How Do the Platforms Compare to the Latest FX Turnover Data

Posted by Colin Lambert. Last updated: February 20, 2024

The world’s FX committees recently released FX turnover data for October 2023, indicating that spot FX activity was down compared to the year before, but how did those FX platforms to report volumes compare?

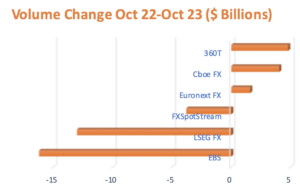

Across the seven centres to report, average daily volume (ADV) in spot was just short of $1.825 trillion in October 2023, a 3.9% drop (or just over $73 billion per day) from the previous October’s report, mainly due to drops in activity in the UK and Japanese report that were not compensated for by gains in the US, Singapore and Hong Kong. Collectively, the six platforms to report monthly data under-performed the broader markets, dropping 7.2%, but within this group there were some sharply different outcomes, with three out-performing the global data and three under.

The CLS monthly data across October 2022 and 2023 also out-performed, rising by a fraction, 0.6%, or $3 billion per day, suggesting that a drop in the activity came in emerging markets pairs, which had performed strongly in 2022.

As noted in a report recently by The Full FX, bilateral or disclosed channels seem to be continuing their seemingly inexorable rise when it comes to market share, although in terms of the specific platforms, the picture is more mixed. While the comparative data makes for difficult reading for EBS and LSEG FX, there was also a comparative decline for the relationship model of FXSpotStream. On the contrary, there was a climb for the ECN-based Euronext FX and Cboe FX, as well as the relationship-based 360T.

It should be noted that neither EBS or LSEG FX break out volume data across their various platforms, however they do report total spot volume. This makes it difficult to assess whether it is EBS Market or EBS Direct that is seeing a decline (or both), likewise with LSEG Matching and FXall.

Either way, EBS, which is owned by CME Group, and which has been struggling to retain market share in recent years – 2022 was only the third time in more than a decade the platform had seen a volume increase, and that less than its peers – saw a drop of 24.2% from October 2022. Perhaps notably, October 2023 was the third lowest ADV for EBS since it started reporting results at the start of 2007, and probably for some time before that, therefore the comparative performance may be something of an outlier. CME Group’s FX franchise saw volume decline just 1.6%, therefore out-performed the global data, although this data includes FX options flow as well.

Again, reflecting the shift away from the traditional powerhouses of the FX platform world, LSEG FX also under-performed the global data, seeing a drop of 13% in October 2023 compared to a year before. As was the case with EBS, October was a quiet month for LSEG FX, although it does not figure in its top 10 quietest since reporting started, it compares poorly to the 2023 average for LSEG FX of just over $95.8 billion (EBS was also below its 2023 average of just under $56.7 billion).

As noted, there was also a degree of under-performance from FXSpotStream, which was down 6.7% (it lost Credit Suisse as an LP during the year), but there were better fortunes for platforms with different models, with the ECN-type Euronext FX and Cboe FX out-performing, as well as the relationship venue, 360T.