BIS Study Finds Retail/Insto Divide in Crypto Post-FTX

Posted by Colin Lambert. Last updated: February 20, 2023

A study published in the latest BIS Bulletin investigates the trading behaviour of different groups in crypto markets using a newly-available dataset and finds a divide in the actions of retail and institutional investors.

The study finds that, unsurprisingly, as crypto prices rose, more investors entered the market. The market did, of course, reverse sharply throughout most of 2022, as the study notes between May and June, over $450 billion in asset value in crypto and DeFi were destroyed following the collapse of the Terra/Luna stablecoin.

A second event, in November 2022, was the collapse of the crypto platform FTX following a run sparked by concerns about its liquidity and solvency. Similar to the Terra/Luna crash, the price of the FTT token (an in-house FTX token) fell rapidly, and ultimately FTX filed for bankruptcy. As part of the rout, bitcoin, ether and other cryptoassets fell by over 20% in value in a matter of days, the authors observe.

During both events, trading increased significantly, but there was a divergence with the data revealing that owners of large wallets, the “whales”, reduced their holdings of Bitcoin in the days after the shock episodes, while medium-sized holders, and even more so small holders (“krill” in the BIS paper), increased their holdings. “The price patterns suggest that larger investors were able to sell their assets to smaller ones before the steep price decline,” the paper states. “Large holders thus profited at the expense of smaller investors.”

To determine the performance of retail crypto investments at the individual level, the study analyses the distribution of the number of users downloading the crypto exchange apps for different Bitcoin prices. These data show that almost three-quarters of the users downloaded a crypto platform app when the price of bitcoin was above $20,000, the study notes. Assuming users invested in Bitcoin on the same day they downloaded the app, it proxies the size of the loss on their initial investment relative to a given price level. Additionally, the study performs a series of simulations, it particular, it assumes that each new user bought $100 of Bitcoin in the month of the first app download and in each subsequent month.

“In nearly all economies in our sample, a majority of investors probably lost money on their bitcoin investment,” the paper states. “The median investor would have lost $431 by December 2022, corresponding to almost half of their total $900 in funds invested since downloading the app. Notably, this share is even higher in several emerging market economies like Brazil, India, Pakistan, Thailand and Turkey.

“If investors continued to invest at a monthly frequency, over four-fifths of users would have lost money,” it adds.

Low Contagion

The good news from the study is that the authors find few spillover effects into TradFi markets – in contrast to warnings sounded regularly by regulators, including the BIS.

The collapse of TerraUSD and the bankruptcy of FTX were each associated with large losses among venture capital and retail investors, the study finds, as it investigates the relationship between crypto adoption and the broader financial system during the two shock episodes.

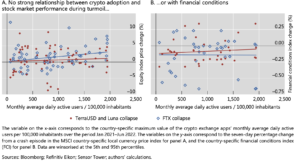

The graph below plots a country’s level of crypto adoption between January 2021 and June 2022 on the horizontal axis. This measure serves as a proxy for the losses subsequently incurred during the Terra/Luna crash by crypto investors. The vertical axis plots the change in local equity prices or financial conditions during the Terra/Luna shock (red dots) and the FTX collapse (blue dots). Each dot represents a country, and the lines show the estimated relationship between crypto usage and conditions in the wider financial system.

“The evidence suggests that crypto shocks have a limited impact on equity prices or broader financial conditions,” the paper states. “For either metric during the two crypto stress episodes, there is at best a weak correlation between broader stress and crypto losses. While the crypto collapse may have affected individual investors, the aggregate impact on the broader system was limited. These patterns underline the largely self- referential nature of DeFi and crypto.”