FX Market Conditions Briefly Impacted by Banking Crisis: BofA

Posted by Colin Lambert. Last updated: April 25, 2023

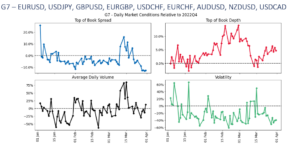

The latest Global FX Microstructure in Review paper from Bank of America, highlights a first quarter of 2023 in FX markets characterised by a gentle narrowing of spreads, a similar decline in volatility and an increase in depth of market – with the mid-March banking crisis providing only a relatively brief deterioration in conditions.

The shift in conditions resulting from the banking collapses in the US and the forced merger of Credit Suisse with UBS was “major”, according to the paper, which was authored by Tan Phull, Dean Markwick and Paul Conlon, but was subsequently reversed. BofA says that while spreads widened, depth fell and volumes increases due to the banking crisis, by the end of the month they had returned to what had been the trend of 2023 thus far, tighter spreads from the start of the year, marginally lower volatility and a gradual increase in top-of-book depth.

Source: Bank of America

Interestingly, the study finds that conditions in Asian and Scandinavian currencies were largely unaffected by the banking crisis, with conditions in Scandi pairs probably improving in the last few weeks of March. Thus far in 2023, spreads have tightened in these pairs, but depth-of-book has decreased, with daily volumes slightly higher.

In Asian pairs, BofA finds that spreads hand volatility have decreased from the start of the year, the former being approximately 50% tighter than the previous quarter. Volumes have been constant, with a minor increase in mid-March, BofA adds that depth has improved in the past few weeks.

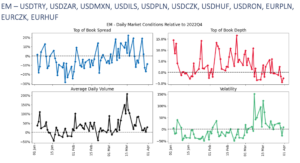

In the broader emerging market space, BofA says spreads have largely followed G7, with tighter spreads and increased depth early in the year reversed in mid-March, as well as increased market volatility. “The EM pairs saw the largest increase in volumes during the banking crisis period,” the study observes.

Source: Bank of America

With the banking mini-crisis seemingly disappearing in the rear-view mirror, conditions have reverted to recent norms, which in the bigger picture means slightly calmer markets than witnessed in Q4 2022. “Overall, the volatility experienced in March appears to have subsided and the microstructure picture across these currency pairs looks like the start of the year, though generally better than the prior quarter,

the study states. “Rapid changes in market volumes and volatility provide an opportunity for spread capture by algorithmic strategies that use dynamic signals and adapt to changes in market conditions.”