Does the Execution Data Offer a Troubling Picture for ECNs?

Posted by Colin Lambert. Last updated: February 13, 2023

While only the UK and US FX committees publish execution channel data in their semi-annual FX turnover reports, they are largely representative of industry conditions globally, and the latest data from October 2022 offers a relatively gloomy picture for ECNs, with even voice brokers outperforming the sector.

The UK and US reports do have reporting differences, but can be viewed side-by-side and perhaps most worrying for the ECN/CLOB model is that the decline is not limited to the last year, it is part of a multi-year decline. Obviously, within the data there may be differing fortunes for different firms, but in the broad picture, the FX market seems to be turning away from the model.

In the UK, across all FX products, there was some good news for the Electronic Broking model in that its share of turnover year-on-year crept higher, by 0.1% to 20.1%, but what growth there was came largely from NDFs (good news for those platforms chasing that market of course), outright forwards and, to a lesser degree, FX options. FX swap and spot turnover through the channel declined – the latter by 1.8% to 30%. This is still the biggest channel for spot trading, of course, so the news can be brightened by this fact, however amidst a growing spot market, the channel seems to be losing ground.

Elsewhere, compared to October 2021 in all FX products, the latest UK survey sees the share of single dealer platforms (SDPs) lower by 0.1% to 12.4%, while multi-dealer platforms (MDPs) saw their collective share rise to 13.4% from 12.1%. There were declines in the share of the inter-dealer direct and customer direct channels (down 0.9% to 19.6%, and down 2.2% to 14.8% respectively), while voice brokers’ share grew by 1.9% to 19.7%.

In the broader survey, volumes between Reporting Dealers grew substantially, this was also noted in the Bank for International Settlements’ Triennial Turnover survey in April 2022, and this is probably the source for the voice brokers’ growth.

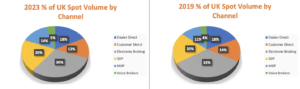

In spot terms in the UK, the voice brokers share grew to 4.7% from 4% (this data has historically been a little volatile), as did the inter-dealer channel (14.9% to 17.6%), although Customer Direct trading was only 13% of spot activity, down from 14.9% in October 2021.

There were contrasting fortunes for the single and multi-dealer platforms, with SDPs’ share rising to 20.3% from 19.4% and the MDPs falling to 14.3% from 15.1% the year before.

Longer Term Trends

Although year-on-year anomalies and outliers are part and parcel of the semi-annual surveys, over a longer term, the same trends tend to emerge. Indeed, comparing the latest data with that of October 2019, the last surveys before the pandemic hit, most are more noticeable.

Again, the Electronic Broking channel does well in non-spot (and FX swap) products, but in those two main markets, its share has declined. Across all products, the share has risen to 20.1% from 19.8% in October 2019, but in spot it has dropped by 3.4%. Over the same time horizon, the MDPs have performed best (+4.3%) in all products, followed by voice brokers at +2.7% share. This growth is fairly general, with only NDFs dropping, but the bulk of the increase is, unsurprisingly perhaps, in FX swaps and options – a reflection of increased dealer hedging activity.

In UK spot markets over the four-year time horizon, the MDPs’ share has increased by 3.8%, the voice brokers by 1.1% and the SDPs by 0.6%. The gains seen by these channels is largely made up by market share losses for the inter-dealer direct channel, which fell 8.4% from October 2019 (customer direct trading was +0.4%).

A (Slightly) Different Story

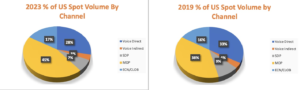

As noted, the New York FX Committee’s survey collates execution data slightly differently, but the numbers can be loosely compared. As is often the case, the different nature of each market is highlighted in the US seeing almost the opposite trends. On a year-on-year basis overall activity on ECNs declined, but in spot it went higher.

Across all products, ECNs (The Full FX has aggregated two channels – labelled Reuters Matching/EBS and Other ECNs – in the FXC report) saw their share of volume drop to 16.9% from 18.1%, however in spot terms, the share rose from14.1% to 15.6%. The latter probably reflects a return to the market of non-bank players and HFTs, a reflection of their dominance on these venues in the US afternoon especially, when banks largely price through disclosed channels.

