FX Prime Brokerage – Defying the Doubters?

Posted by Colin Lambert. Last updated: August 12, 2022

Ahead of the release of the eagerly-awaited Bank for International Settlements’ Triennial Survey of FX Turnover, The Full FX is taking a look at different aspects of the regional surveys, taken in the same month – in this article, we look at the influence of prime brokerage in the markets

In recent, very unscientific, poll on social media, The Full FX asked if the FX prime brokerage industry, specifically the banking PB sector, was in decline? The response was broadly inconclusive, however, it was notable there was a majority (53%), who felt that it was indeed, on a downward trend.

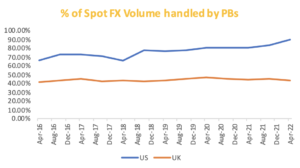

A better picture can be found by studying the turnover surveys from the UK and US committees, who break out FX volumes executed via a prime broker. As is the case with the broader survey picture, the two centres are very much not moving in step with each other – the US is continuing to grow as a PB centre, while the UK is very much treading water.

For those who feel the banking PB industry is in decline, the surveys raise questions, not least that in the UK and US alone, this is a business segment handling almost $1.2 trillion per day across all products. Equally, while the picture in the UK has recently been one of a slight decline, compared to the April 2017 surveys, volume via PBs has grown by 6.7% in the UK and a whopping 43% in the US – not bad growth over a five-year span. At the same time the overall market in these centres has grown by 34% and 7% respectively – a tale of two centres is reprised.

In many ways the data reflects the market structure in each centre, as noted in a previous report on these surveys, the US market seems very much dominated by non-bank market makers once London goes home, hence the high percentage of volume executed using prime brokers. In the latest survey in the US, 89.7% of spot turnover is via this mechanism. This continues a steady rise in the centre, in April 2017, the same ratio was at 72.5%, indeed April 2022 represents a new high mark for prime brokers’ share of the spot FX market in the US.

In the UK, meanwhile, spot FX volume via PBs – again this reflects the greater influence of banks in the centre, was at 42.9%, lower than the recent average and down from 45.7% in April 2017.

The pattern is repeated in other products, with the prime brokers in the US market showing continued growth, while in the UK the exact opposite is occurring. In outright forwards (including NDFs), PBs in the US handle $85.2 billion, or 42.8%, of flow daily – again a new high since the centre started reporting this data in 2016. This compares to 37.7% of flow in these products being prime broked in April 2017.

Interestingly, prime brokers are also seeing an increased share of the FX swaps market in the US – this against a backdrop of declining FX swap volumes in the centre more generally. A still healthy $99.4 billion is PBed every day in the US, this represents a 31.8% share of activity, more than two and half time the ratio from April 2017 of 12.4%. It is a similar picture in FX options, with PBs handling 43.5% of activity, up from 32.8% in April 2017.

The increased share of PBs in markets like swaps and options, suggests that banks are less involved than previously in the market and that the activity seen is generally hedging on the part of clients, mostly in the short dates.

In the UK report, 24.2% of outright volume is PBed, slightly lower than April 2017’s 25.1%, while NDF PB volumes at 14% of the overall, less than half of that in April 2017, when it was 28.2%.

It is a similar picture in FX swaps, which has seen tremendous growth overall in the UK market, PBs handle just 4.2% of flow in the latest JSC report, compared to 8% in April 2017. Equally, in FX options, 35.8% of activity is via a PB, compared to 39.1% five years earlier.

On a year-on-year basis, the PBs’ share of UK activity has increased slightly in spot, outrights and FX options, and declined slightly in NDFs. FX swaps are broadly unchanged. In the US over the same period, PBs have grabbed more market share in all products, with increases of between six and 12 percent.

It could be argued that the turnover surveys merely reflect prime brokerage as a business and that prime-of-primes are responsible for the growth, however there are two problems with this line of thought. Firstly, most PoPs are themselves provided with credit by a major prime broker, therefore they are just another link in the chain.

Secondly, the market share reports from the UK and US suggest that the influence of the top dealers continues to increase. In the UK, the top 12 dealer are responsible for 93.1% of all spot volume (up from 91.5% in April 2017); 89% of Outrights (87.1%); 95.9% of NDFs (94.4%); 83.8% of FX swaps (81.6%) and 96% of FX options daily turnover (94.2%).

In the US the picture is a little more muddied thanks to the FXC changing its market share report in October 2018 to calculate share in buckets of four dealers, rather than five. Comparing data from October 2018 to April 2022, the top eight dealers in the US had market shares of 90.9% in spot (90.7% in October 2018); 79.9% in outrights and NDFs (82.5%); 73.1% in FX swaps (75.7%); and 92.5% in FX options (91.9%).

Given the overall increase in influence of the major dealers, it seems reasonable to assume that their prime brokerage businesses are helping to drive the growth.

Overall then, the picture looks healthy for prime brokers, although the cost side of the ledger, thanks to regulation in particular, is also growing considerably. Perhaps, as noted in a recent column in this publication, the success or otherwise of an FX prime brokerage business comes down to the client type and products they support. A PB supporting non-bank market makers in the US market is probably doing very well indeed, and is not being overly harmed by changes to capitals. A firm seeking to support clients’ derivatives business on the other hand, is probably seeing margins diminish. Either way, however, at a trillion dollars-plus daily turnover in just the UK and US, it is hard to see too many banks turning their back on the business.