FX Benchmark Choice Emerges as First Siren Trade Executed

Posted by Colin Lambert. Last updated: April 19, 2021

FX market participants looking to execute FX trades against a regulated benchmark now have a choice of providers after Siren, which is managed by Raidne, executed its first trade earlier this year. The trade was in EUR/USD for the 4pm January month-end fix and executed by a major US investment bank on behalf of a large European asset manager.

According to Jamie Walton, co-founder of Raidne, the trade resulted in an execution performance some $500 per million better than would have been achieved at the WMR 4pm Fix on the same day. He is also happy that a project that started with a white paper in 2019, first gained regulatory approval by the UK’s FCA that year, and has been trademarked, has hit another crucial milestone. “Siren is no longer a theoretical product and our first trade proved the concept,” he says. “The asset manager has done their first live trade, and they were happy with the savings, so are now looking to move a substantial portion of their portfolio onto Siren.”

Although the savings are inexact because Raidne replicates the WMR Fix using New Change FX data so may not have the exact fixing rate – any difference will be tiny – Walton says that the January month-end fix reinforced the results from 2020. More intriguingly, with the return of volatility in 2020 he says that execution improvements, or savings, using Siren dramatically outstripped even those in a white paper published by Raidne which indicated an average saving of $70 per million.

“Those results were for the period 2016-19,” Walton explains. “So we ran the same analysis for 2020 and the results were significantly better. On average in G10 currencies across 2020 Siren offered an $800 per million improvement over our calculation of WMR.”

When asked if the data was skewed by what was a very volatile April 2020 month end, when Cable for example moved almost 80 points in the 15 minutes before and five minutes of the WMR Fix, Walton acknowledges that Siren does indeed perform better in volatile conditions, but observes it wasn’t only at the end of April that it offered a better outcome. “There were some big moves throughout the year, the volatility around the fix didn’t really go away, so our findings are only minimally skewed by one or two big days.”

On average in G10 currencies across 2020 Siren offered an $800 per million improvement over our calculation of WMR

The key difference between Siren and WMR is the length of the calculation window – although Siren does have optimal execution spot weightings which gives it slightly different characteristics to the straight TWAP of WMR. At 20 minutes, Siren is able to capture a significant proportion of any pre-hedging that takes place. Indeed in many ways, the improvements cited by Walton – which are available publicly on the New Change FX website (NCFX is the benchmark administrator) – actually reflect the benefits of pre-hedging to an executing dealer. If anyone was wondering how much money can be made out of pre-hedging, perhaps the answer is available in the Siren data?

“Banks are pre-hedging to provide a better execution,” Walton says. “They are trying to reduce market impact for their clients, because they recognise that there is significant market impact in the WMR window. By having a 20-minute window, we capture a great deal of that pre-hedging – Siren doesn’t eliminate market impact but it does severely reduce it.”

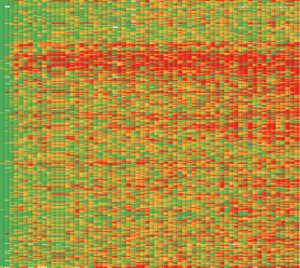

Siren Performance Heatmap

Interestingly, given a recent QIC paper on the use of the Fix which described “systematic patterns which can be exploited from observing momentum leading in to 4pm, and mean reversion of exchange rates after 4pm”, Walton says he has similar observations. “We are also seeing more reversals at the end of the Fix window, which signals information leakage and speculative trading is going on around the Fix. Again, in a longer window that is reduced.”

Walton is quick to acknowledge that Siren does not outperform WMR every day, there are days when the reverse is true, but rarely to the extent in dollars per million terms that Siren outperforms WMR. “We have a heat map (see right) that analyses the performance of Siren over WMR,” he explains. “Anything red signifies a fund trading in the direction of the Fix would have achieved a saving of over $1,000 per million. Orange is $200-$1,000, and green less than $200. For 2020 there are huge patches of red, which indicates how often and by how much Siren can offer savings.”

Obviously a major factor in calculating savings is the direction of the flow – typically clients with flows that go against the overall direction will make more by sticking to WMR, but the nature of the fixing beast is a heavily skewed flow, therefore only a minority of users actually see this benefit. To help clients better understand their fixing flows, Raidne has developed a solution that provides the fund manager with a correlation rating relative to the direction of the Fix. At 50% they will achieve a balance of flow and there will be little or no cost, but for every percentage point above 50% the cost will increase.

Walton says that Raidne analysed over 100,000 fixing trades from 19 funds and found correlations of between 56% and 79%. “Using these correlations we found that at 56% there would have been a saving of around $250 per million at month end and $80 per million intra-month,” he says. “At the top end in correlation terms those sayings are obviously much higher, more than $400 per million – at 79% correlation the savings are $470 per million at month-end and $250 intra-month.

