FX Execution Costs and US Policy: What Does Liberation Day Tell Us?

Posted by Colin Lambert. Last updated: December 8, 2025

If there has been one ever-present driver of volatility in FX markets over the past year it has been the vacillations of US public policy – most notably trade policy. Volumes spiked in April as the so-called “Liberation Day” took place, but this event did not settle policy, we have since seen numerous changes and announcement, and as we work through Q4, the uncertainty persists – and is likely to into 2026.

The latest paper in Bank of America’s FX Market Microstructure series, US Public Policy and FX Execution Costs, looks at conditions in the FX market, focusing in on key dates from inauguration to Liberation Day in the search for potential clues as to how FX markets will react into, and around, the turn of the year. The paper, authored by Dean Markwick from the bank’s e-FX quant team, finds that before Liberation Day liquidity reduced on headlines but improved after a day or two, but during the event (including the period after the announcements), it deteriorated and was low for two weeks until the US administration announced the 90-day pause.

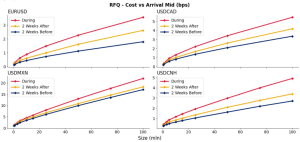

As was seen during the onset of Covid when conditions also deteriorated, the paper finds that a widening of risk transfer spreads (in this instance by as much as two-times the 30-day average) saw algos continue to outperform risk transfer. Moreover, the research finds that spreads took multiple weeks to revert to regular levels.

While volumes followed a predictable path of spikes on events dates (and sometimes the following day), the paper notes that Liberation Day broke this pattern, with volumes “highly elevated” and sustained at roughly 1.5X the 30-day average for two weeks – broken only by the announcement of a 90-day pause by the US administration. Spreads followed a similar pattern, as noted, as did volatility, which was also at 2X the 30-day average until the 90-day pause.

In the paper, Markwick notes this indicates two types of headlines; those that cause a temporary degradation of liquidity (that reverts within a day), and those that trigger a longer period of reduced liquidity (this was most evident after Liberation Day). Notably, perhaps, the paper also touches on another theme of US policy over the past year – vacillation. “It’s difficult to predict which headline will lead to either of the reactions and more so if the US Administration can quickly retract the policy changes,” it states.

Indicative real money risk transfer spreads over different time periods

Source: Bof A data

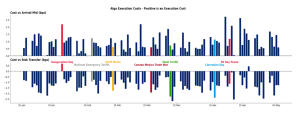

While algos outperformed RFQ trading over this period, the paper does observe some increases in algo costs over the event days, which is inevitable given the market reaction to the headlines, but notwithstanding that, the theme of general outperformance continued across both individual pairs and sizes.

BofA execution costs for liquidity seeking algos. <0 means algo savings vs referenced benchmark

Source: Tradefeedr

The paper also notes that this algo outperformance “doesn’t come for free”, because users must take on some element of market risk as the algo executes. Over the Liberation Day period, BofA finds the execution speeds were still “acceptable” with 100mio EURUSD/USDCAD/USDCNH taking around five minutes on average and 100mio of USDMXN taking 15 minutes. “Whilst across a large dataset an algo can outperform risk transfer, you must be able to dedicate multiple executions to overcome the variance in performance,” the paper observes.

In terms of what the data tells us, the paper highlights the importance of a dedicated execution policy and having a plan for periods of high volatility and relative illiquidity, noting that a combination of both types will improve overall execution outcomes. More pertinently, perhaps, it also stresses the value in reflecting upon the experience (and data) from around the Liberation Day period to prepare for future events – and not just US government public policy.

Regime change is a constant theme of markets in the current era, something market participants need to be aware of and which may be new to some. This is why papers like this from BofA are valuable. A ‘one-size-fits-all’ execution policy is unlikely to work well – as always, the execution tools exist in the FX world for participants to use, it’s really a question of using them as and when appropriate and not shutting off any corridors to improved execution – and if there is one over-riding message from the BofA paper, it is probably this.