The Voice Indirect channel – largely the voice brokers – saw a slide in its share from October 2021, by 2.5% to 14% across all products, and in spot it fell from 3.8% to 3.2%. From October 2019, this channel saw a 1.9% increase in share in all products, while in spot it was unchanged.

The busiest channel in the US is somewhat ambiguously entitled “Other”, but is largely understood to be the MDPs and some aggregation venues. This channel handled 30.6% of all products, up 0.3% from October and up 4.9% from October 2019. In spot, the share is even higher with 42% of volume, slightly down year-on-year (by 0.4%), but significantly higher than the 35.4% share it had pre-pandemic.

Single dealer platforms remains a minority channel in the US, handling just 7% of overall and spot volume, both of which are down year-on-year (by 0.6% and 0.3% respectively) and since October 2019 (by 2.8% and 1.8% respectively).

Customer Dealing a Bright Spot?

Although it should be noted that dealing by customers has declined as a percentage of daily volume in recent surveys, there is better news for the ECNs in data showing where customers are trading. Although the data is not broken down by product, in the UK the percentage of Other Financial Institutions (OFI) volume executed via and Electronic Broking System rose to 24.8% in October 2022 from 22.7% a year earlier. Since October 2019 this share has declined slightly, it was at 25.1%, but interim declines do seem to have been reversed.

In the US meanwhile, 19.8% of OFI activity is via an ECN/CLOB, down from 22.4% in October 2021, but unchanged from October 2019. OFIs execute slightly less of their volume by MDPs in the UK (23.3% in the latest survey), this is significantly higher, however, than the share in October 2021 (18.2%) and October 2019 (18.8%). In the US OFIs execute 34.5% of their volume via an MDP (down from 36.5% in October 2021 but up from 30% pre-pandemic).

There are mixed fortunes for SDPs when it comes to OFIs – in the UK the share of trading has risen to 23.3% of activity across all FX products, from 20.3% in 2021 and 20.5% in 2019; while in the US this channel saw its share drop to 7.2% from 7.4% in 2021, but this is significantly lower than the 12.5% market share pre-pandemic.

Interestingly, given these firms are not generally seen as attracted to the ECN/CLOB model, the share of Non-Financial Institutions (NFIs) actually went up in both the UK and US. In the former 13.8% of volume was via an ECN, this is down from 14.7% a year earlier but is up from October 2019’s 12.6%.

Likewise in the US NFIs executed 11.6% of their volume via an ECN/CLOB, down from 13.6% in October 2021, but up from the pre-pandemic level of 10.8%. The MDP remains the preferred channel for these clients, however, even though there are, again, differing fortunes either side of the Atlantic.

UK NFIs executed 19.4% of their flow via MDPs in October 2022, down from 20.2% the year before and 5.3% below October 2019’s share. In the US MDPs had a 29.5% share of NFI volume, up from 18.4% in 2021 and from 24.9% pre-pandemic. The mixed fortunes continued in the SDP space, with NFIs executing 18.6% of volume on this channel in the UK (from 16.7% and 12.1% respectively in October 2021 and 2019), while in the US 15.2% of volume went down this line, up from 14.7% in October 2021, but down from 17.3% in October 2019.

Overall, as the pandemic recedes in the rear-view mirror and, perhaps more importantly, sustained volatility returns to the FX market, there does appear to be a shift in behaviour on the part of FX market participants. Generally speaking the sense is that more deals are put into competition, but on a disclosed, bilateral basis and that information leakage on ECNs remains, rightfully or not, a concern.

That said, for those concerned about the diminishing share of the so-called “primary” venues, it should be noted that in spot, in the UK and US, the ECN/CLOB model still handled some $400 billion per day in October 2022. A lot of this volume is on venues subject to last look, and therefore the data may not be as valuable (or even useful), but for post-trade execution analysis at least, or knowing where the market last traded, it is likely to be enough to paint a sufficiently realistic portrait.