34.3% of a smaller pie in April 2021.

While single dealer platforms saw their notional ADV increase to $199.2 billion, this also represents a smaller share of the spot market at 19.4% compared to 20.5% the year before, while the opposite was true of the multi-dealer platforms, which handled $148.2 billion, this being 14.4% of activity, compared to 13% in April 2021.

In the US, ECN activity was largely steady at $71.2 billion per day and the FXC actually breaks out Refinitiv (which brilliantly it still refers to as Reuters as all true FX people do!) and EBS data. This indicates that over the two months, activity dropped from $22.1 billion per day in April 2021, to $17.7 billion in April 2022. Overall ECN data, including these two platforms, represented 14.4% of spot activity, up slightly from 14.4% in 2021.

Single dealer platforms handled $36 billion per day in April 2022 in the US, slightly higher in notional terms from the year before and a 7.3% share, compared to 7.2% in 2021. Multi-dealer platforms, however, saw $207.4 billion per day, a decent increase from the $193 billion in April 2021 and a market share of 42.1% of spot, compared to 40.9% the year before.

In the UK report, the e-ratio for spot was 65.7% in the latest report, down from 67.8%, while that in NDFs was 50.4% (up from 47.9% in April 2021); outright forwards was 59.4% (57.2%); in FX swaps it was 26.8% (35.2%); and FX options 20.8% (19.6%). The e-ratio across all products was 41.3%, down from 45.8% in 2021.

The sharp drop in FX swaps’ e-ratio was largely the result of volume moving to the inter-dealer brokers, however it was noticeable, given the respective data from Refinitiv and 360T, that electronic broking saw its notional volume drop by some $73 billion per day to an 11.4% share, from 16.2% in April 2021.

The Japanese FX committee also breaks out some execution data, however, on an all-product basis. In Tokyo there was also a decent increase in usage of the electronic channels in April 2022 with 50.2% of all volume between Reporting Dealers being electronic (up from 44.1% in April 2021), while 53.8% of activity with Other Financial Institutions was electronic, up from 40.8% in April 2021.

Overall, the platforms can be content with how their market share is holding up compared to the broader market, because in recent years it has not always been the case that they have been able to do keep pace. The big test comes with the likely publication of execution channel data from the BIS – likely in its Quarterly Report for the fourth quarter of this year – then we will have a truly global picture.