Gaining Traction

Aside from the observation that savings in the hundreds of dollars per million range render any discussion about whether fees for the Fix should be $5, $10 or $20 per million meaningless, the question has to be, with such evidence why are managers not switching?

Without doubt, there is an inertia in some firms where mandates are in place and there is little desire to change them. Equally, some trustees struggle to understand the nuances of FX execution, and others, as was pointed out to The Full FX recently by a senior execution executive at a US asset manager, argue that because the underlying assets are also revalued at the Fix, the actual level of the benchmark has no impact.

Source: Raidne

There is, however, plenty of evidence that a lot of managers could improve their FX execution performance and reduce market impact, so are they listening?

Jim Wyatt, co-founder at Raidne, says the onset of the pandemic, while creating market conditions in which Siren’s performance was enhanced, did not help take up of the benchmark, mainly because firms had a long list of priorities, number one being maintaining some sort of ‘business as usual’. As the world both got used to working conditions and the aforementioned volatility was maintained, however, he says Raidne is having an increasing number of conversations with interested parties – thanks to a change of tack late last year.

“We have reached out to two distinct groups, the top pension funds and the largest 400 asset managers by AUM,” he explains. “We were advised, however, by a regulator, that the people we really needed to engage were the fiduciary managers, because they are the ones that effect real change – they have the mandates to make decisions that will help improve outcomes for investors.

“It is hugely frustrating when we are told that some firms’ mandates stipulate use of the WMR 4pm Fix,” he acknowledges. “But talking to the fiduciary managers they largely see it is a minor tweak. They keep the same systems in place, the only thing that changes is they tell their currency managers to trade using Siren – it’s a slight adjustment of language and process but the savings they can access can be significant.”

A factor in Raidne’s favour as it seeks to engage more firms is that six further banks have agreed to offer fix executions using Siren. “Of all the banks we have spoken with only one has declined to offer Siren,” Wyatt says. “The rest are all at different stages of preparation, but we are hopeful that very soon asset managers will be able to execute on Siren largely with the same banks they do for the WMR Fix.”

Wyatt is also confident that Siren will soon be adopted by another key player in the fixing landscape, MSCI. “Our understanding is that if even a small number of funds ask for it, MSCI could produce a Siren version of its key indices,” he says.

Bringing Focus

Although only time will tell how well Siren gains traction, the very fact that live trades have been executed – and a performance benefit shown – should grab the attention of those designated to protect investor interests. As pointed out by Walton, no longer are the dollars per million theoretical, real savings can be achieved.

This is likely to focus minds amongst asset managers, especially if rumours of law firms looking at their apparent negligence around FX execution prove founded. Equally, whether they have signed up or not to the FX Global Code, one aspect that the Global Foreign Exchange Committee has continued to reiterate over the past year is that market participants using the WMR 4pm Fix should regularly assess whether it remains fit for their particular use.

Source: Raidne

No doubt some managers will still believe it is and will point to transition costs that fail to justify potential savings, but others, now there is a real alternative, may find they have less excuse. One element of ensuring the “fit for purpose” requirement is met has to be proper analysis into a regulated alternative – and here the numbers may well prove conclusive. To put this into perspective, Walton says that analysis of one fund’s trades done last year found it would have saved over £1.5 million in March alone (and, to recall, March month-end did not witness extreme volatility) based upon a 65% correlation. This is serious money in anyone’s book and could tip the balance for many funds who need to be seen to be doing their best for the end investors.

It would appear, therefore, that Siren is likely to win business through the sheer weight of statistics, although it would be interesting to see what would happen if, for example, Refinitiv Benchmarks decided it will adopt a 20-minute window. Whether that will happen is unclear, although generally speaking sources with knowledge of the business suggest no major changes are likely in the near term.

That provides a window of opportunity for Siren to cement its position as a reliable, and seemingly more profitable, alternative. This is something likely to be welcomed by regulators who are often keen on redundancy of key financial market mechanisms – if nothing else, having choice can only be a good thing, especially when there are different models on offer.

“We are confident that as more trades are executed using Siren, funds will evaluate the savings they can make – and the best execution argument should play a key role – and act in the best interests of their investors,” says Walton. “Our data show that the benefits of Siren are not some anomalous quirk, rather they highlight a systematic problem with the existing Fix. We didn’t design Siren to give better fills – it was designed as a fairer benchmark that more accurately reflected how firms execute – but there are clear benefits for investors and as such we think managers should seriously consider switching.”