FX Markets Remained Orderly During Recent Interventions: BofA

Posted by Colin Lambert. Last updated: November 14, 2022

While FX markets remained orderly during two recent interventions by central banks, a Bank of America study finds that they are quick to react, but much slower to revert.

The study in a paper released by the bank, The Microstructure of Intervention, studies two recent, but different central bank policy moves – the intervention by Japan to push USD/JPY lower and the Bank of England’s purchasing of gilts to stabilise domestic sterling markets. BofA says, as a market participant, “what was very encouraging about both events was that the market remained orderly”, adding all FX venues operated normally with continuous liquidity and that credit and counterparty controls provided the required coverage to enable a functioning market.

It observes, however, that “Markets react quickly to interventions and are slow to revert. For both USD/JPY and GBP/USD, it took hours for spreads to come back to typical levels, despite each intervention lasting for less than an hour.”

Providing consistent liquidity across market conditions can be challenging when “an indiscriminate buyer” enters the market and upsets natural supply and demand, the bank writes, adding that the recent interventions by Bank of Japan and Bank of England, “caused tidal waves that reverberated through the markets and were evident in the cost to trade, spreads and volumes”.

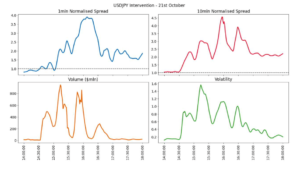

The study looks at the BoJ intervention on the afternoon of October 21, observing that on the nearly 400 points move, the primary market dislocated and became crossed against secondary venues. Unlike the earlier intervention by the BoJ, no official confirmation was made after October 21, however the bank estimates its size to be “tens of billions of USD” and prompted volumes larger than usual across several minutes.

Source: Bank of America

Close to a billion dollars of notional was observed through the primary markets each minute. In addition, the one- and 10-minute normalised spreads were four times wider and volatility also jumped. Once volume reduced, the study finds that spreads remained at twice their 30-day levels, although volatility did trail off as the rate stopped moving so sharply.

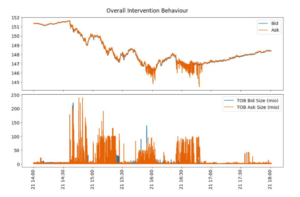

Drilling into the data, BofA finds there were two periods of intervention, one before 15;30 UTC and one after. In the first, it observes that offers for 100s of millions appeared, draining liquidity and pushing the market lower, while in the second “at most” $100 million appeared on the ask “without noticeable price impact”. This offer, the paper says, just induced volatility.

Source: Bank of America

After 16:00 UTC, the bank says, it started to see a new pattern emerge. “Large sizes on the ask cause the market to become crossed but quickly reverts once the liquidity is removed,” it observes. “By the end of this phase, hardly any trades happen at the new levels and there is minimal permanent impact. This could also be a function of credit availability at that time.”

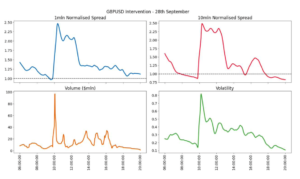

Although the Bank of England’s Gilt intervention of September 28 was different in that it wasn’t directly in the FX market, exchange rates did react and BofA says it saw spreads widen to two-and-a-half times the previous 20-day average. Again, a substantial amount of volume went through primary markets and volatility spiked before easing over time.

Source: Bank of America

The bank notes that in addition to not being directly in the FX market the reaction to the BofE’s intervention was more muted because it took place at a more liquid time of day. “While reports of potential instability amongst pension funds and a somewhat expected intervention from the BOE resulted in rapid price changes in Gilts these actions were well absorbed into the FX price,” BofA writes.

As was the case during the initial spike in activity following the onset of the pandemic, BofA also finds that heightened volatility and wider spreads represents an opportunity for an execution algorithm that can capture spread. “Therefore, if we see further intervention in a currency, remember that the rest of the day will likely be expensive to trade,” it writes. “If the size to trade warrants taking some duration risk, it may be advantageous to use an intelligent algo strategy that can capture spread.”

The bank also observes that the orderly nature of markets enabled it to stream consistent liquidity in a range of sizes and fulfil its role as a risk warehouse.

To access the full paper please contact the authors: tan.phull@bofa.com, dean.markwick@bofa.com and Pconlon@bofa.com