Did Sterling Flash Crash on Monday?

Posted by Colin Lambert. Last updated: September 27, 2022

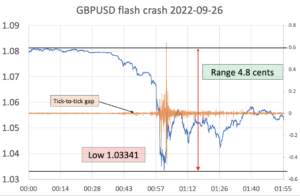

The price action in Cable on Monday morning in Asia has led some to question whether the FX market saw its latest flash crash as the pound dropped from just under 1.08 to 1.0327 (the official low), before bouncing sharply to 1.06.

Dealers report “very thin” conditions in the early Asian market when the moves took place, although it should be noted that unlike previous liquidity events in Asia, Singapore and Tokyo were both up and running. Spreads also blew out as volatility continued, one liquidity consumer tells The Full FX that they went from 10 pips wide to around 50 on a single LP basis and that “one or two” LPs stopped pricing on their aggregator.

As to the question of whether this was a flash event, Jamie Walton, head of product and co-founder of analysis firm Raidne, creators of the Siren benchmark, suggests there are some characteristics that would back such an argument. “The orange lines [on the chart below] which represent the tick-to-tick gap are insightful,” he says. “This is the amount the mid moves (in at least 1M LHS) from one tick to the next tick update. This stays fairly stable until around 1am, just slowly increasing as vol increases.

Source: Raidne, data from NewChange FX

“I believe this stable behaviour is more indicative of algos and automated trading in spot,” he explains. “Whereas the whipsaw moves around the lows are more indicative of manual traders intervening. We saw similar behaviour around the AUDUSD flash crash of 2020-09-03 at the start of the pandemic and given the eventual recovery of Cable there is some justification for calling this a flash crash.”

Source: Raidne, data from NewChange FX

Others remain less sure, with one trader in Asia arguing “someone panicked”. The trader adds, “There were bids most of the way down even after it went through the 1985 low, although spreads were wider, anyone wanting to sell could have done.”

This is backed up by analysis from another trader who indicates that Cable was given five times at the low, suggesting that there was sufficient two-way interest most of the way down.

Where observations from both traders support the observation of a flash event is in the rebound, with Cable trading back above 1.06 within one minute. “Once it started bouncing it was hard to find sellers,” the Asia-based trader says. “Liquidity thinned out for a while there, at least until 1.0550-1.0600, then we reverted to normal, albeit a nervous normal.”