Execution Data Highlights Continued Move to Bilateral Trading

Posted by Colin Lambert. Last updated: February 10, 2024

The latest execution data from the semi-annual FX turnover surveys published by the UK’s FX Joint Standing Committee and New York FX Committee reinforce a trend of the past few years with bilateral trading channels continuing to gain ground at the expense of ECNs and electronic brokers.

Unfortunately, the JSC report has reduced granularity, with single dealer and multi-dealer platform data lumped in together for the first time, but collating historical data, the combined channel saw an increase in all products with the exception of FX options. Across all products in the UK the platform channel handled just over 26.6% of all flow – the largest individual (or combined!) share. This is up from 25.8% in the October 2022 survey, and for context, in the last survey before the pandemic, which shook up execution data for a short period of time, these channels executed just under 21% of volume.

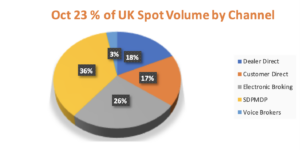

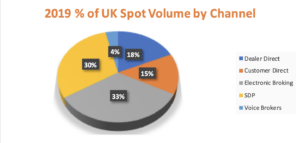

It is a similar picture in spot, where the SDP/MDP channel handled 36.1% of volume – again easily the most popular channel, this is up from 34.6% in October 2022 and in the pre-pandemic survey it was just over 30%.

By contrast, in spot, which is the ECN/electronic broking strong suit, the channel’s share of activity has dropped quite sharply, to 25.7% of volume, down from 30.1% in the October 2022 survey. Again, for context, in October 2019, this channel handled 33.4% of spot flow. Another channel to see good growth in spot is Customer Direct in the UK, with its share rising to 17% from 13% a year before, while granular detail is unavailable as it is not collated, this could also be a signal customers are putting their dealers in competition on the phone.

In the US, the multi-dealer platform (including aggregation) channel is most popular for spot, with43.2% of volume going through, up from 42% in October 2022. Again, this reinforces the trend, in the October 2019 survey just 35.4% of spot volume was via an MDP/aggregation channel.

The decline in the ECN/CLOB channel is less marked in the US, with the channels handling a combined 15.2% of spot volume, down from 15.6% in October 2022. Here, however, the latest ratio matches that of October 2019.

A further decline in spot trading in the US has come via the single dealer channel, which is perhaps less of a surprise given the non-dealer domination of that market. In the latest survey, 6.6% of volume is via an SDP, whereas in October 2022 it was 7% and in October 2019 it was 8.8%.

Electronic trading seems to be gathering steam in the US – the Voice Direct channel now handles 25.4% of spot volume, down from26,6% in October 2022 and 31.1% in October 2019. Overall, the October 2023 e-ratio for spot was 65%, slightly higher than the previous October’s 64.6%, but significantly up on the 59.4% pre-pandemic. In the UK by contrast, the picture is more muddied, with the spot e-ratio in the latest survey being 61.8%, the lowest it has been for almost a decade. In the previous October it was 64.7%, in October 2019 it was 63.7%, but it has regularly been in the 64-68% in the meantime.

Non-Spot Diversity in the UK

Away from spot in the UK survey, there were a range of outcomes for the various channels. In what is perhaps a surprising development, the growing channel in NDFs was Customer Direct. Again, this could reflect dealers being put in competition in NDFs, but the channel is up 9.7% year-on-year in terms of its share of business. A decline in inter-dealer business saw that channel drop 4.9%, but the real surprise, given the growth reported in NDFs by various platforms, is how the Electronic Broking channel’s share fell by 6.8%. Thanks to the new reporting methodology in the UK, the MDP/SDP channel has now overtaken Electronic Brokers as the most popular channel, however the reality is the latter still commands the biggest market share if the SDP/MDP volumes are broken out.

Interestingly, voice brokers saw an increase of 1.4% in NDF activity from October 2022, something that was also a characteristic of the FX swaps data in the UK. Here, the voice brokers added almost 4.9% to their market share on FX swaps, and remain easily the busiest channel with 39.2% of business.

In both NDFs and swaps, the likelihood is the voice brokers are taking advantage of the decline in direct dealing between Reporting Dealers, in FX swaps, this channel declined 5%, suggesting the major banks moved back to the voice brokers as interest rate volatility settled somewhat in the last quarter of the year.

Finally in the UK survey, FX options bucked the trend, with the all channels seeing modest gains with the exception of the newly-combined SDP/MDP channel, which saw its share drop 3.8%.