Azzilon Launches Currency Management Strategy with SGX AUD Index

Posted by Colin Lambert. Last updated: February 12, 2023

With sustained volatility returning to the FX market for the first time in many years, corporate bottom lines and asset manager performance are once again being significantly impacted by exchange rate moves. The recent Kyriba Currency Impact Report highlighted FX headwinds of over $46 billion for companies exposed to the rising dollar in 2022 and debate has reactivated in the money manager world over the pros and cons of more active currency management.

The challenge for many of these firms is finding the resources – and cash – to fund the larger operations required to effectively hedge currency risk. Even outsourcing, which has become more popular in recent years, comes with costs and risks, which leaves managers searching for more cost-effective solutions.

Another factor to rear its head thanks to the return of volatility is in those banks and funds who have effectively depleted their FX trading businesses during the years of historic low vol – these firms are also keen to exploit the wealth of opportunities FX is now offering. Effectively then, FX is back, but there is a large swathe of firms unable to take advantage of it.

This may make it especially timely that Singapore Exchange (SGX) recently launched the iEdge-Azzilon Strategy AUD/USD Index, a new smart beta product developed by systematic risk management firm Azzilon, which says it has previously seen good success with its QQQ indices, developed with Solactive, representing the ETF on Nasdaq.

FX industry veteran Simon Winn is head of product development and distribution for Azzilon in Asia-Pacific; he says the company had been seeing growing demand for currency-related products and selected the AUD. “We chose the AUD because there are pan-Asian investments both ways and significant two-way currency risk,” he explains. “Equally, there are great opportunities for white labelling of the strategy by Australian firms to their clients, who are all seeing the impact of exchange rate moves.

“Once we had decided on the AUD, we went to SGX, as the leading index publisher in the region, to explore a partnership,” he continues. “SGX validated the methodology applied by completely recoding the model, back tested the results using independent market data, and published it for the first time in mid-January.”

The SmartB AUDUSD RM, as the AUD/USD strategy is called by Azzilon, will soon be available in a second form, as a structured note that will be issued by an A+-rated bank. “There are two ways to engage with the Azzilon strategy,” Winn explains. “The Index is rebalanced daily, based upon the WMR London 4pm Fix, and clients can opt to receive trade signals from SGX – the owner of the Index – and adjust their hedges themselves.

“It is always difficult for a new player in the market to establish their credentials but by partnering with leading index publishers such as SGX and Solactive we can benefit from their established reputations,” he continues. “They independently validate our strategies and back tested results and take ownership of our indices. Clients will then face the index publisher as their counterpart rather than Azzilon.”

On the structured note, Winn says the firm intends to replicate the strategy it implemented with BNP Paribas for the Solactive QQQ related index where it incorporated a vol target to minimise downside market risk. “Using a volatility target lower than that of the underlying index enables a bank to issue a capital guarantee note on the indices we develop.” he says. “For currency products we believe the guarantee is likely to be 100% of the capital and include a participation ratio of circa 125% of its performance.”

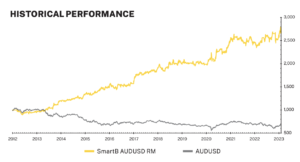

Data published by SGX and Azzilon (the NAV is also published on Bloomberg and Refinitiv Eikon) shows historical annualised performance over the 10 years to the start of January 2023 was +14.99% with annualised volatility of 9.97%. This represents a return over risk of 1.5, significantly better than the -0.30 provided by the AUD/USD itself in currency markets. The maximum drawdown in that 10 years was -11.09%, compared to the AUD’s -46.86%, thus the firm is very confident in its ability to out-perform basic AUD/USD strategies.

Source: Azzilon

“The key to the strategy is its ability to reduce the market correction’s negative impact,” says Winn. “Simply put, the algorithm detects the disequilibrium in the market behaviour and liquidates the AUD/USD investment when such instability is measured, preventing potentially severe pull back in the portfolio component’s value.”

Winn is keen to stress that buying the note is more advantageous as a long-term play, probably over four to five years, although he also observes that there will be a secondary market for the notes especially. “The capital guarantee in the note provides a good stop-loss for anyone with AUD exposures,” he says.

Growth

With the launch of the AUD Index, the question inevitably turns to what’s next, and Winn says there are multiple use cases for the strategy. “Because the costs are nowhere near so many Smart Beta strategies, we are talking to some of the world’s largest investment firms, who are interested in adopting Azzilon’s strategies. These firms can effectively use us as a third-party quant shop, and are outsourcing their currency management to a degree,” Winn says, “We are also asset class agnostic. As an example, we recently signed a partnership with 3Iq, a crypto asset manager regulated in Canada. They retained us to create a system which will greatly reduce risk and maximise profitability for their substantial client base.

“Some leading investment banks are considering using our indexed technology for their own trading. There is real potential for these institutions,” he continues. “As an example, a bank can access returns circa 15% per annum from the AUD/USD without having a dedicated trader and all the risks and costs that come with that. Equally, they can white label the strategies for their own clients.

“With the AUD strategy, clients can subscribe to a certain amount in the SGX Index, receive the signals, and do the rebalancing trades themselves – with the potential to enhance returns through internalisation,” Winn adds. “The trading strategy is based upon a long and short model but we can break this down to provide overlay hedging strategies for institutions with long and short exposure to the AUD.”

With a strategy planned for USD/CAD – Azzilon recently relocated its headquarters from Singapore to Quebec but retains a strong presence in the city state – the other major FX pairs are also on the horizon. Winn says the firm is looking to develop similar strategies for the other major FX pairs, are working to create a non-dollar basket index, and a crypto product. “In short, we can build risk management tools for any investment universe and all risk appetites,” he says. “The results we have had speak for themselves and by making access easier through the Index or a note, we think we are offering an excellent risk management product that will outperform traditional hedging strategies, at a fraction of the cost.”