FX Automation Growing…But Unevenly

Posted by Colin Lambert. Last updated: July 30, 2024

The latest turnover surveys from the UK and US FX committees indicate that automation continues to grow in the FX market, but while it is starting to be more noticeable in non-spot products, there is no trend across all products.

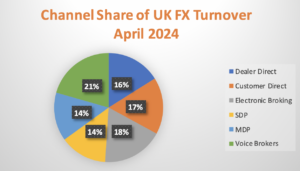

As noted in our previous report, activity was up across all product groups, albeit with particular strength in certain centres, but the pace of automation varies – at least in the two jurisdictions that publish detailed execution data, the UK and US. On a year-on-year basis, the e-ratio for NDFs and FX options in the UK actually fell from April 2023, the both quite strikingly, the former from 58.5% to 53.7% and the latter from 21.9% to 14.6%. In the US, by contrast, the e-ratio for FX swaps rose from 49.4% to 51.8%, while in FX options it rose from 19.8% to 23.7%, the US survey does not break out NDF volumes by execution channel.

The world’s busiest product in the busiest FX centre, FX swaps in the UK, also saw an increase in the e-ratio, rising to 35.6% from 32% the year before. Not all channels saw an increase, however, with swap volumes via electronic brokers falling from just over $241 billion per day to just under $219 billion. In terms of the percentage of volume, this is a decline from 14.3% to 12.4%. In the US, ECN volume rose in FX swaps to $93 billion from $84 billion, however as a percentage of volume, the channel lost ground from 21.3% to 19.2%.

Elsewhere, however, it was a more positive story, with FX swaps volume via single dealer platforms (SDPs) in the UK rising sharply from $128 billion to $201 billion – the highest it has been since the data was first published. In the US, SDPs also saw a sharp uptake in FX swaps volume, from $24 billion per day to just over $40 billion, taking its share of the product from 6.1% to 8.3%.

On the multi-dealer platforms it was also a good news story in FX swaps, with activity in the UK rising from $172.5 billion per day to $208.3 billion. This means that 11.8% of FX swaps volume in the UK goes through MDPs, up from 10.2% in April 2023. Collectively in the UK, the SDP/MDP combine handled $409.3 billion in April 2024, up from $300.5 billion the year before – bringing the collective ratio to 23.2%, the highest it has been to date. In the US, the MDP/aggregator channel handled $117.5 billion per day in the latest survey, up from $86.2 billion in 2023. The channel’s share of volume also rose, from 21.9% to 24.3%.

FX Options

In FX options, meanwhile, the story was more mixed. In the UK, in spite of multiple initiatives in the space, the SDP and MDP channels actually saw a decline in influence in the latest survey. Turnover via SDPs fell slightly, from $12.3 billion to $11.3 billion, but the overall increase in FX options volumes in the centre means the channel’s share of business fell to 4.1% from 6.3%.

Similarly, MDPs in the UK handled $4.9 billion per day in April 2024, down from $7.8 billion the year before, bringing the channel’s share down to 1.8% from 4%. Only via electronic brokers did notional volumes rise, and then slightly from $22.9 billion to $24.2 billion, but even here, the channel’s share declined, from 11.6% to 8.7%.

In the US, however, these channels grabbed a bigger share of the business. SDPs transacted just over $7.7 billion per day in the latest survey, up from $4.4 billion the year before. This means SDP handle 7.9% of FX options volume, up from 7% the year before (but down from the intervening survey in October, when it peaked at 9%).

MDPs and aggregators handle a trivial amount of FX options business, according to the US survey, activity rising to $609 million from $335 million, however activity via ECNs almost doubled from $7.7 billion to $15 billion in the latest survey. This brings the channel’s share to 15.2% from 12.2%.